-w9EakWPs8rzCoFralb-v_v6LrDZf94Ial7_i.png)

Topics:

5. Important note for users migrating from Kotak Neo API V1 to Kotak Neo API V2

I. API Activation:

The first step to using Kotak Neo API with Quantiply is to activate the Neo API. Follow the steps mentioned below to activate your API.

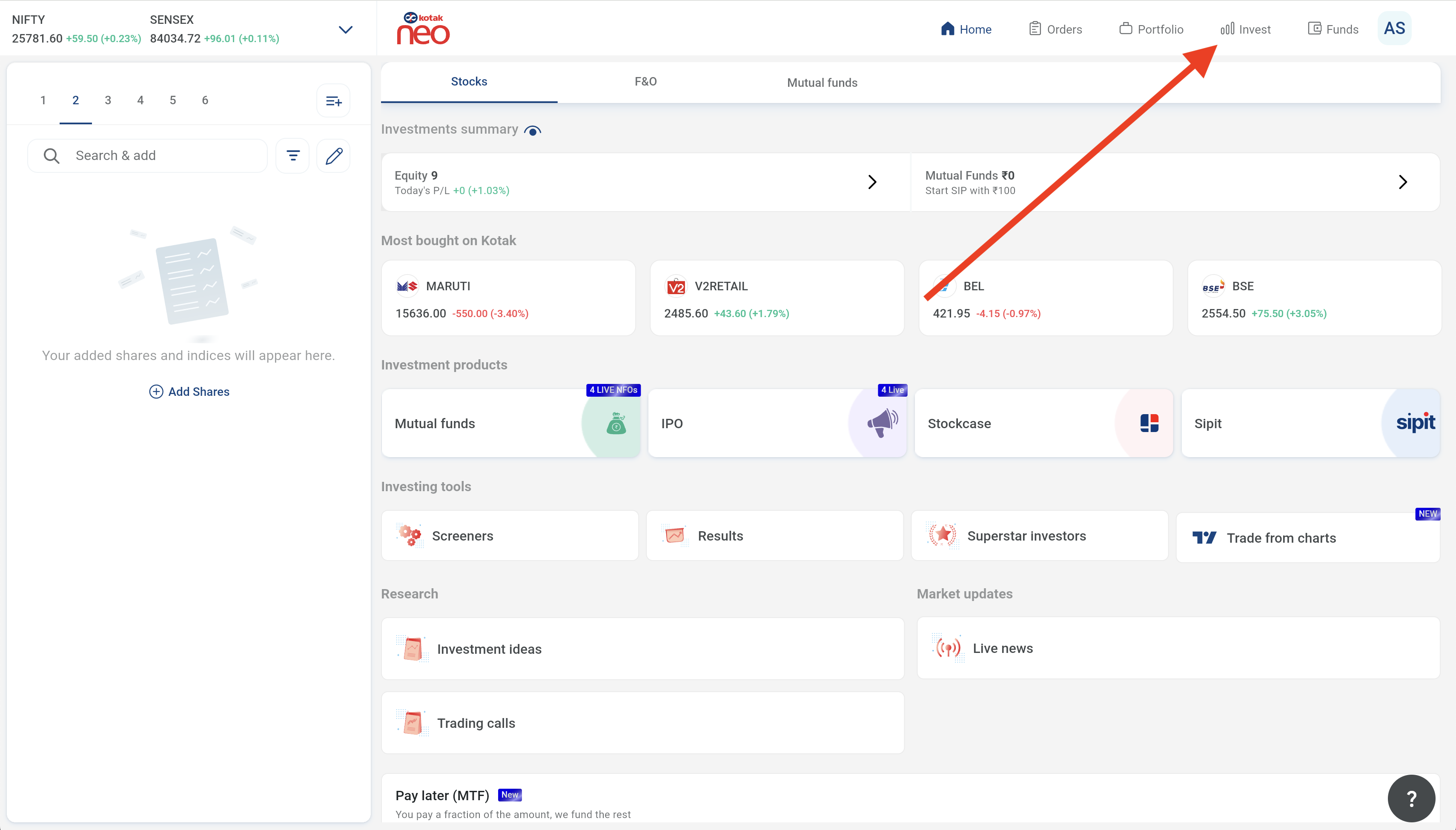

1. Login to the Kotak Neo web terminal - https://neo.kotaksecurities.com/Login

