What is Entry order delay & Exit order delay?

A delay in order placement can be added for either BUY or SELL orders for ENTRY and/or EXIT orders.

Entry order delay

This setting allows you to add a delay for either BUY or SELL orders while opening a new position ie. while entering a fresh new trade.

Exit order delay

This setting allows you to add a delay for either BUY or SELL orders while closing open positions ie. while exiting trades.

Settings:

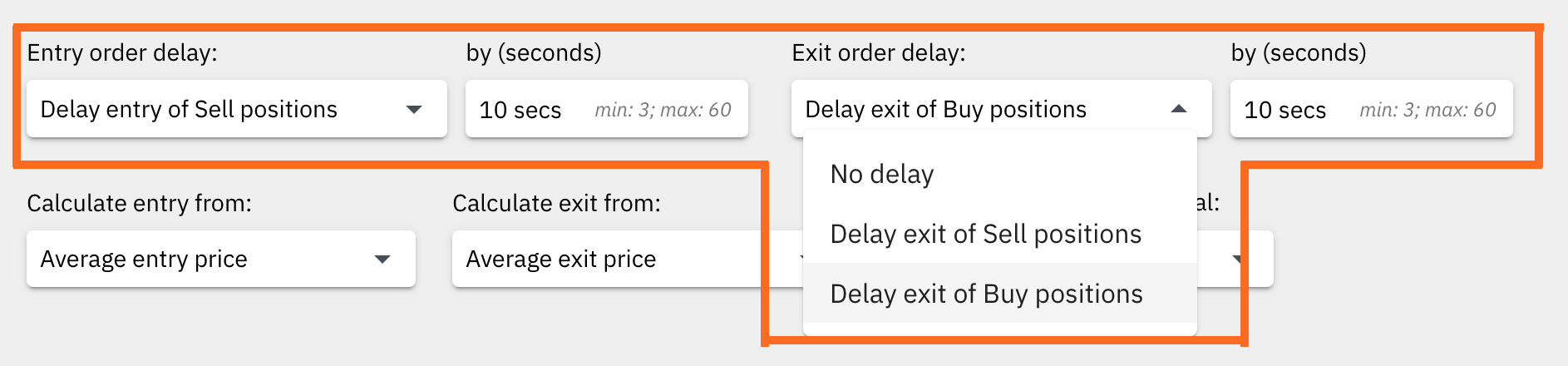

- Entry order delay:

- Delay entry of BUY positions: This option will delay the entry of Buy positions by the specified number of seconds from the Start time.

- Delay entry of SELL positions: This option will delay the entry of Sell positions by the specified number of seconds from the Start time.

- by (seconds) value: This is the number of seconds for which the order placement of the buy or sell entry orders will get delayed by.

- Exit order delay:

- Delay exit of BUY positions: This option will delay the exit of Buy positions by the specified number of seconds from the time MTM Stoploss or Target was triggered, or an exit was triggered at the End time.

- Delay exit of SELL positions: This option will delay the exit of Sell positions by the specified number of seconds from the time MTM Stoploss or Target was triggered, or an exit was triggered at the End time.

- by (seconds) value: This is the number of seconds for which the order placement of the buy or sell exit orders will get delayed by.

Disclaimer for Delay Buy or Sell orders

- The algo just adds a delay in shooting either buy or sell orders as configured using this setting. It is possible that both types of orders get executed at the same time, as maybe the initial orders get processed at the brokers end or executed at the same time at the exchange, as the delayed orders.

- The algo does not wait for a confirmation of the execution of the orders that are sent out first before firing the delayed orders. The delayed orders are just sent out with a time delay irrespective of initial orders getting filled or not. This can cause margin shortfalls and rejections as well. Please keep this in mind before using this feature.