What is the Entry by Premium feature?

You can now enter positions in strikes with premiums close to a specified premium value. This feature scans the entire Option Chain to select an appropriate strikes as per the specified premium value set by the trader.

Settings:

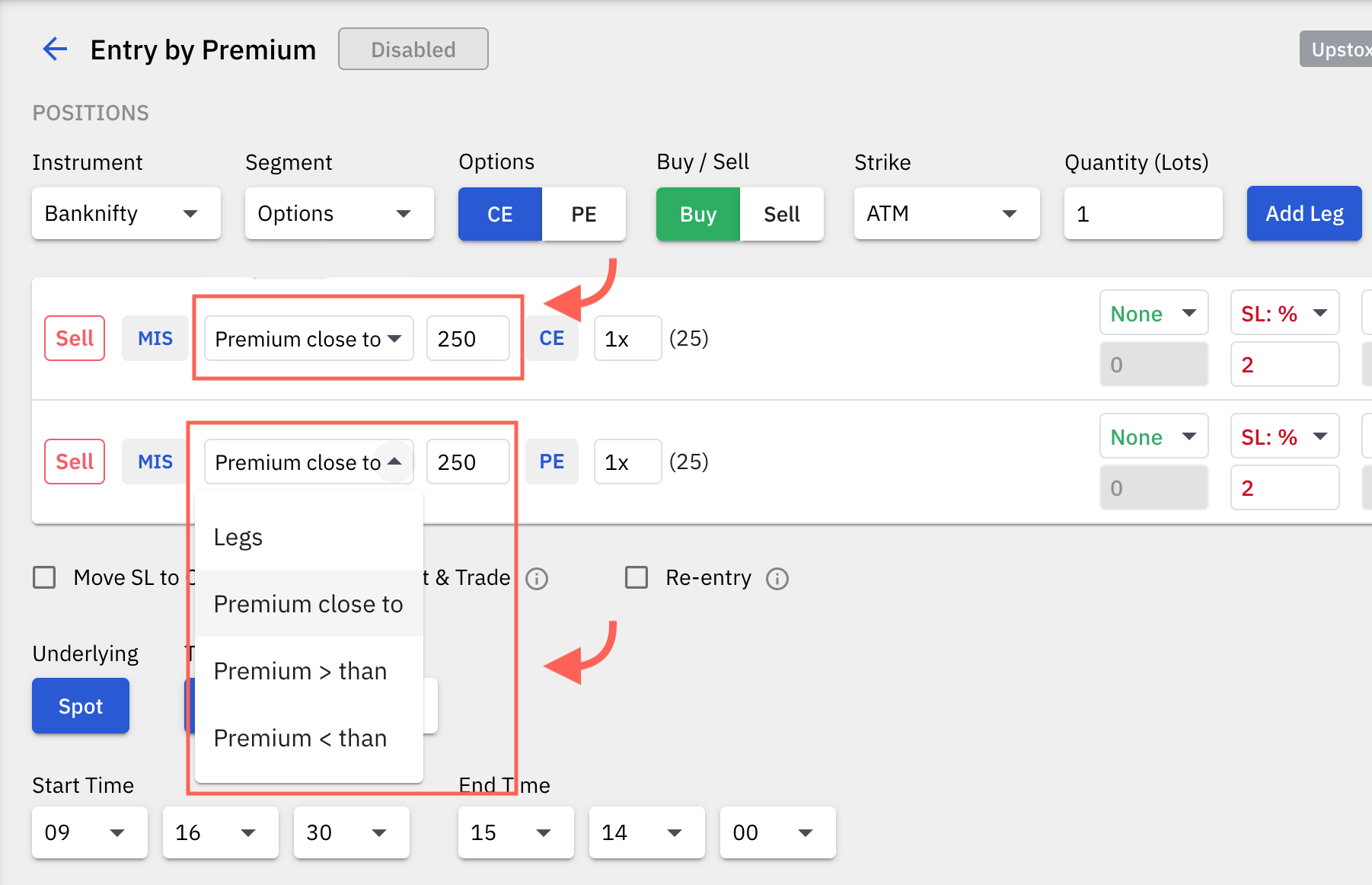

I. Specify premium value:

- Premium close to: A strike with premium closest to the specified value will be selected. The premium selected can be more or less than the specified value but will be the closest to the specified value.

- Premium higher than: A strike with premium higher than but closest to the specified value will be selected.

- Premium lower than: A strike with premium lower than but closest to the specified value will be selected.

