SL order placement delay

This functionality allows the Stoploss orders to be placed with a delay, after the stoploss is hit.

Essentially, this functionality allows the Stoploss condition to be re-checked again after N secs of the stoploss getting hit the first time, which means that after the stoploss is hit, the algo doesn't exit the positions immediately, in fact, it will wait for another N secs, and at the Nth second, it will re-check if the stoploss hit condition is still true, if the stoploss condition is fulfilled only then the algo will exit the positions.

There are 2 types of SL order delays:

1. SL order placement delay for individual leg SL.

2. SL order placement delay for MTM SL (Combined premium SL).

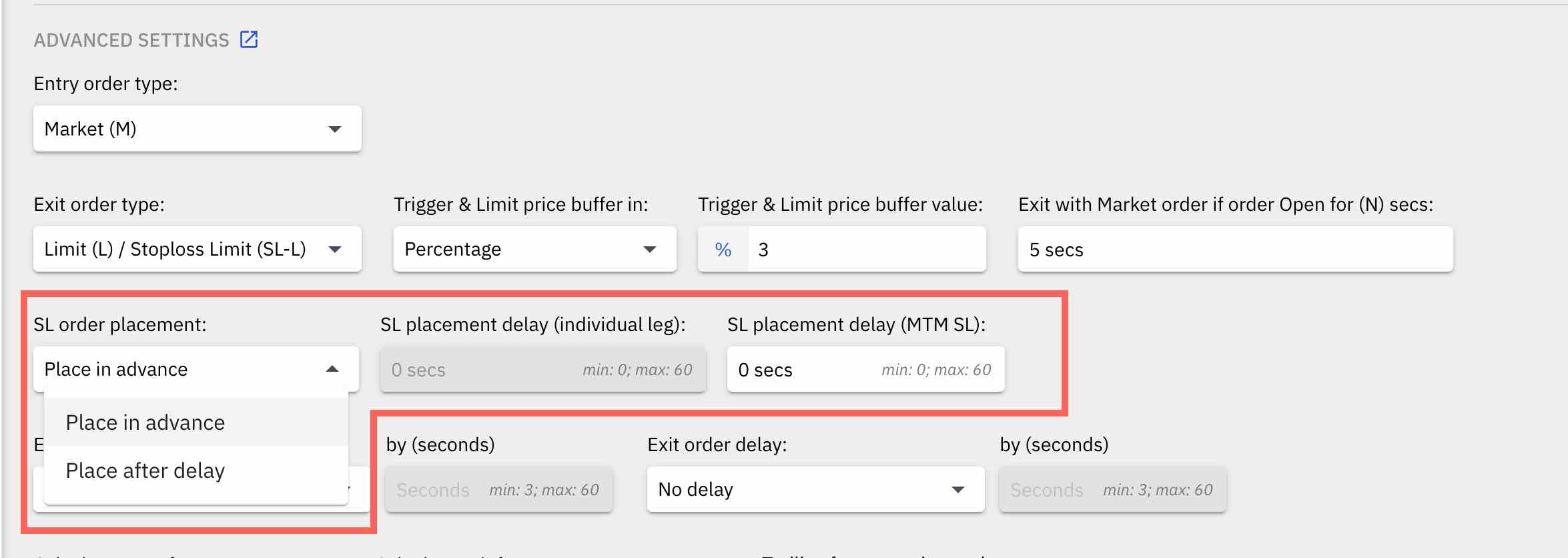

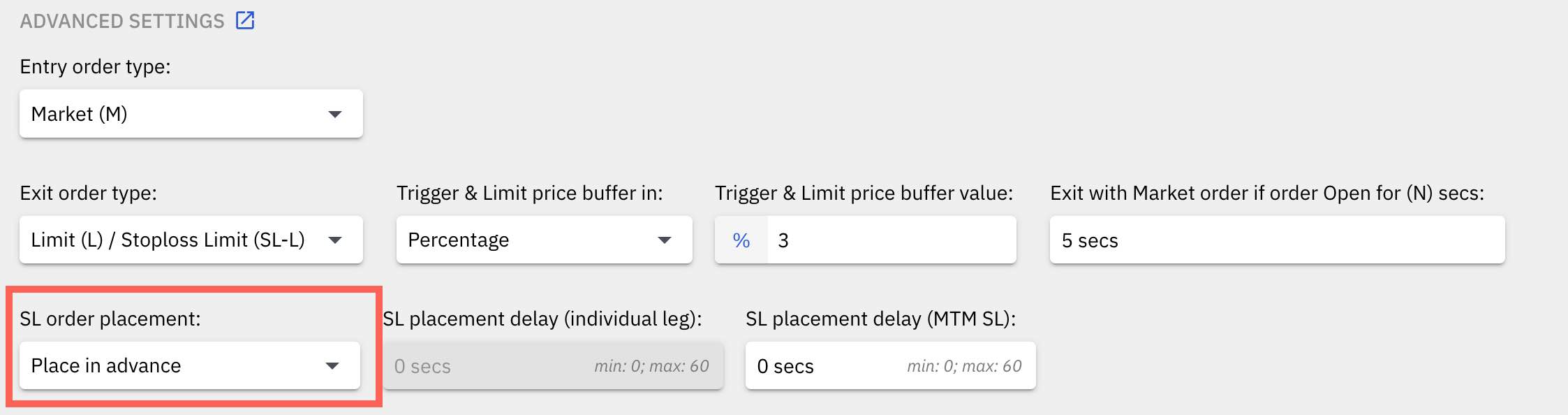

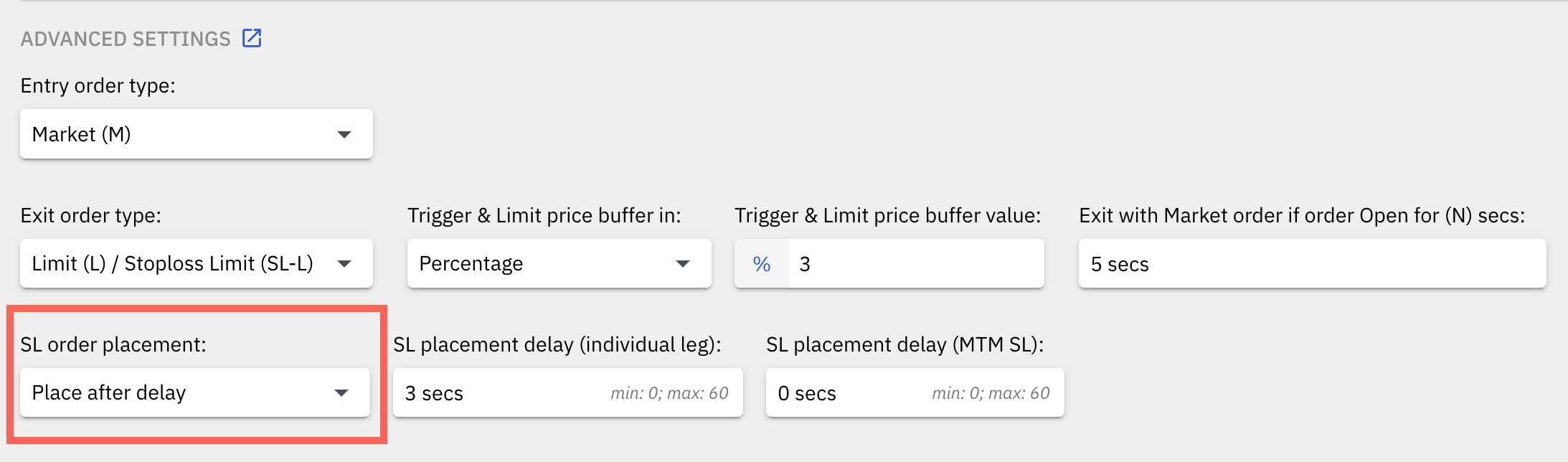

This setting can be accessed from under the Advanced Settings > Exit order type.

