Kotak will be making TOTP based login compulsory as a part of the Broker Login (access token generation) process 31tst March 2025 onwards.

On Quantiply, Kotak Neo clients will have to migrate from the older Kotak Neo broker to the new Kotak Neo [TOTP] broker.

You may migrate the account anytime before 31st March.

SETUP PROCESS FOR ALL NEW SETUPS & MIGRATION FROM OLD KOTAK NEO BROKER TO KOTAK NEO [TOTP] BROKER

I. Register for Kotak Neo [TOTP] Trade API:

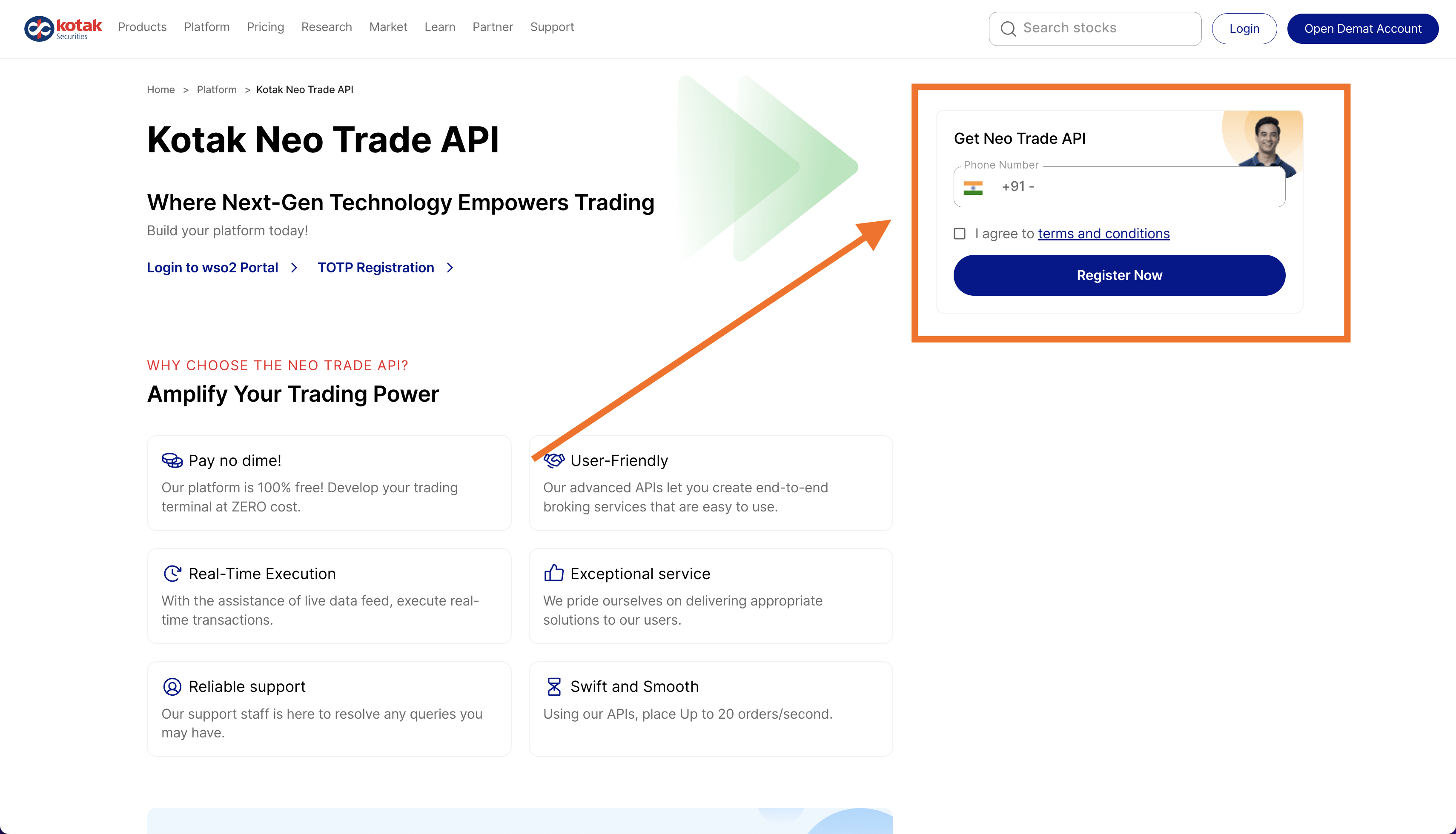

1. Go to https://www.kotaksecurities.com/platform/kotak-neo-trade-api/