2. Once logged in, click on the 'INVEST' tab on the top menu bar.

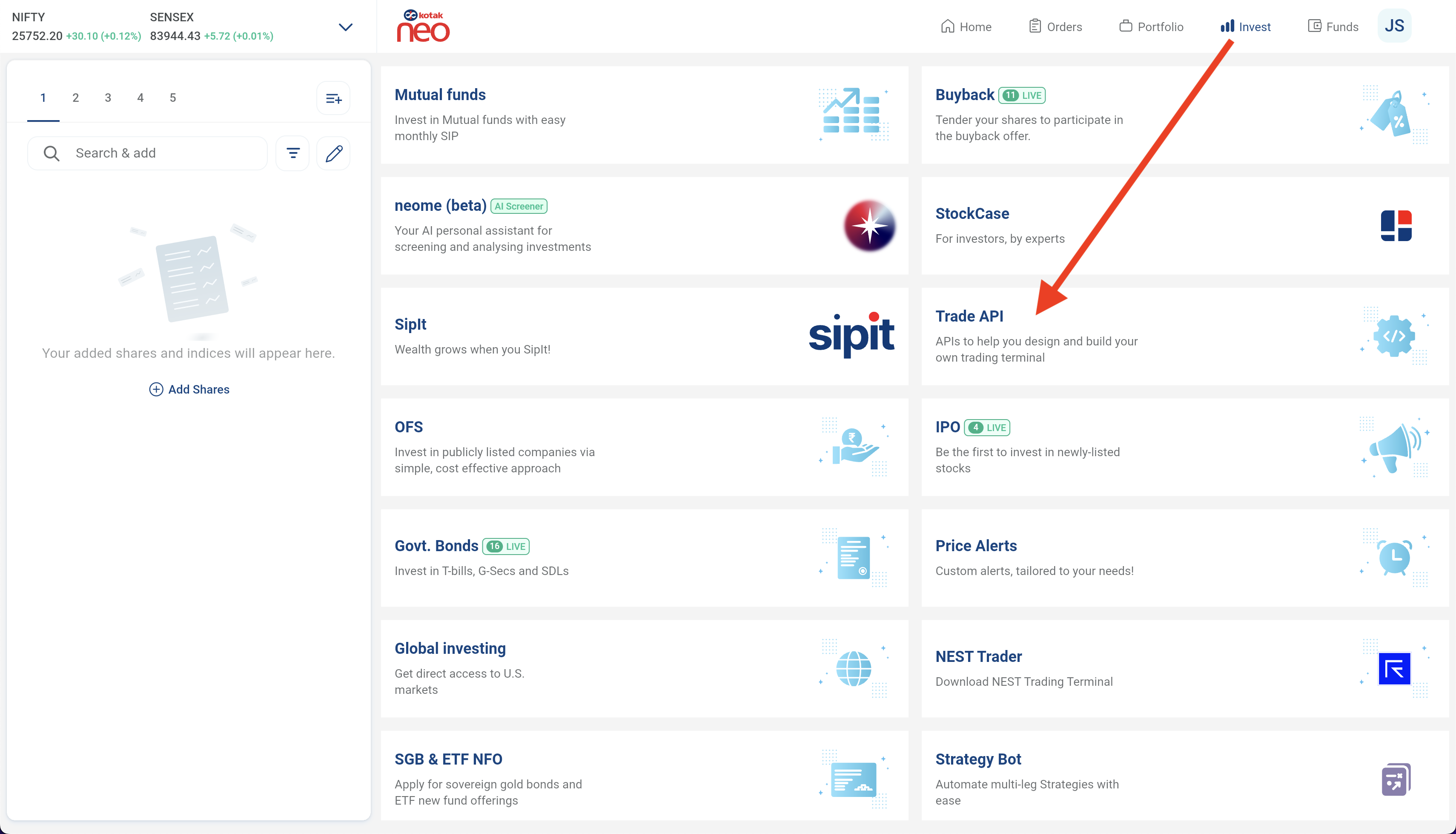

3. Once you are on the Invest page, click on the 'TRADE API' menu item.

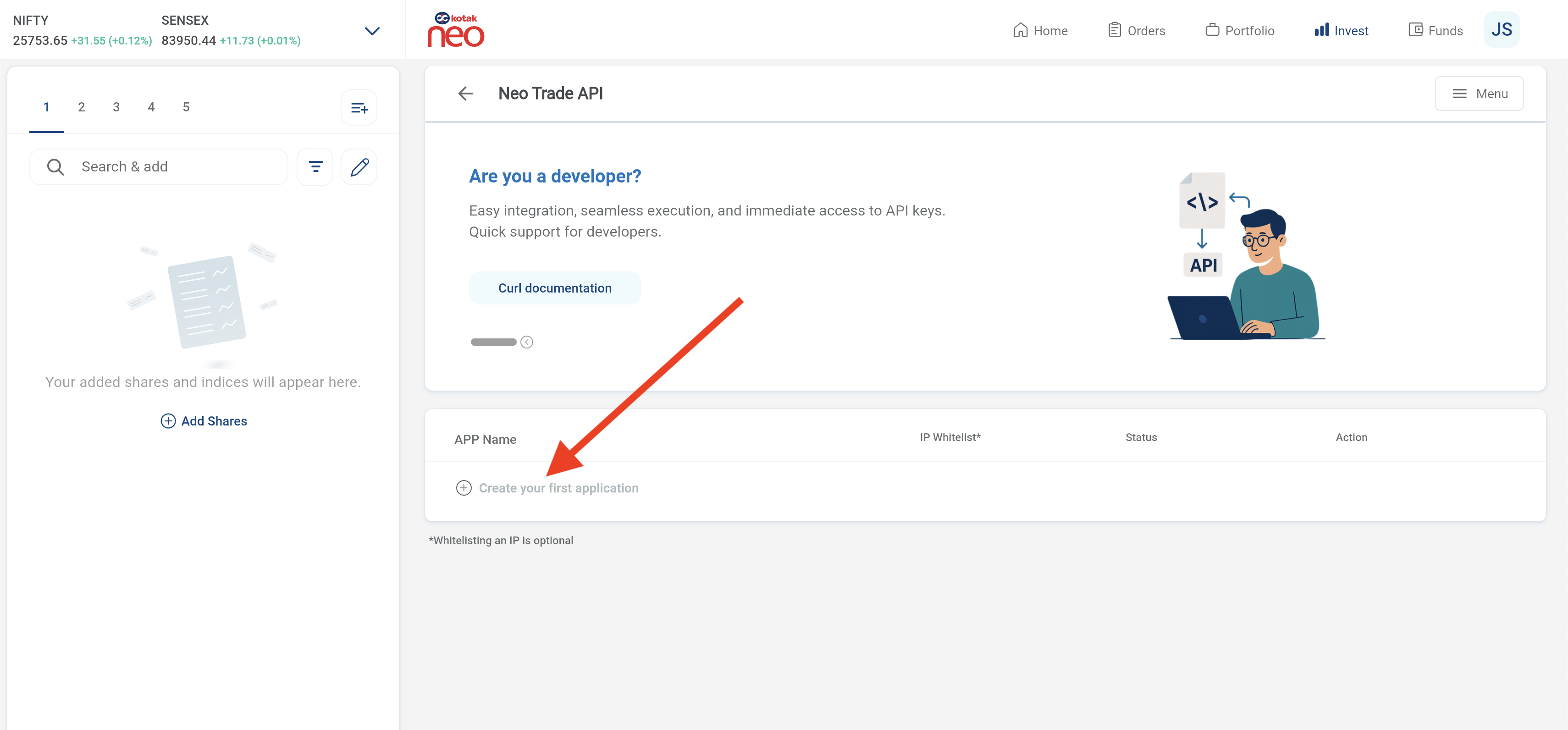

4. Once you are on the Trade API page, you will see the 'Create your first application' button. Click on that button to create a new API app.