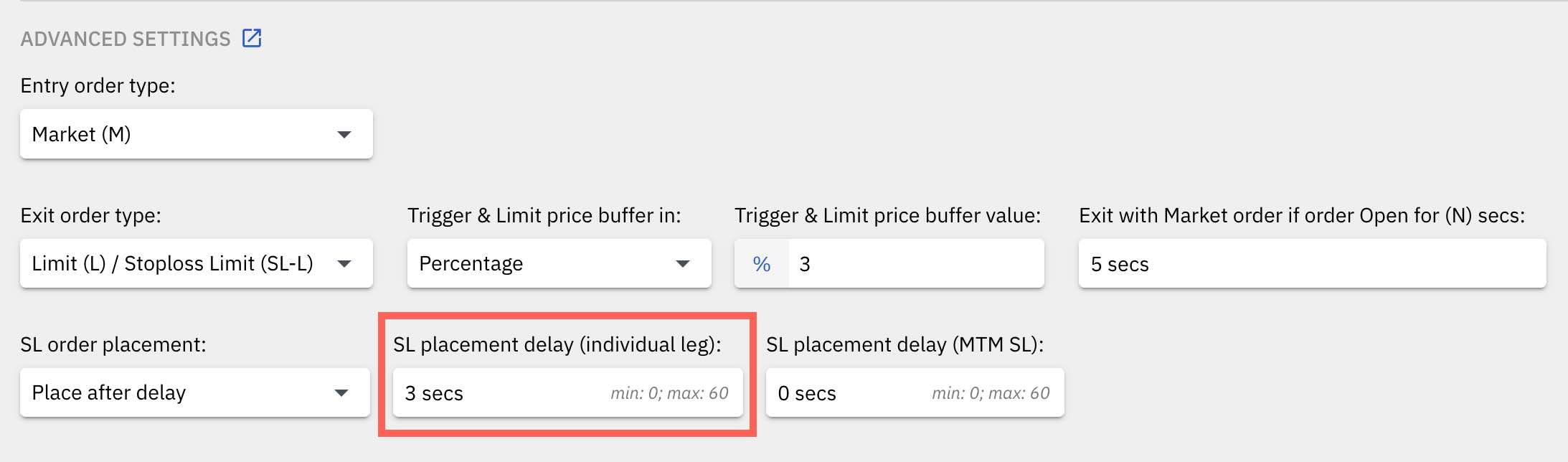

I. SL order placement delay for individual leg SL:

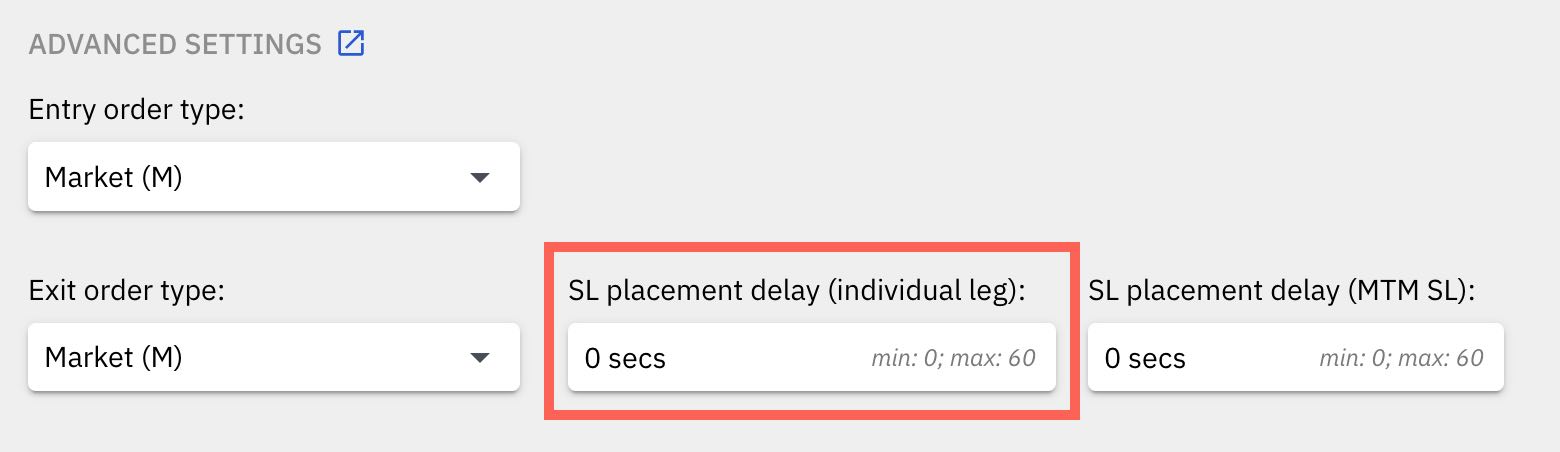

Individual leg SL order placement delay with MARKET order

Individual leg SL order placement delay with MARKET order Individual leg SL order placement delay with Limit/SL Limit order