2. Enter your Kotak registered mobile number, agree to terms and conditions and click register now.

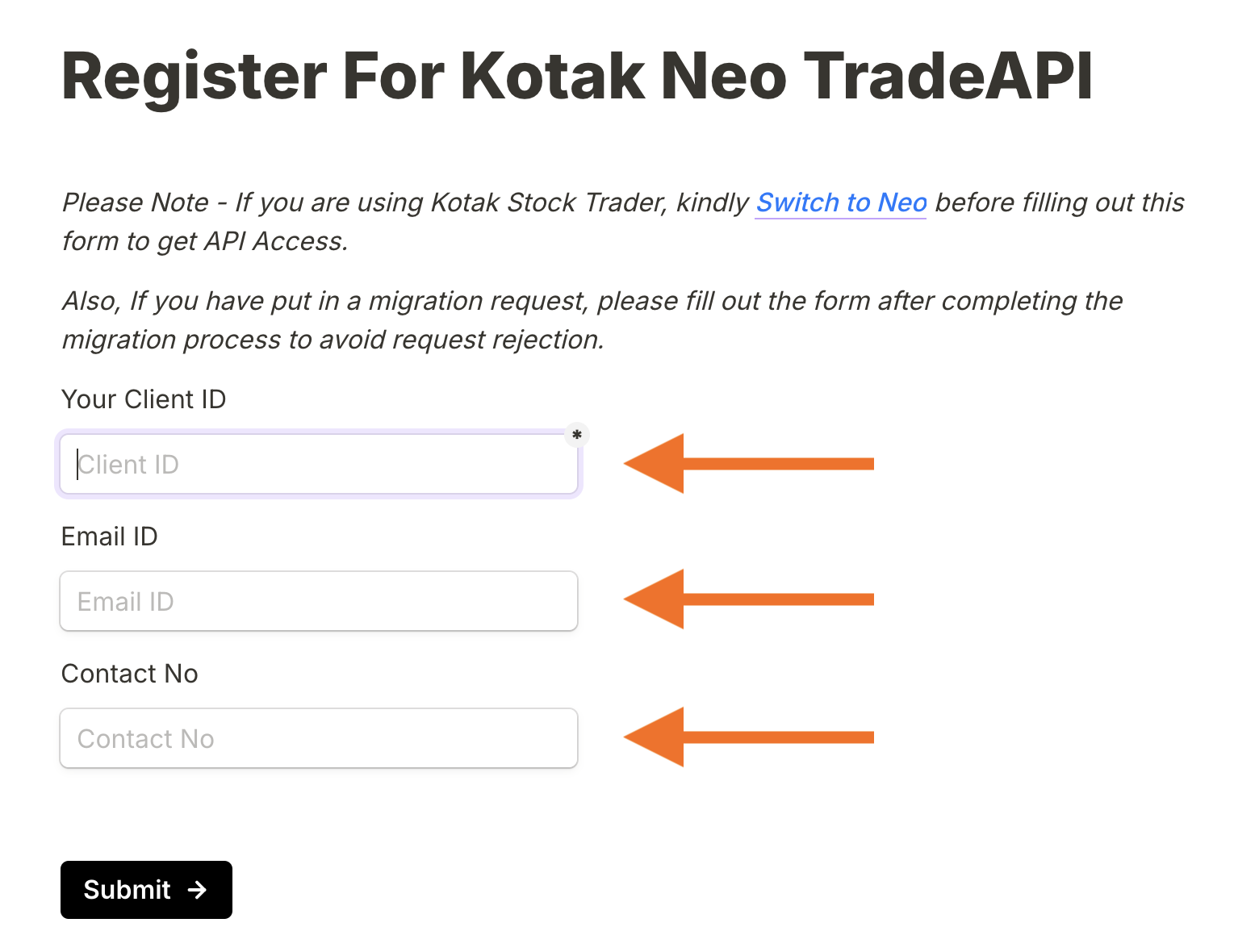

3. Fill out the following details on the next page:

- 5 digit Kotak Neo Client ID

- Registered Email ID (associated with the above Client ID)

- Registered Mobile Number (associated with the above Client ID)

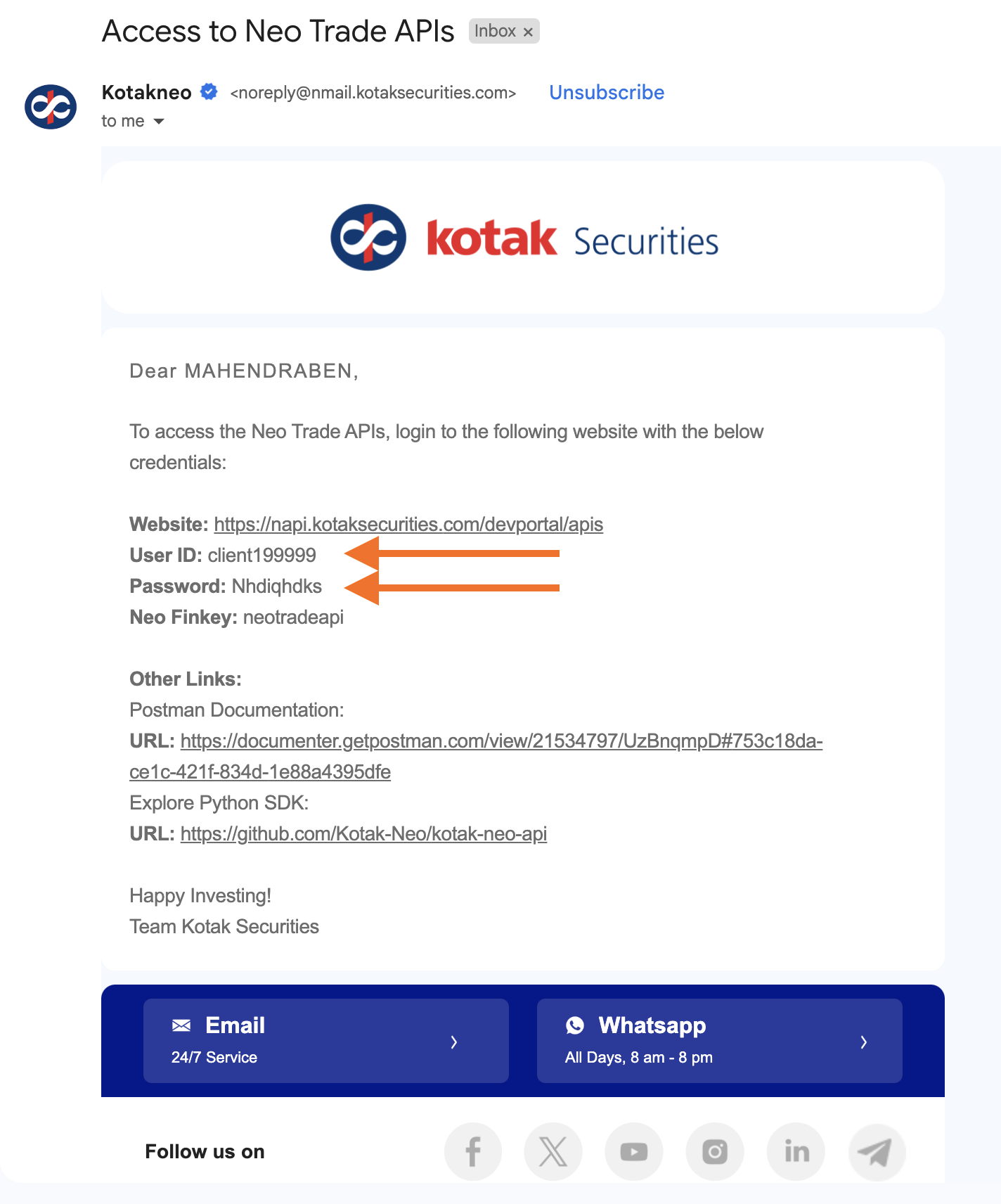

4. Once you have filled and submitted the form, within the next 30 mins, you will receive an email with your new Kotak Neo API User ID and Password.