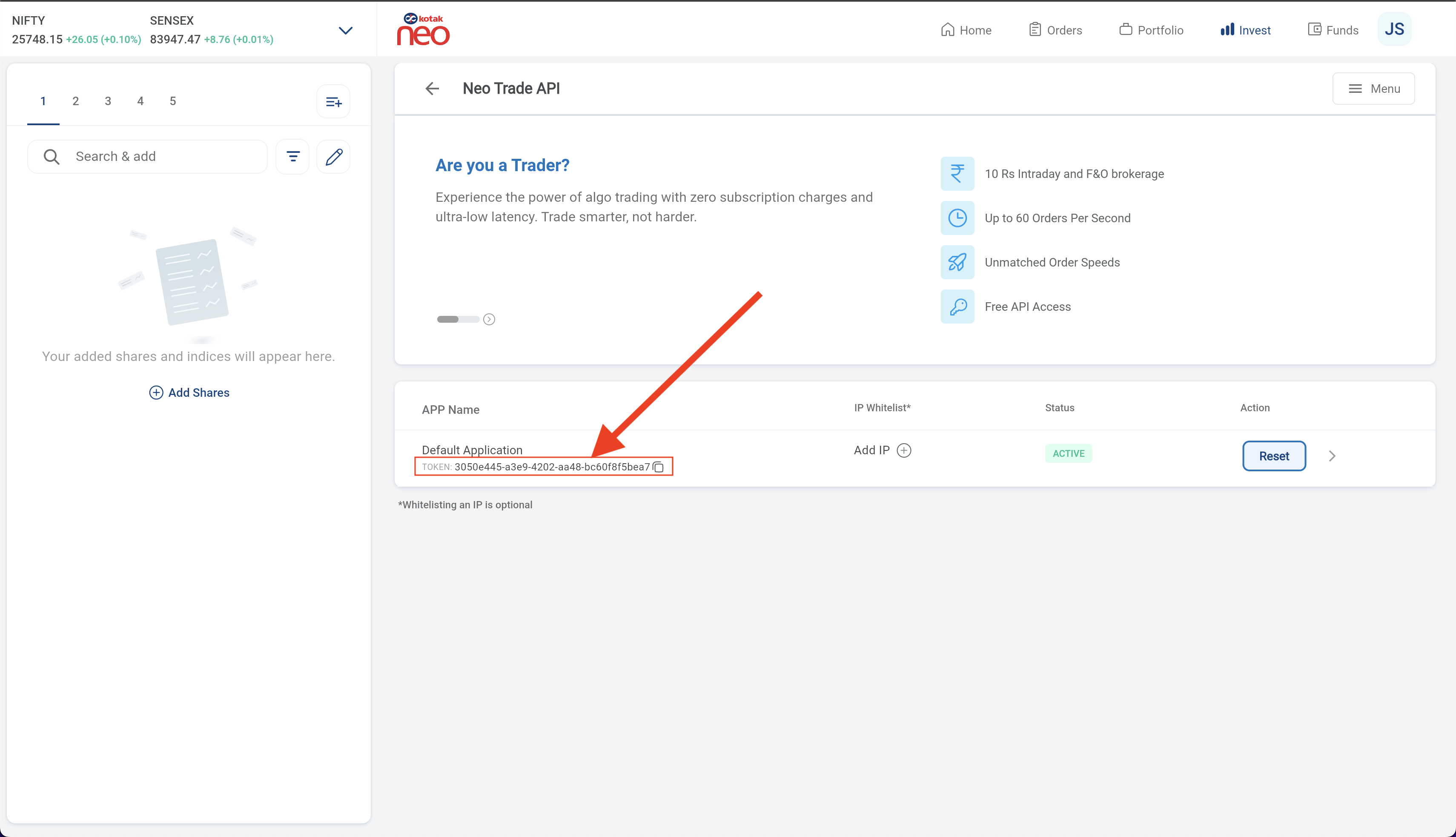

5. Upon click on 'Create your first application', a new API app will be generated with app name Default Application along with a Token under it. This Token will be used later when you setup your Kotak account with Quantiply.

With this, your API Activation step is complete. You can now move on to the next step ie. TOTP activation.