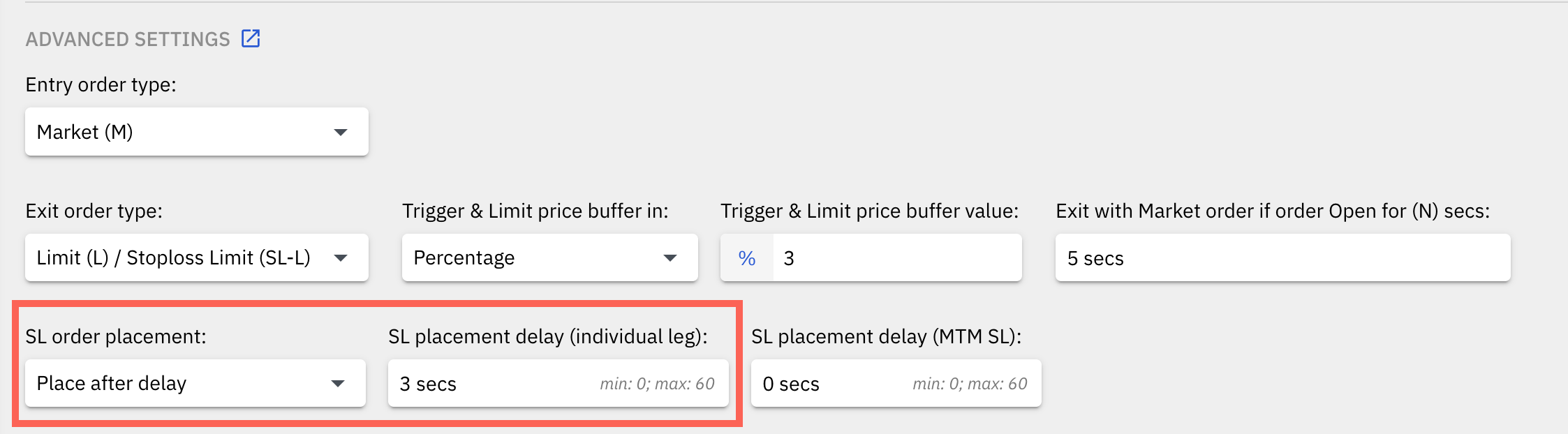

Individual leg SL order placement delay with Limit/SL Limit orderFirst of all, if the Place order after delay option is selected, the stoploss order is not placed in advance.

If the Place order after delay option is selected, and say the stoploss is hit at anytime, the position is not squared off immediately, the stoploss condition is again checked after a delay of N seconds, if the SL condition is fulfilled at the Nth second, the stoploss square off order is placed at the Nth second and the position is exited.

If, at the Nth second the price has not crossed the stoploss price ie. stoploss condition is not fulfilled, then again the algo will wait for the price to cross the stoploss price and apply the delay to it again, before checking the stoploss condition again.

Setting 1: Type

Option 1: Place order in advance (default):

This is the default setting, where the algo places the SL orders as soon as an entry is taken in a particular leg. Hence, the stoploss order for squaring off the open position is placed in advance, well before the actual stoploss is hit.

Option 2: Place order after delay:

With this option, the stoploss condition is again checked after a delay of N seconds, if the SL condition is fulfilled at the Nth second, the stoploss square off order is placed at the Nth second.

Setting 2: SL placement delay setting in Seconds:

This setting is configured in terms of number of seconds, after which the algo will re-check the SL condition. If the SL condition is fulfilled after ’N’ seconds as sepcificed by the user, the stoploss square off order will be shot out.