II. Activate TOTP:

1. Go to https://www.kotaksecurities.com/platform/kotak-neo-trade-api/totp-registration

2. Enter your registered mobile number and click on Proceed.

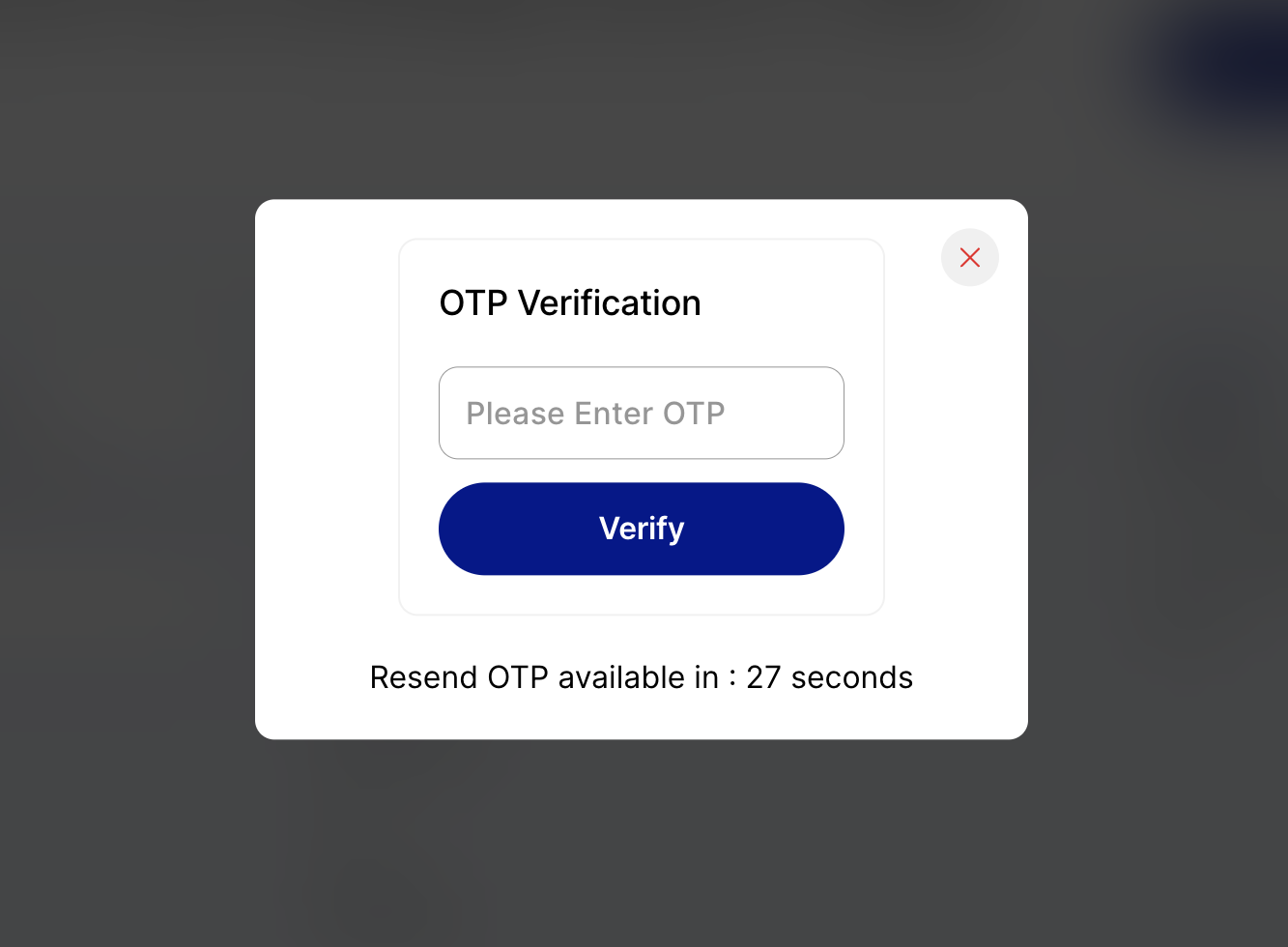

3. Enter the 4 digit OTP received on your registered mobile number.