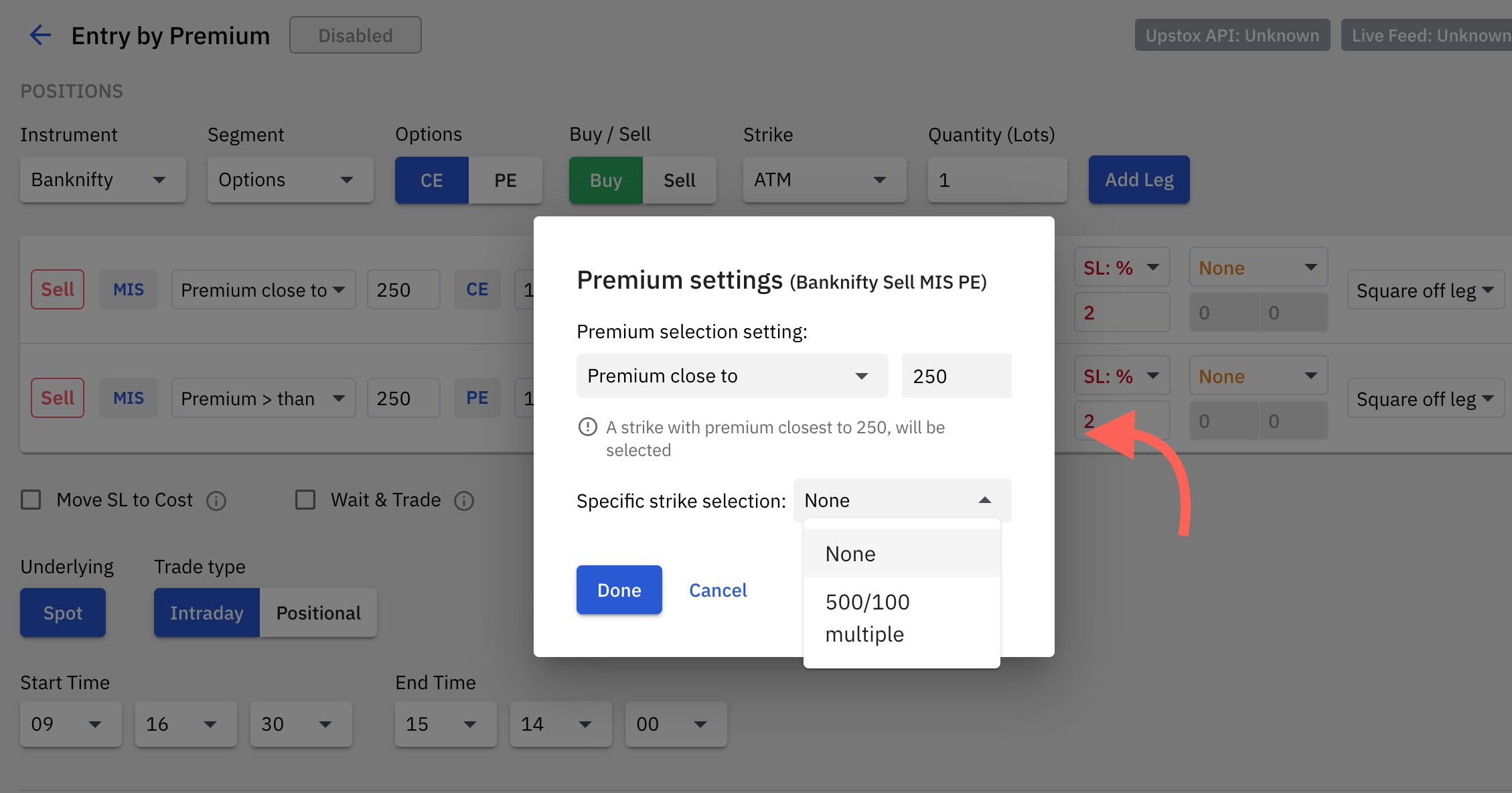

II. Specify strike selection:

- None (default setting): With this option there is no restriction in terms of which strike is selected in the option chain, the algo will scan the premiums of all available strikes and select the strike as per the premium value specified.

- 500/100 multiple strikes: The specified premium will be checked only for the strikes that occur in the multiples of 500 for Banknifty (eg. 39000, 39500 and so on), & 100 for Nifty (eg. 13000, 13100 and so on). The 500 multiple strikes for Banknifty and 100 multiple strikes for Nifty hold good OI and are more liquid compared to other nearby strikes, hence, are a better option when taking positions in far OTM or ITM strikes.

Important points & recommendations:

- When buying or selling far away OTM or ITM strikes, use the option to select strikes which occur in multiples of 500 (in Banknifty) and 100 (in Nifty) as some far away strikes may have 0 or very low Open Interest or no live updating price at all.

- When trading far away OTM strikes, with Entry order type SL Limit selected, it is best to keep a buffer value in percentage rather than points, so as to avoid placing stoploss limit orders with limit prices that cross the circuit price for that symbol. For example: for a strike being entered where the premium is 5 and the SL Limit buffer value is 5 points, there are high chances that the order gets rejected as the limit price of 10 may be outside the circuit limit for a strike that has a premium of 5.

- Wait & Trade with premium based entries: The strike will get selected as per the specified premium value and the current price as reference price, and the trade will get executed as per wait & trade settings.

- For deep OTM and ITM strikes, price updates can be slow sometimes, in such a case, the algo will take positions only when the latest tick arrives for all known strikes after the start time, this can take an additional 10-15 seconds. Only once all legs have a price update will the algo shoot the order in all legs together. This has been done as far away OTM strikes don't have many continuous trades and continuous price updates, hence to aid correct strike selection this waiting period is added. Also the algo will not take positions in a few legs partially, it will wait for all strikes to have a price update after the start time.

- For very low deep OTM premium values, make sure to use premium higher than or premium close to settings, and NOT premium lower than. There can be strikes which may not have the premium that you may have specified with the setting premium lower than, and the algo won’t be able to take positions if it can’t find the premium that you have specified. Keeping the settings premium higher than or premium close to will allow the algo to take positions in the deepest OTM or ITM strike closest to the specified premium value.