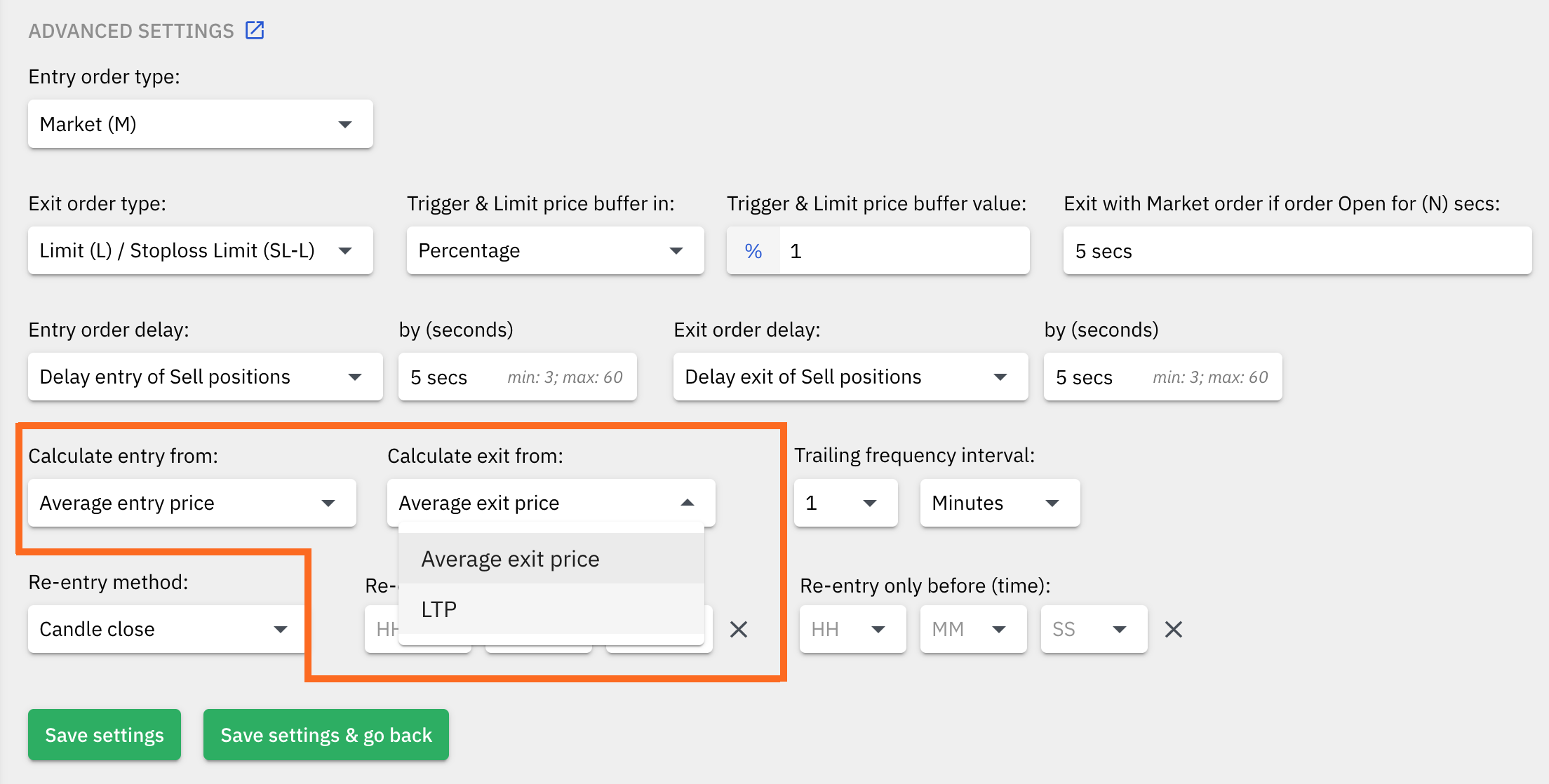

This setting instructs the algo to calculate targets, stoplosses, entry points and exit points from either the Average Entry or Exit prices at which the orders have got filled OR the LTP of the symbols at the time the orders had got filled.

1. Calculate entry from:

(A) Average Entry Price (default setting):

The algo will calculate all targets & stoplosses from the average entry price (ie. the average execution price for the whole quantity or the whole order). This is the current default mechanism that all algos use.

(B) LTP:

The algo will calculate all targets & stoplosses from the LTP recorded at the time when the order was fully filled ie. the LTP of the symbol when the order was fully executed.

Example:

At 9:20:00 the price of a CE strike is 100, the algo fires an order in this CE strike at 09:20:00, the order was successfully filled at 09:20:01 @ 98, the LTP of the CE strike at 09:20:01 was 99. In this case, if option (A) - Average Entry Price is selected, then the algo will calculate Targets & SLs from 98. If option (B) - LTP was selected then the algo will calculate Targets & SLs from 99, as 99 was the LTP at the time the order was successfully filled

In the case of Wait & Trade, if option (B) - LTP is selected, then the algo will calculate all targets & stoplosses from the Entry price, which is derived from the Reference price. In all other cases, it will consider the LTP from the time the order was fully filled or executed.

2. Calculate exit from:

(A) Average Exit Price (default):

The algo will consider the exit price as the average exit price (ie.the average execution price for the whole quantity or the whole order). This is the current default mechanism that all algos use.

(B) LTP:

The algo will consider the exit price as the LTP that was recorded at the time the exit order got fully filled or executed.

Example:

At 15:15:00 the price of a CE strike is 20, the algo fires a the square off order in this CE strike at 15:15:00, the order was successfully filled at 15:15:02 @ 21, the LTP of the CE strike at 15:15:02 was 20.5. In this case, if option (A) - Average Exit Price is selected, then the algo will consider the exit price as 21. If option (B) - LTP was selected then the algo will consider the exit price as 20.5, as the LTP at the time the order got executed at 15:15:02 was 20.5.