II. TOTP Activation:

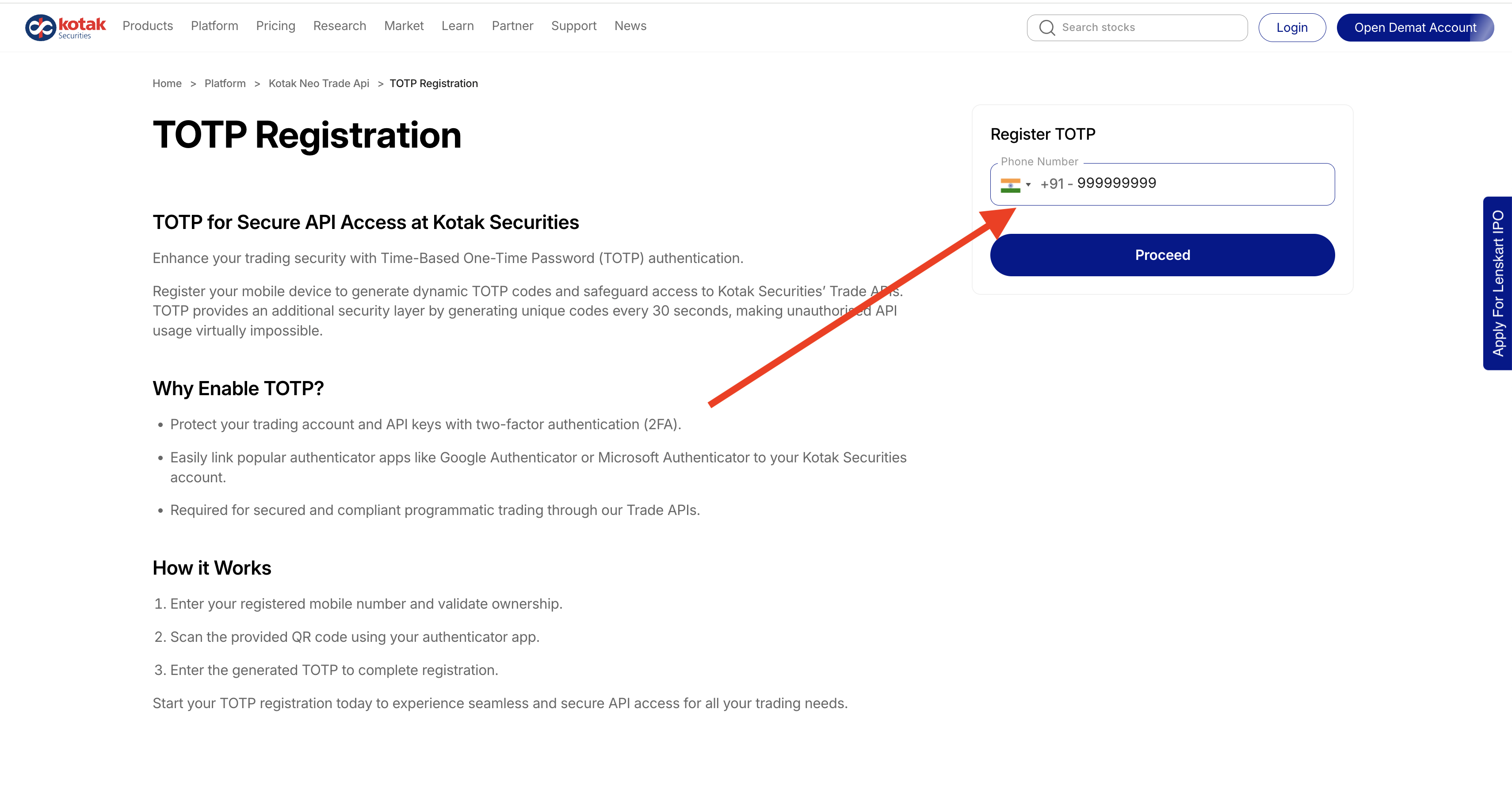

1. Go to https://www.kotaksecurities.com/platform/kotak-neo-trade-api/totp-registration

2. Enter your registered mobile number and click on Proceed.

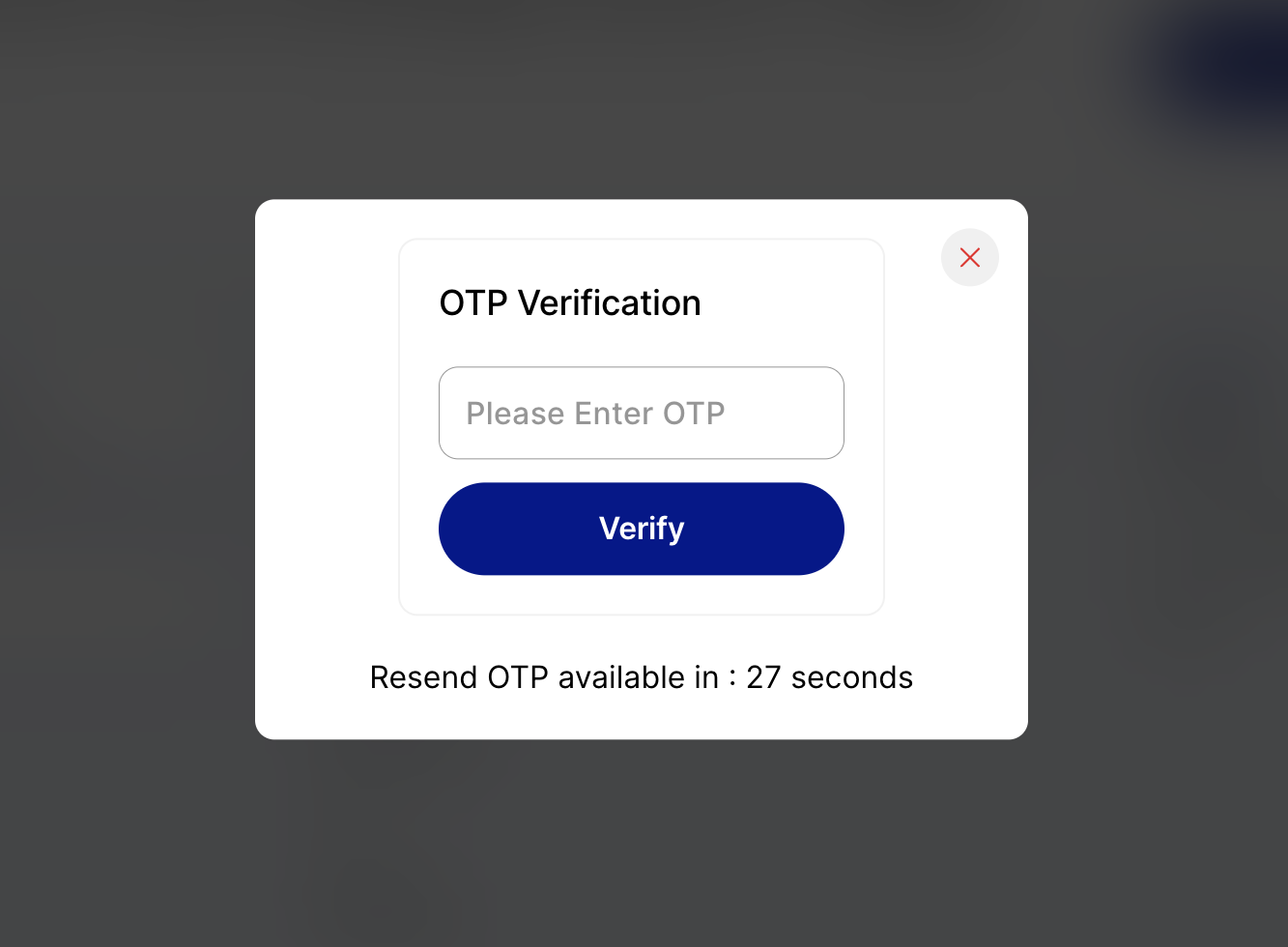

3. Enter the 4 digit OTP received on your registered mobile number.

