This setting is only applicable if your strategy is Positional and contains Wait & Trade and/or Range Breakout.

This setting allows you to decide whether you want the initial entries of Wait & Trade (W&T) or Range Breakout (ORB) trades to happen next day or not, incase of Positional strategies. In case of Stockmock backtested strategies, if the initial entry hasn't happened on the strategy Start Date, then those entries will not happen on the next day or the following days.

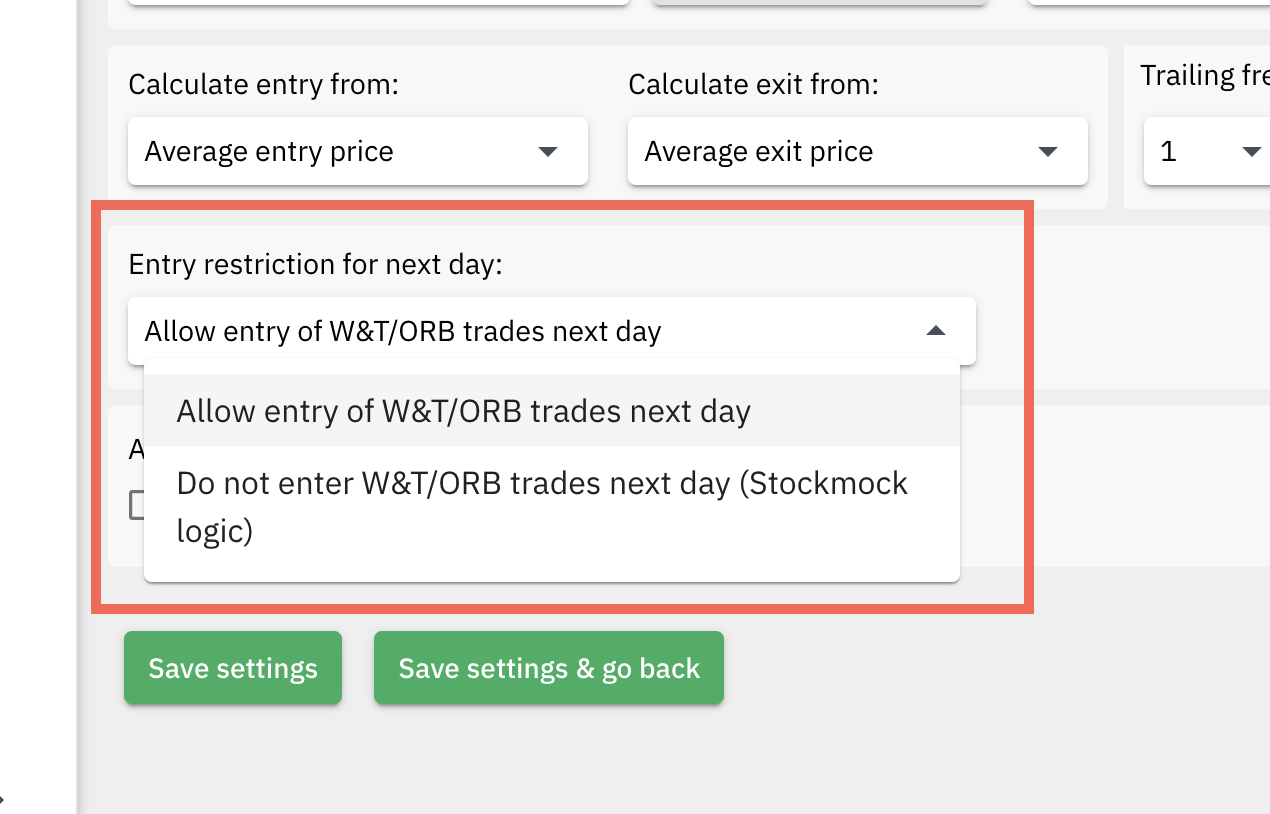

There are 2 options in this setting:

1. Allow entry of W&T/ORB trades next day:

This is the default setting for every Positional strategy which has W&T/ORB configured. If this setting is selected, even if the initial entries has not happened on the Start Day or the first day the strategy has been run, if the entry condition is fulfilled on the next day, then the entry will happen on the next day.

2. Do not enter W&T/ORB trades next day (Stockmock logic):

If you are following a strategy backtested on Stockmock.in, then this is the option you should select.

If this setting is selected, then if the initial entry has not happened on the Start Day or the first day the strategy was run, then on the next day and all following days, even if the entry condition gets fulfilled the entry will not happen. ie. the initial entry is restricted from happening.

Note:

1. All re-entries which may or may not have W&T configured, will still continue to happen. This is specific only to initial entries or the first entries, where W&T or ORB was configured.

2. Once this setting is configured, and if the strategy goes into TRADE ACTIVE status, this setting cannot be modified or changed. You can only change this setting when the strategy has not yet activated. You can change this setting when the algo is in ENABLED, READY or TRADE CLOSED state.

3. Select the second option "Do not enter W&T/ORB trades next day (Stockmock logic)" if you are trading Stockmock backtested strategies which are Positional and have W&T/ORB.

2. In the case where the second option "Do not enter W&T/ORB trades next day (Stockmock logic)" is selected, if none of the positions have entered on the Start Day or the first day, then at the end of the day, the algo (strategy) will automatically get TERMINATED, which means it will not start on the next day.