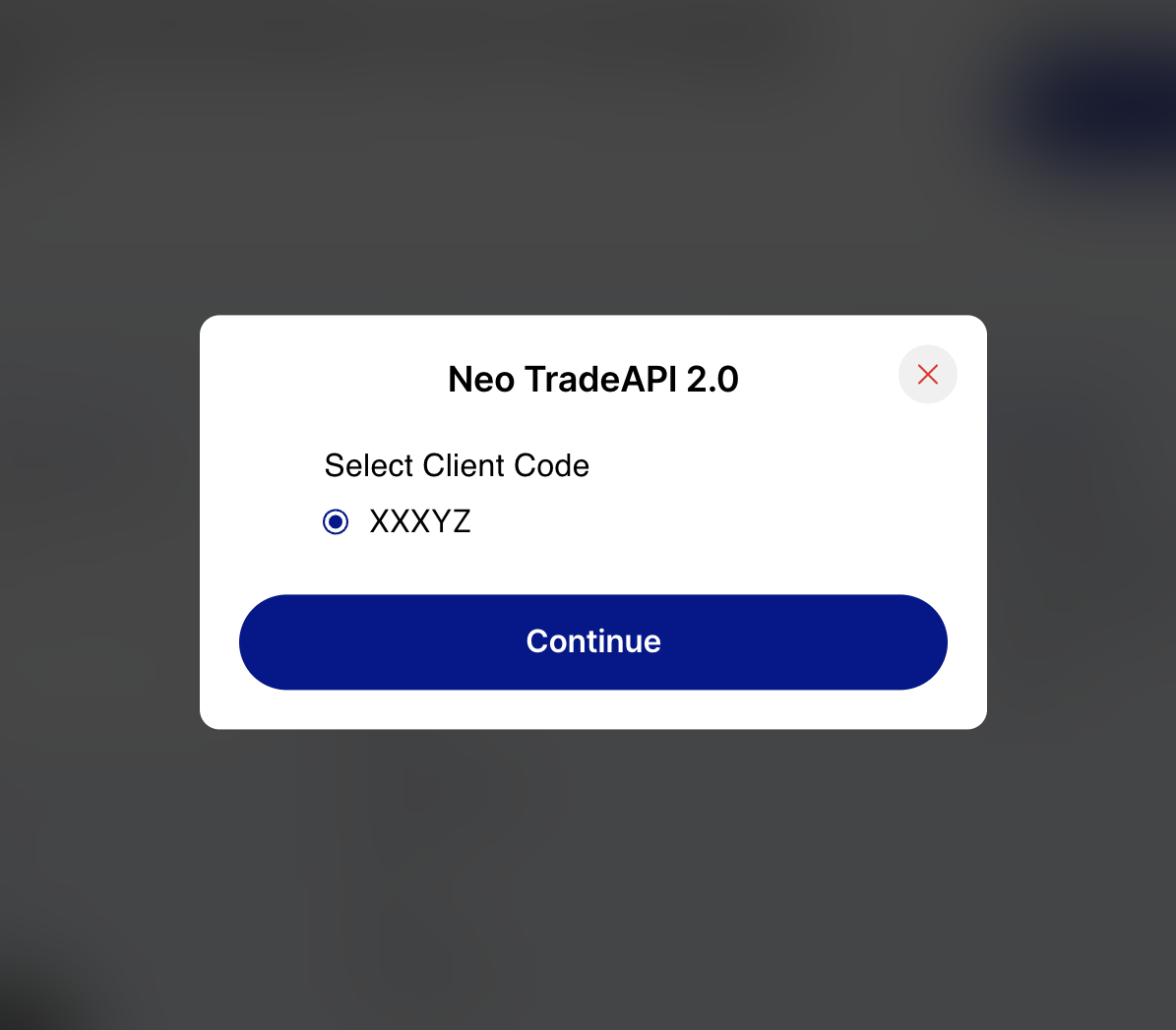

4. Select the Client ID and click continue.

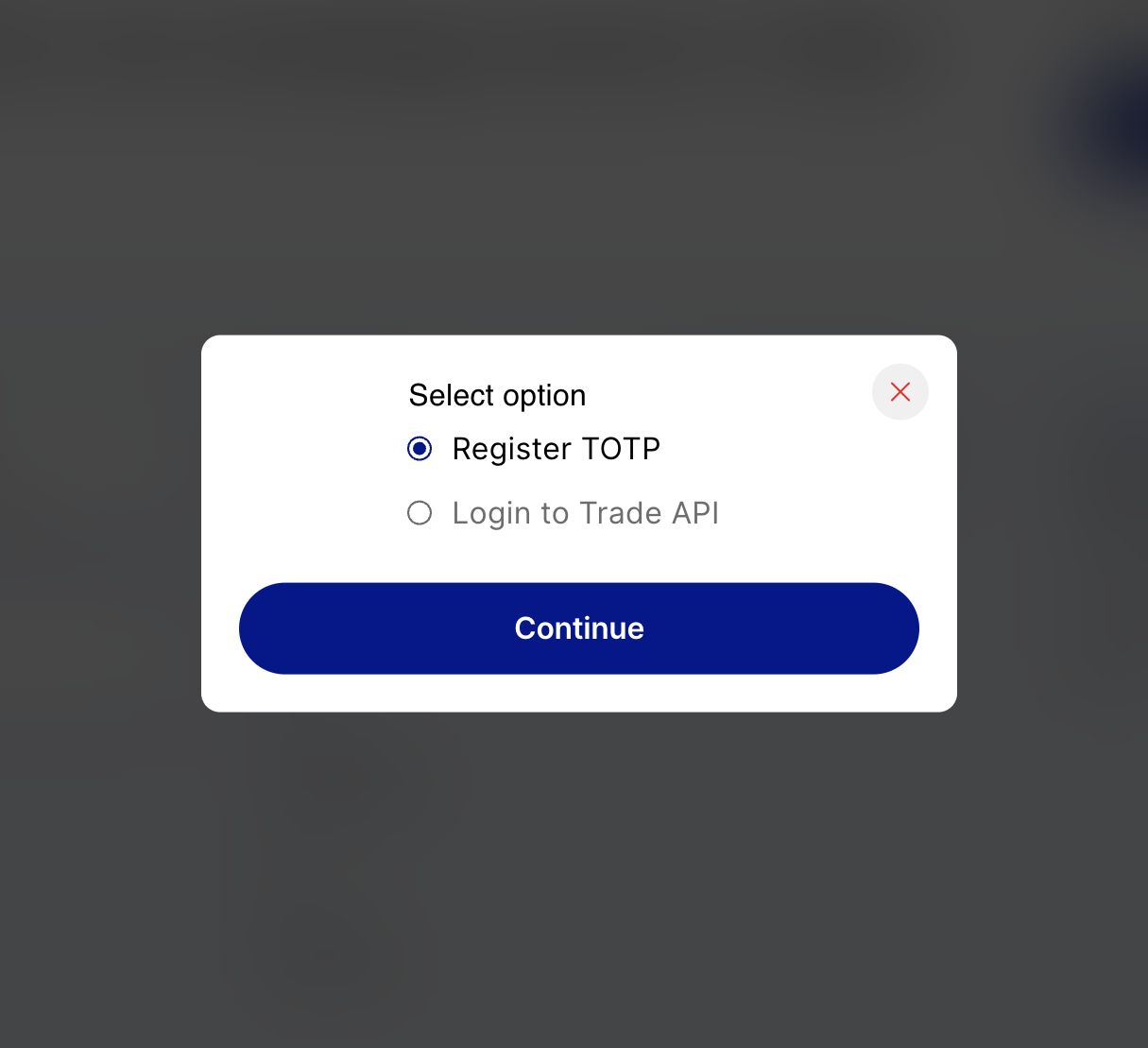

5. Select the option Register TOTP and click Continue.

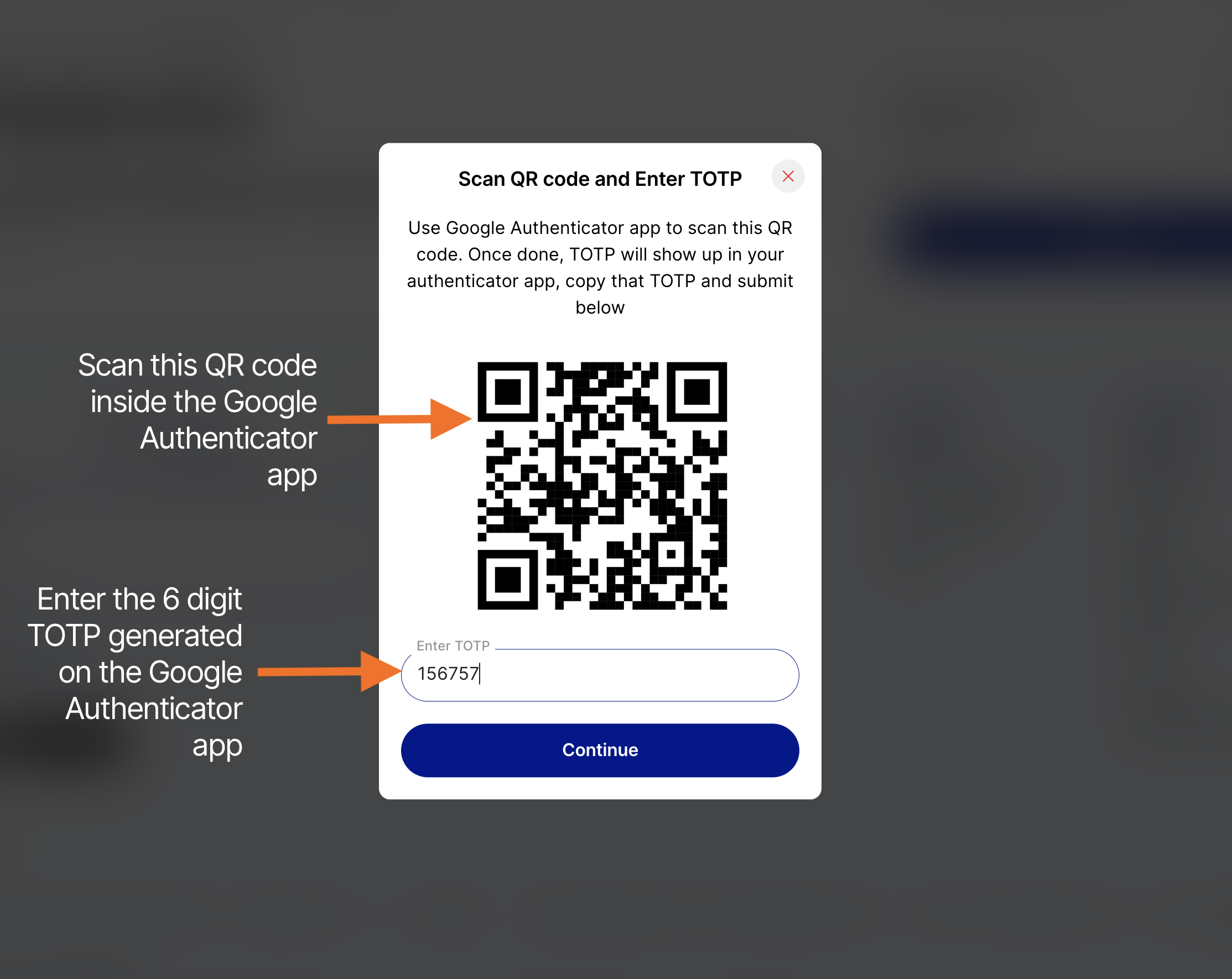

6. You will now see a QR Code. Scan this QR code in your