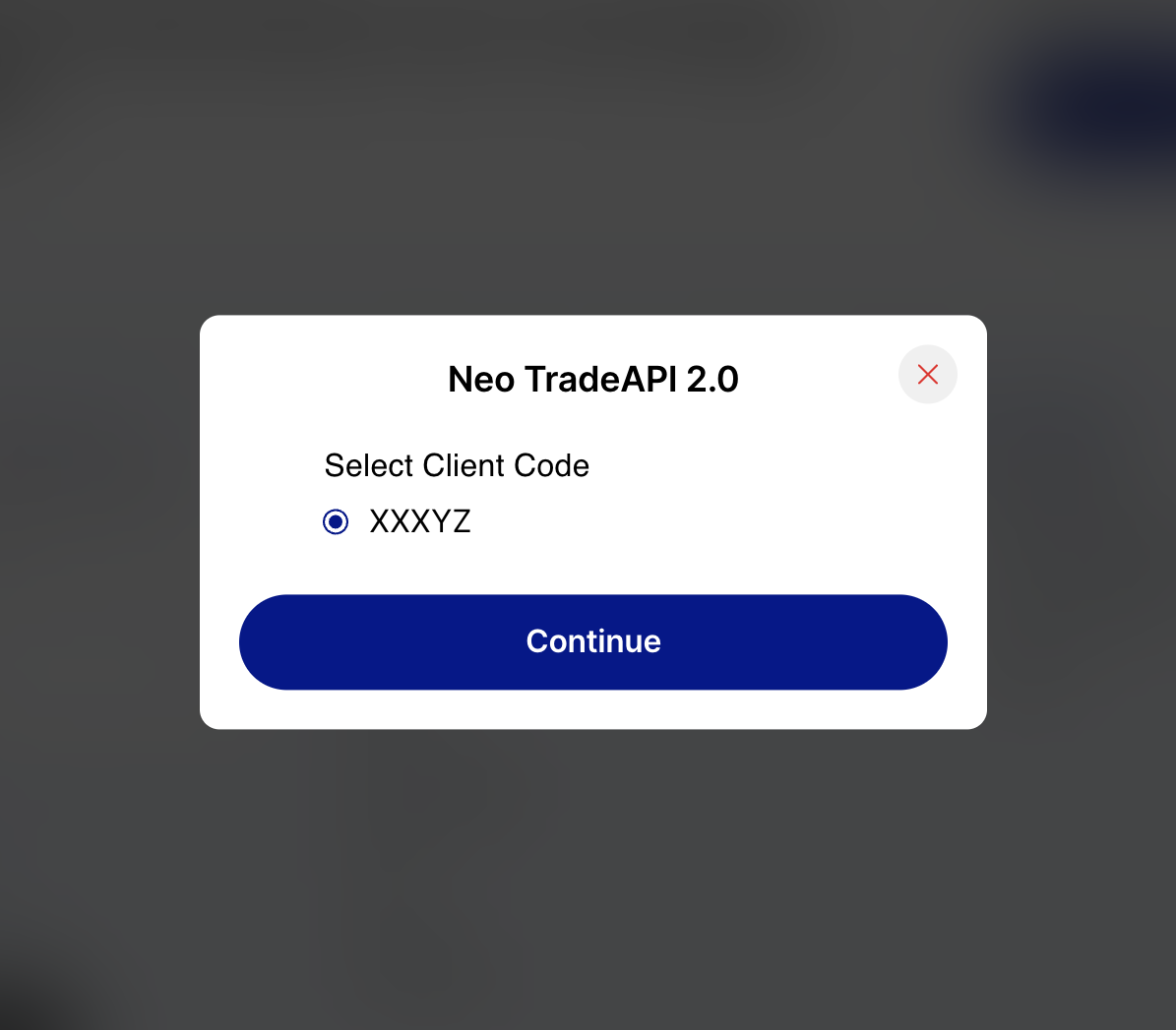

4. Select the Client ID and click continue.

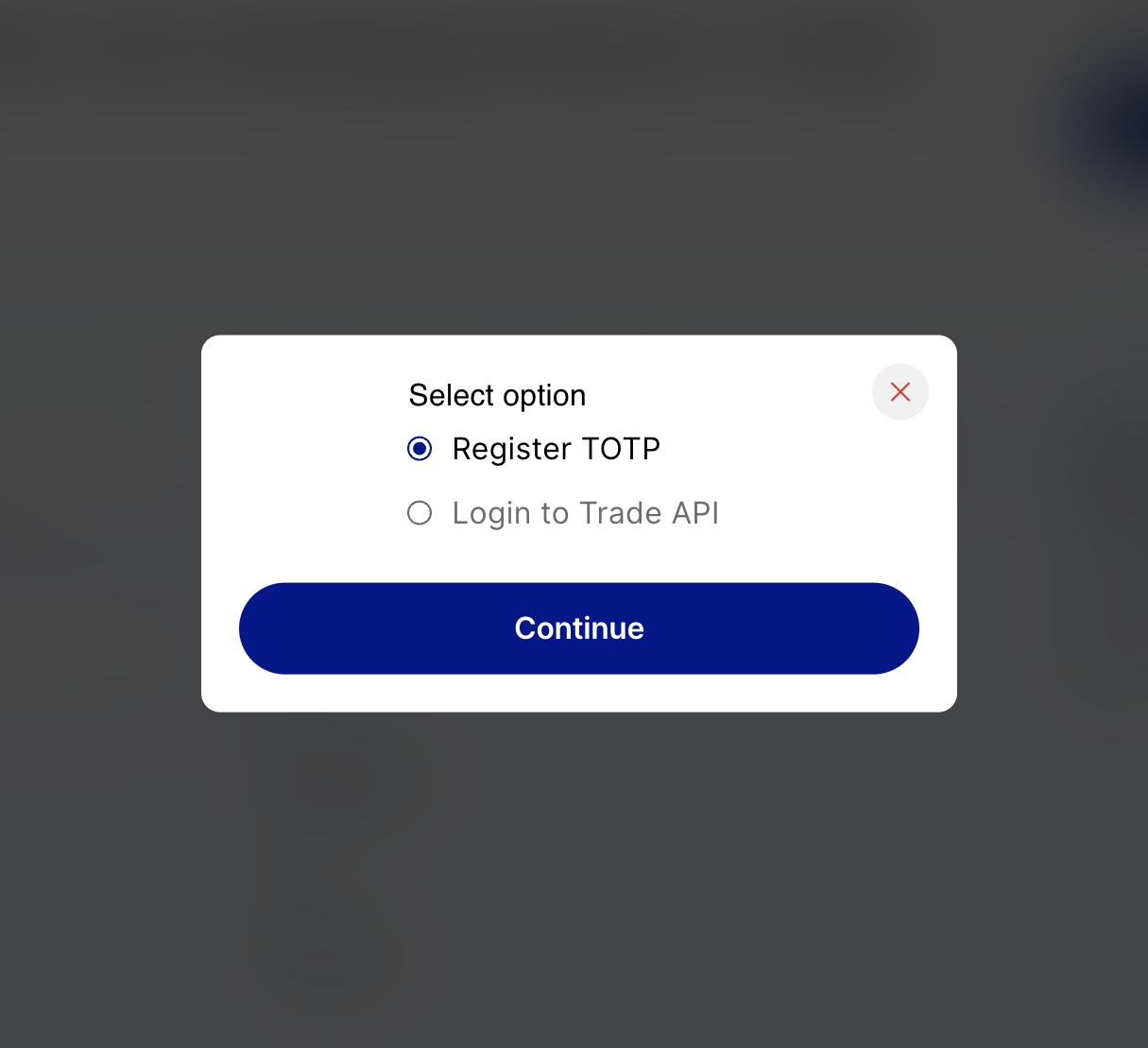

5. Select the option Register TOTP and click Continue.

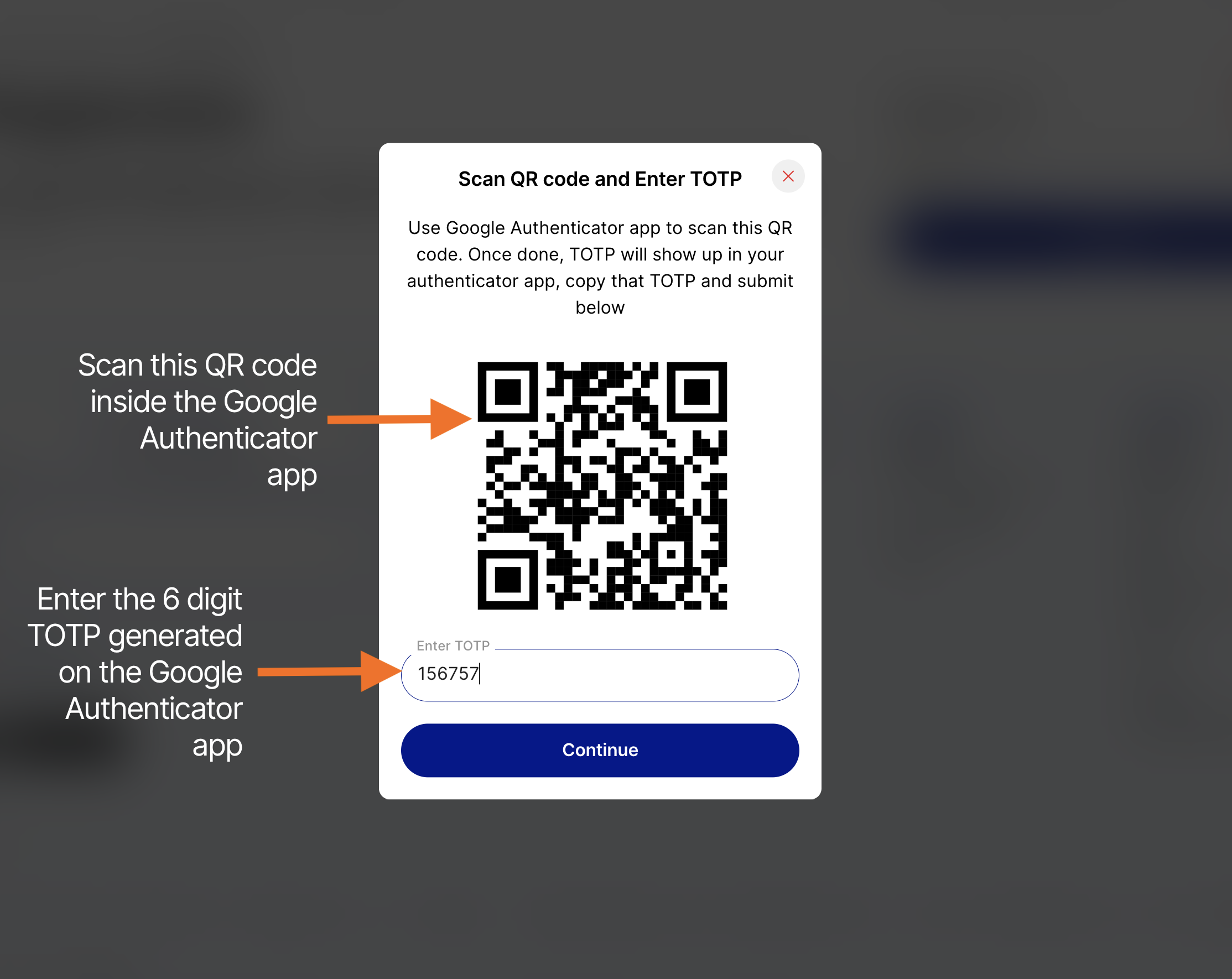

6. You will now see a QR Code. Scan this QR code in your Google Authenticator app. You will see the new TOTP generated after scanning the QR code, enter the TOTP in the box below the QR code and click Continue.

If TOTP is successfully activated, you will see the message TOTP registered successfully.

III. MPIN Setup:

Please note that MPIN will be required to generate the daily access token to use the API. Follow the steps below to create your account MPIN.