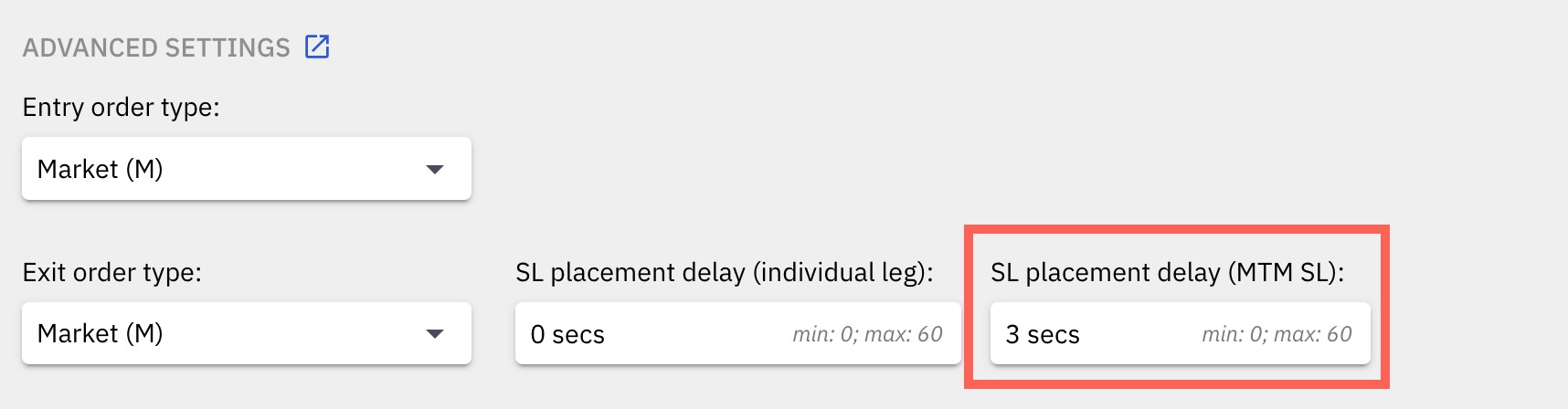

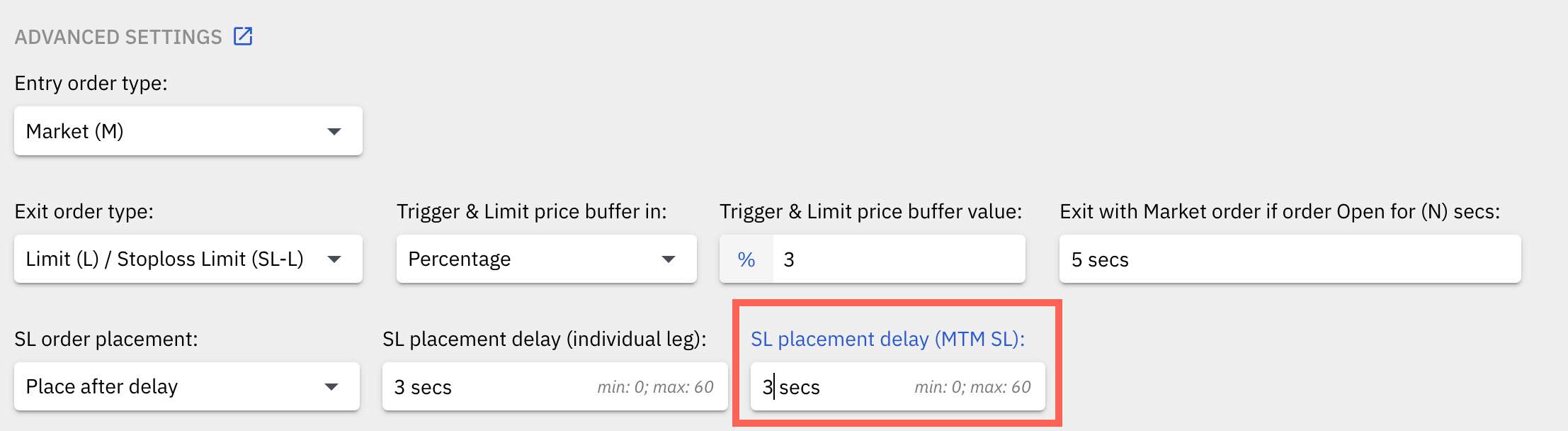

II. SL order placement delay for MTM SL (Combined premium SL)

MTM SL order delay with MARKET order

MTM SL order delay with MARKET order MTM SL order delay with Limit/SL Limit order

MTM SL order delay with Limit/SL Limit orderThis setting allows to add a delay in placing exit orders in the case where MTM SL is hit.

In the above example, SL placement delay setting of 3 seconds is configured. In this case, once the MTM SL is hit, the algo will not immediately exit the positions. It will wait for 3 seconds and re-check if the MTM stoploss hit condition is still true, ie. it will check if the MTM SL has hit after those 3 seconds. Only if it is true, then the algo will exit the positions. If not then exit orders will not be fired and the algo will keep running and subsequently keep checking for MTM SL condition, till the next time the MTM SL is hit.

Important points:

- Stoploss order placement delay works with both order type selections - Market & Limit/SL Limit orders

- 0 seconds value for delay is allowed. If a setting of 0 seconds is given, it means that when the stoploss is hit, the algo exits the orders immediately without any delay ie. with 0 seconds of delay.

- If you wish to place stoploss orders only when stoploss is hit, and not in advance, then you configure N seconds setting as '0'.

- Minimum delay value is 0 seconds and maximum is 60 seconds.