Google Authenticator app. You will see the new TOTP generated after scanning the QR code, enter the TOTP in the box below the QR code and click Continue.

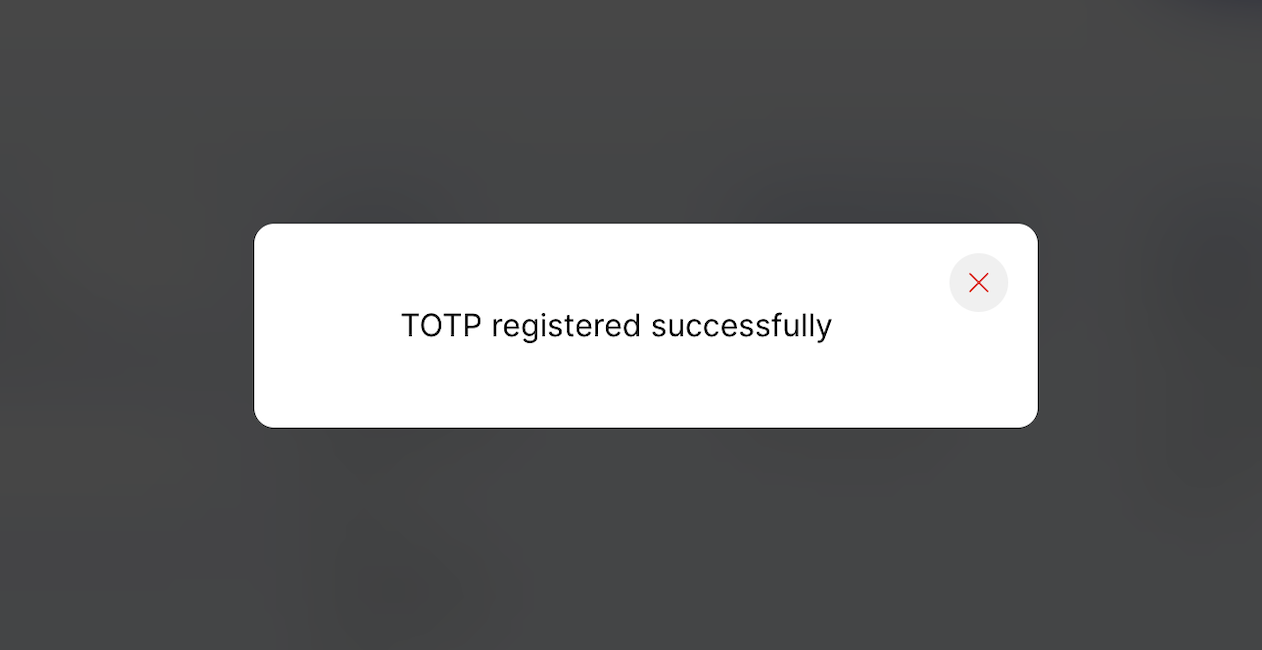

If TOTP is successfully activated, you will see the message TOTP registered successfully.