1. Login to the Kotak Neo web terminal - https://neo.kotaksecurities.com/Login

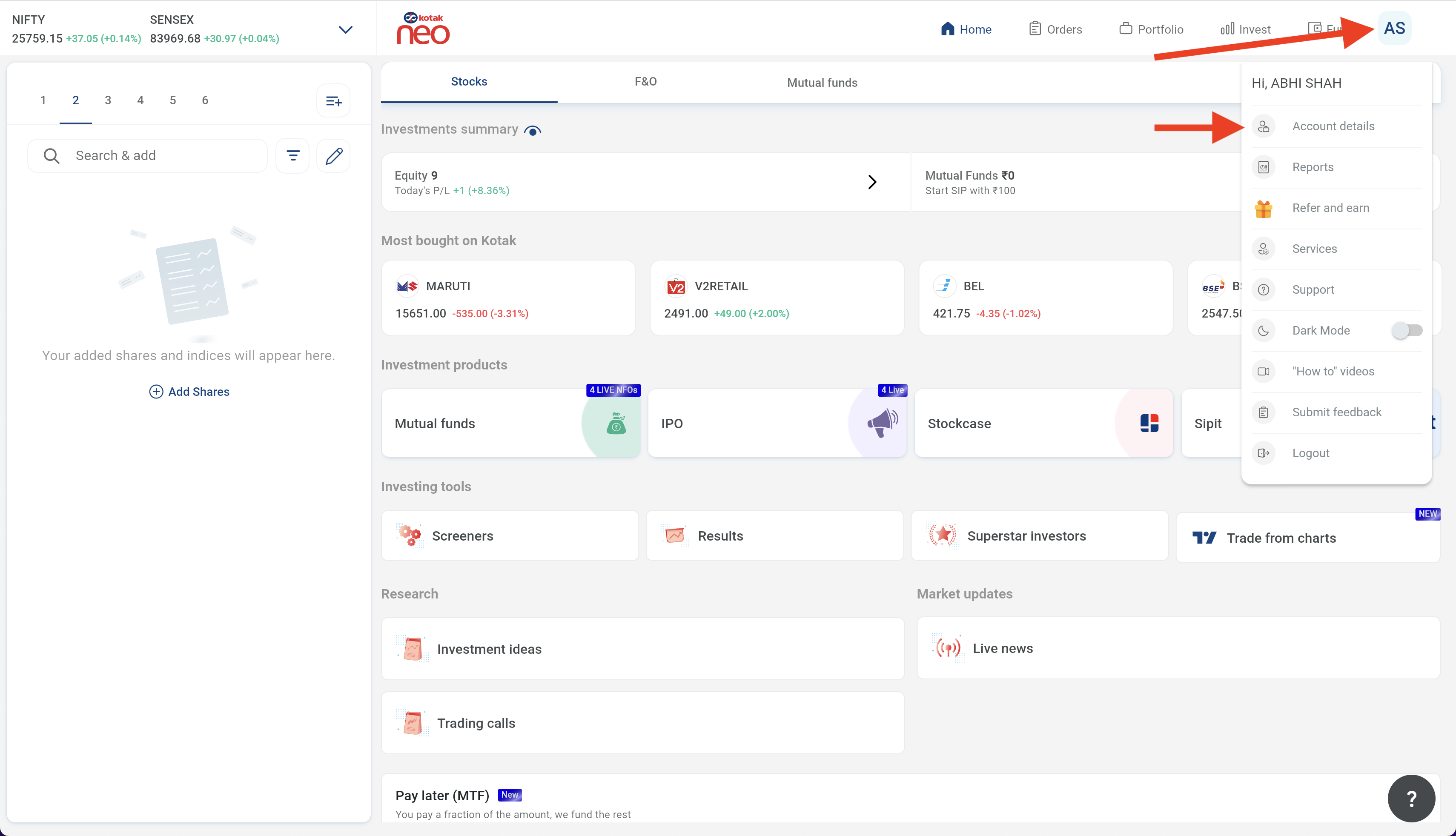

2. Once logged in, click on your initials on the top right hand corner of the screen to open the main menu bar, and then click on the Account Details option.

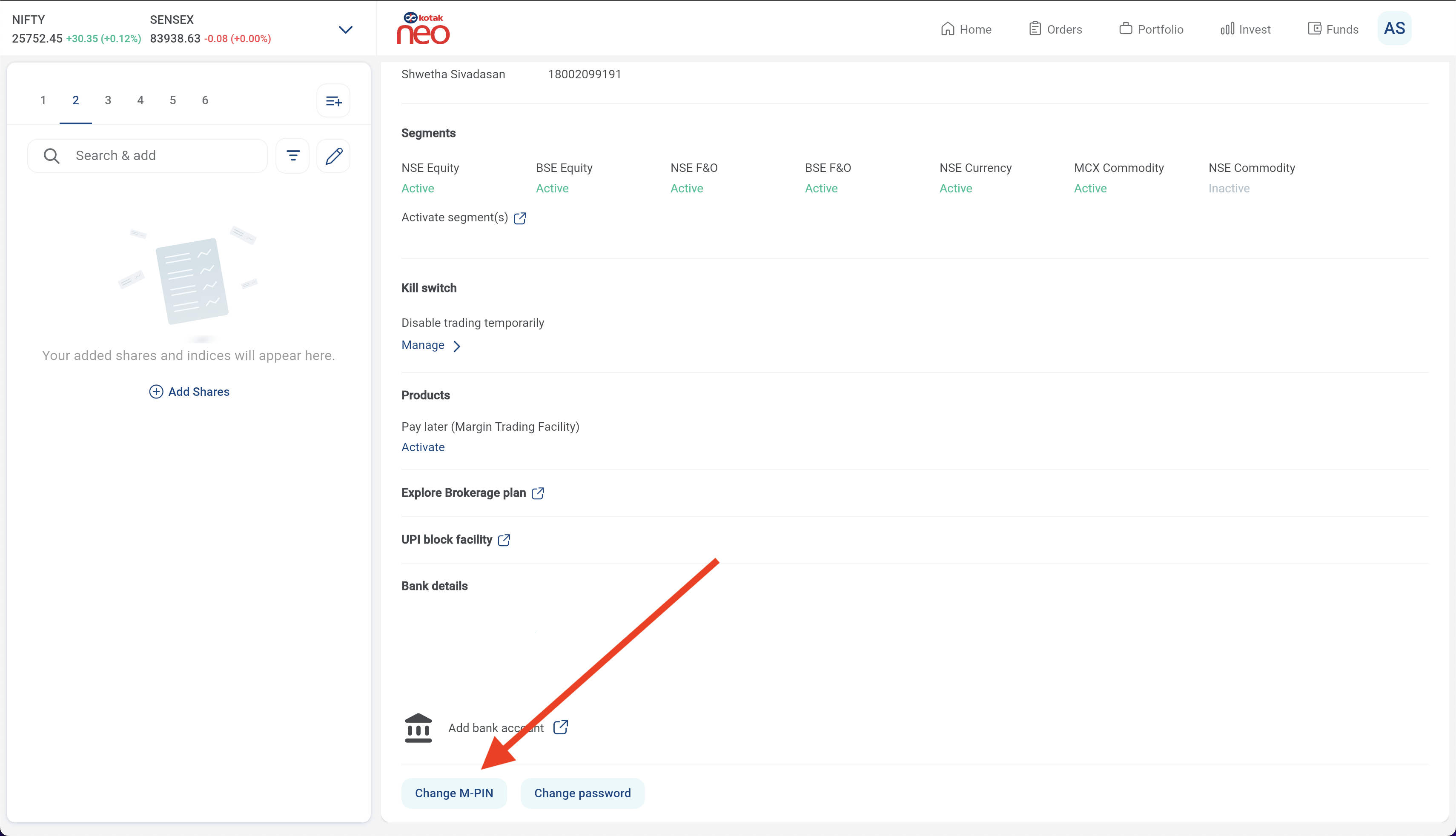

3. On the Account Details page, scroll down to the bottom of the page and find the MPIN option. Click on it and setup your new MPIN.