III. API Activation & Setup:

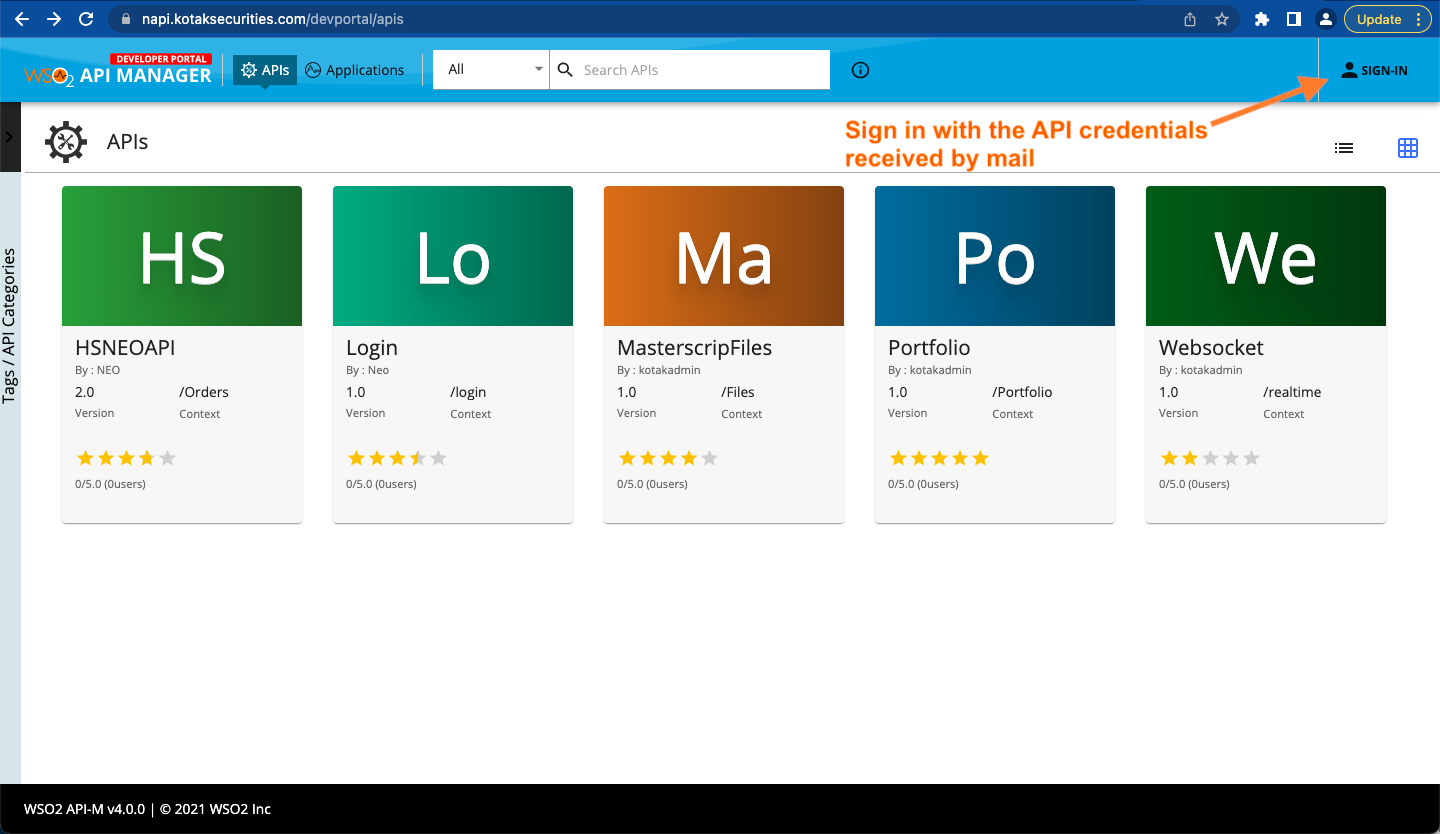

1. Go to the developer portal: https://napi.kotaksecurities.com/devportal/apis, and login with the User ID and Password received by Email in the earlier step.

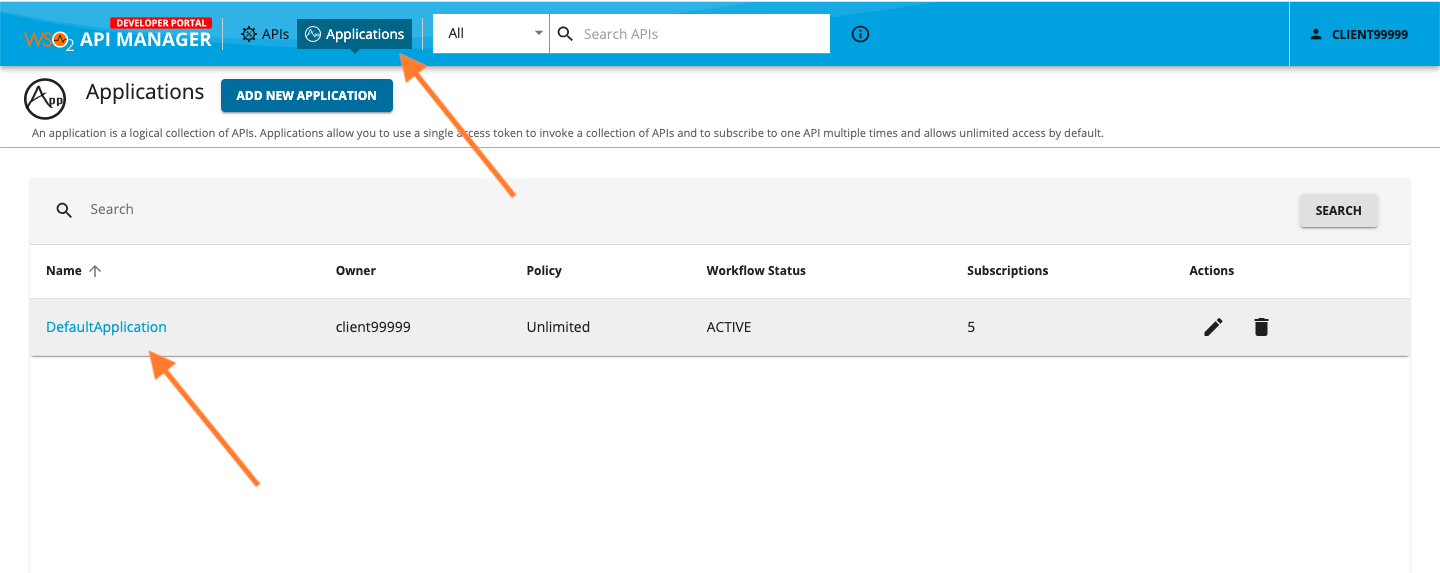

2. Once logged in to the developer portal, go to the APPLICATIONS tab, and click on the DEFAULT APPLICATION.

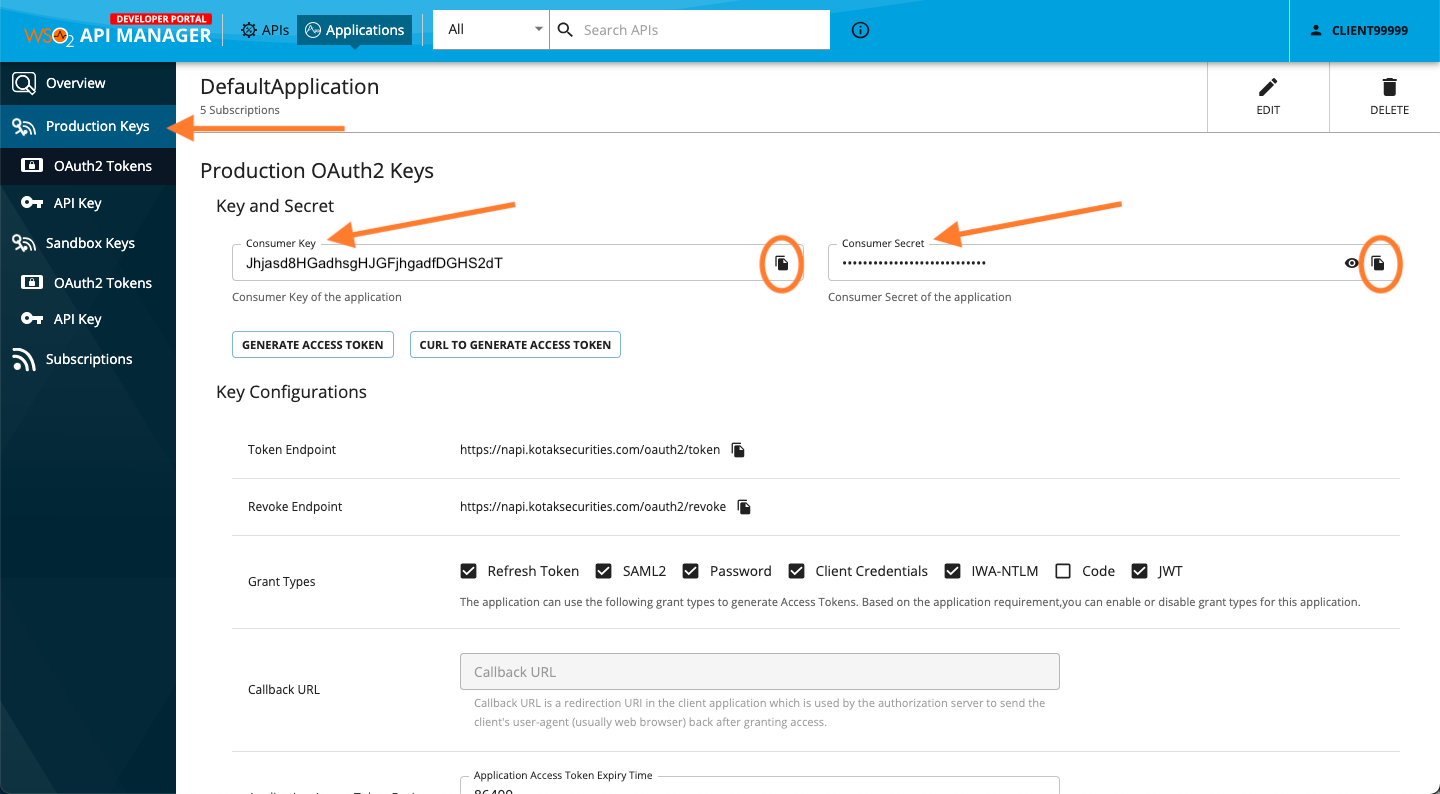

4. Click on the PRODUCTION KEYS tab from the side bar.

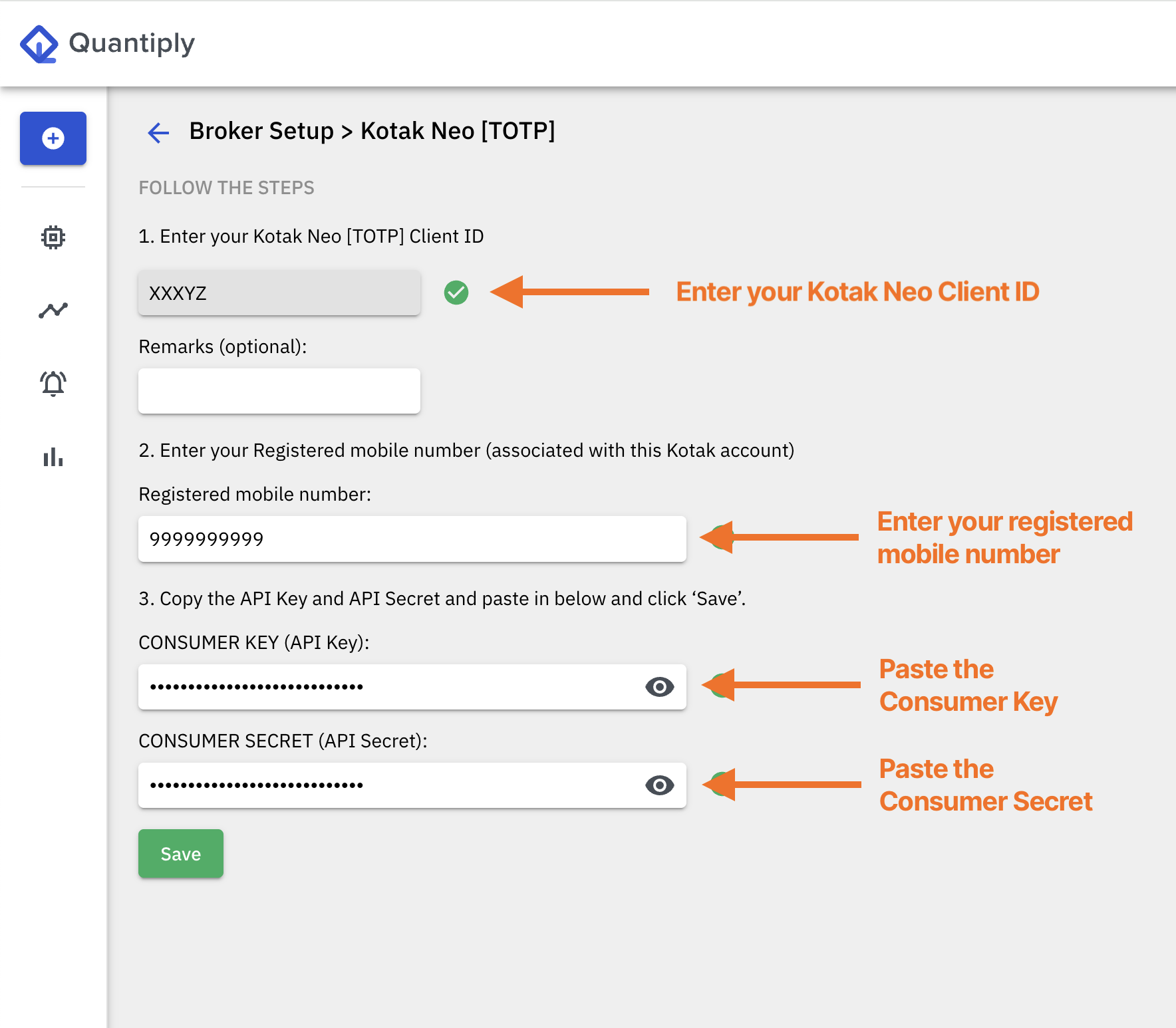

5. Go to the Broker Setup page on Quantiply, and click on SETUP under the Kotak Neo [TOTP] broker. Enter your Kotak Neo Client ID, your registered mobile number, copy paste the Consumer Key and Consumer Secret from the developer portal into the Quantiply Broker Setup section.