IV. Quantiply Setup:

Once your API, TOTP and MPIN are enabled, you can now move to Quantiply to configure your Kotak account and start trading. Follow the steps shared below:

1. Go to the Broker Setup page on Quantiply, and click on the SETUP button under the Kotak Neo V2 [TOTP] broker.

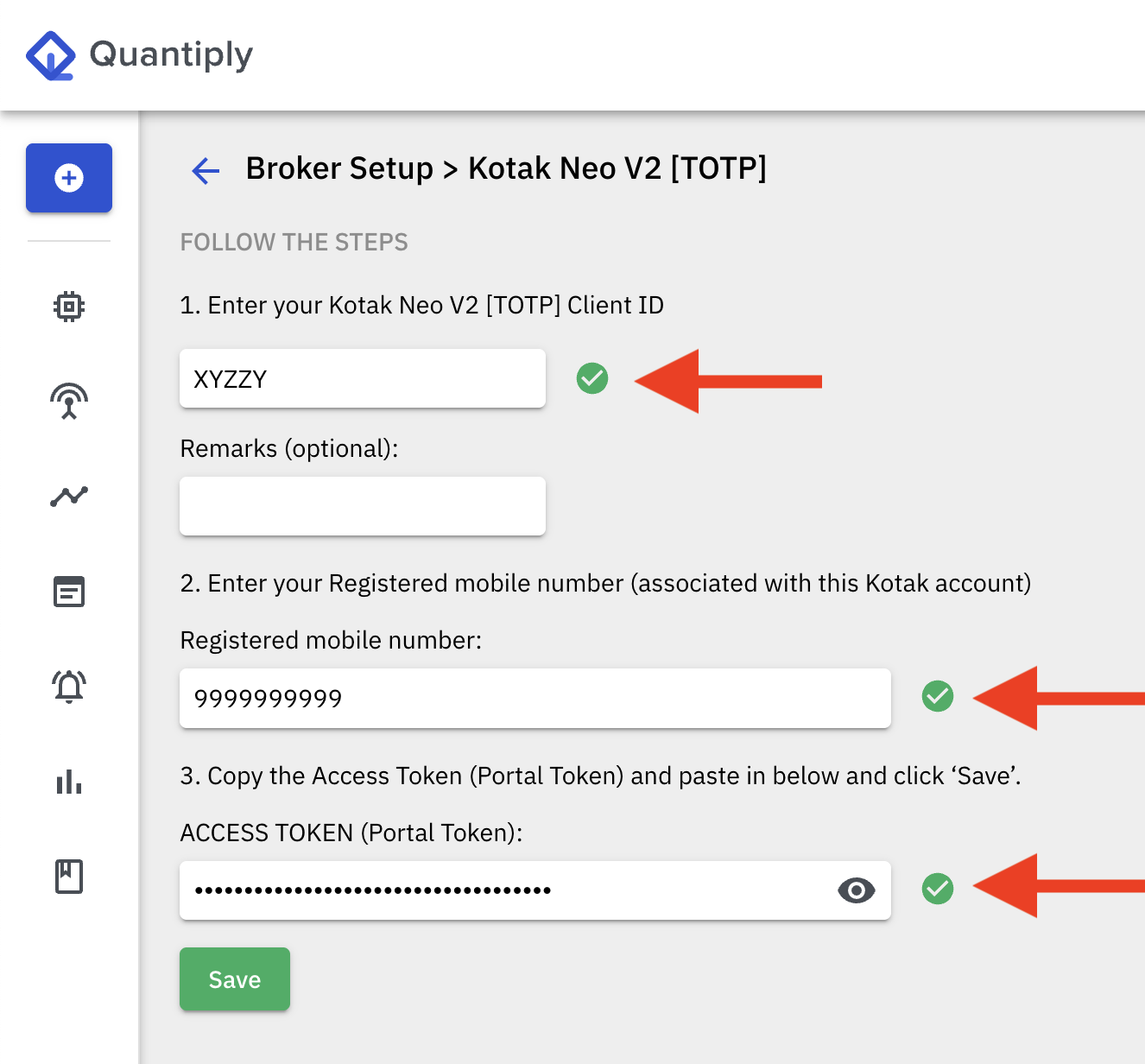

2. Enter your 5-digit Kotak client id, your Kotak registered mobile number and Token generated at the time of API activation in Step 1. Click Save once all the three details are added and your Setup is complete.

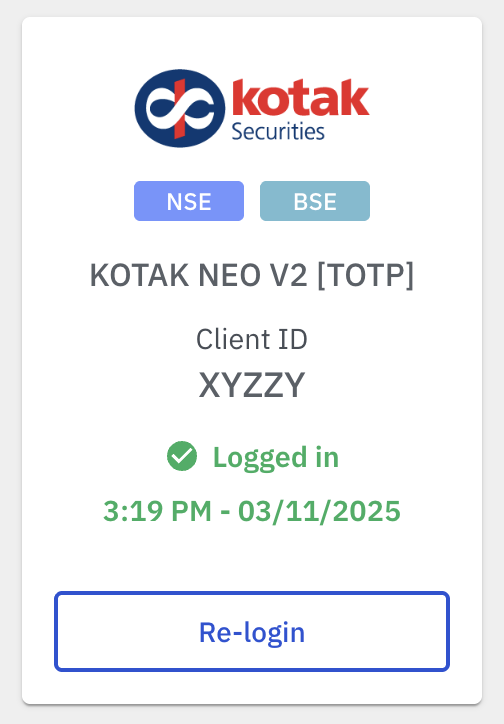

3. Do a trial broker login from the Broker Login page on Quantiply. Click on the Login button under the newly setup Kotak Neo V2 [TOTP] account. Enter the MPIN and the 6-digit TOTP and click on Login. If the setup was done correctly, you will see the message 'Logged In' under your Kotak Neo V2 [TOTP] client id on the Broker Login page.

V. Migration from Kotak Neo API V1 to Kotak Neo API V2:

For any queries related the setup, you can get in touch with Quantiply Customer Support: https://quantiply.tech/contact.