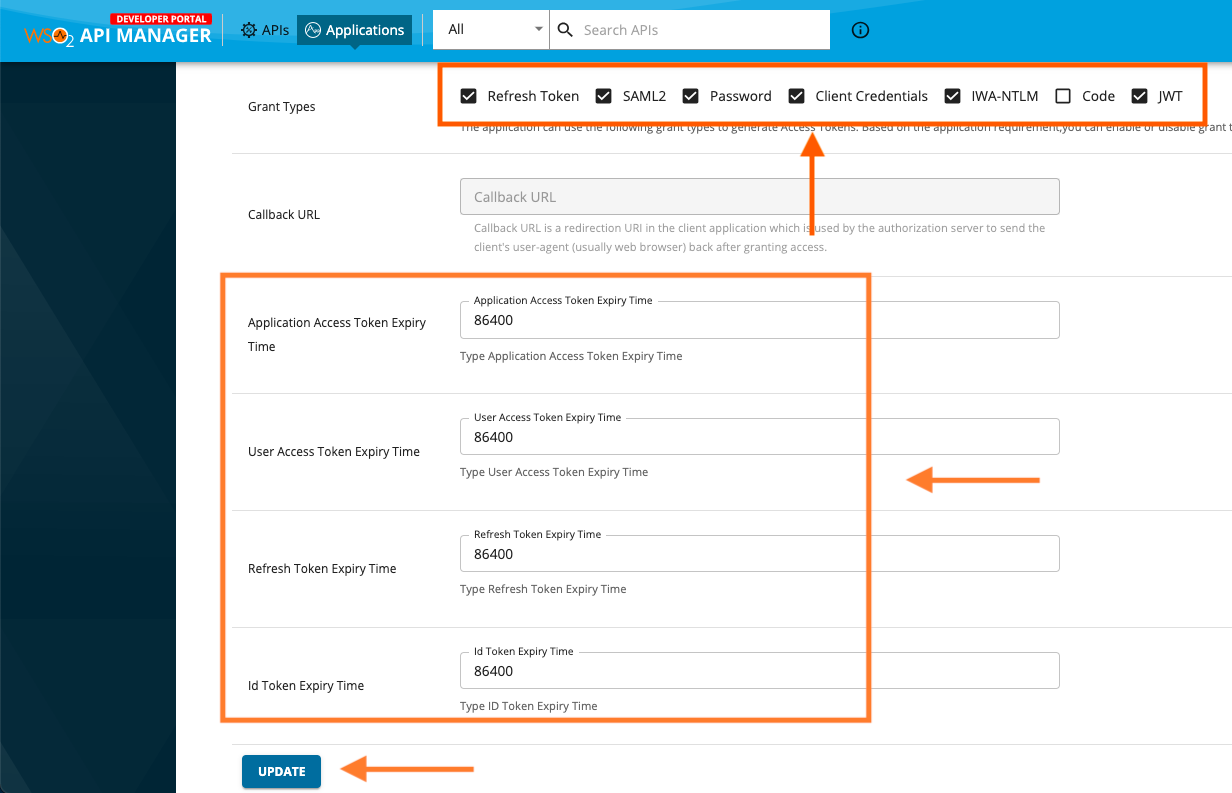

6. On the developer portal, on the PRODUCTION KEYS page, select the checkbox for all settings seen in the screenshot below and change all the default Expiry Time values to 86400, and click UPDATE.

IV. Setup MPIN:

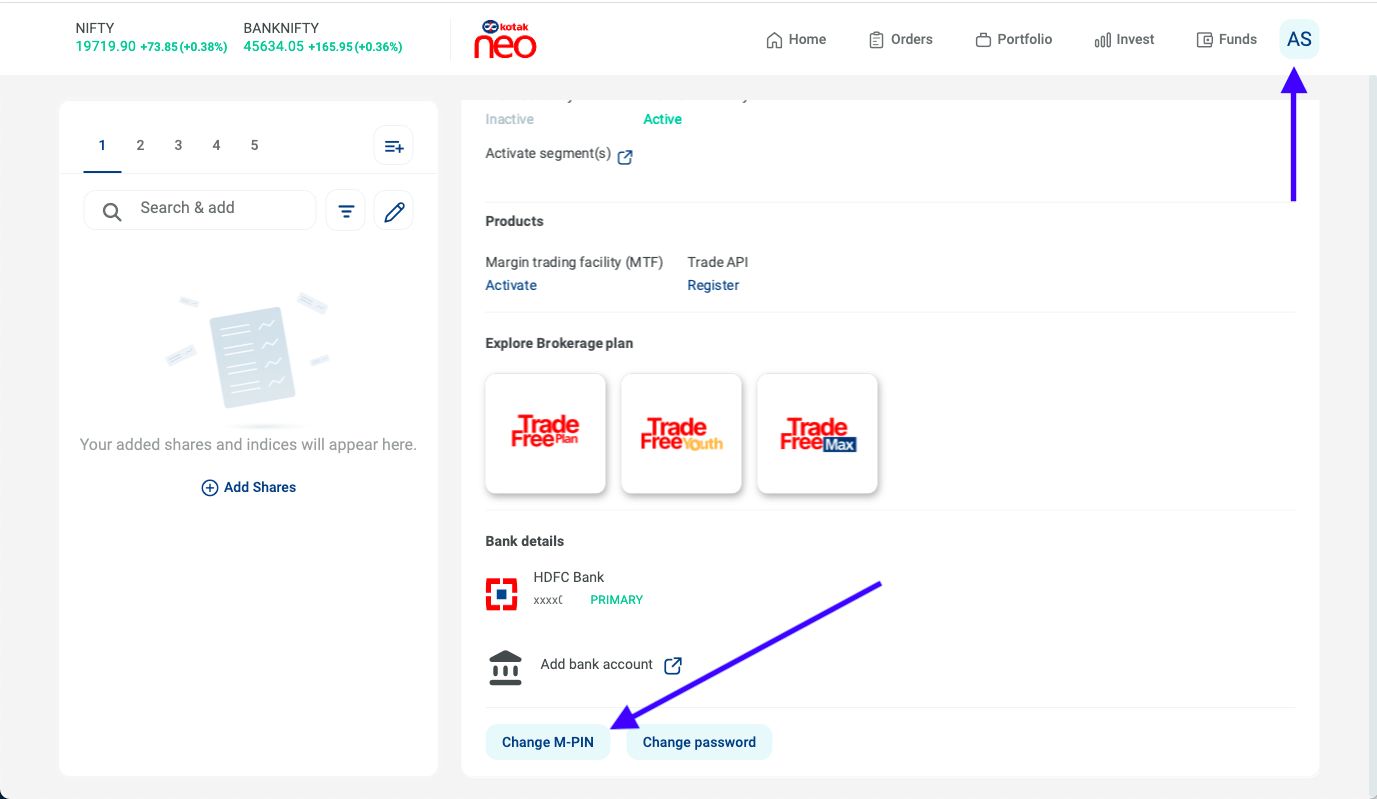

If you have not already setup MPIN while doing your first login into Kotak Neo trading terminal, then follow the steps to enable MPIN.

Setup a 6 digit MPIN from the Account Details section on the Kotak NEO trading Terminal. This MPIN is compulsory while doing broker login (access token generation) on Quantiply.

V. Broker Login:

Go to the Broker Login page on Quantiply, and click Login under your newly setup Kotak Neo [TOTP] Client ID.

Enter the MPIN and TOTP and click Login. Once logged it you can start trading.

For Support Queries regarding the setup, you can get in touch with Quantiply Customer Support: https://quantiply.tech/contact