Using this functionality the percentage value of the current spot price is calculated and strikes with premium closest to the calculated percentage value are selected.

Example:

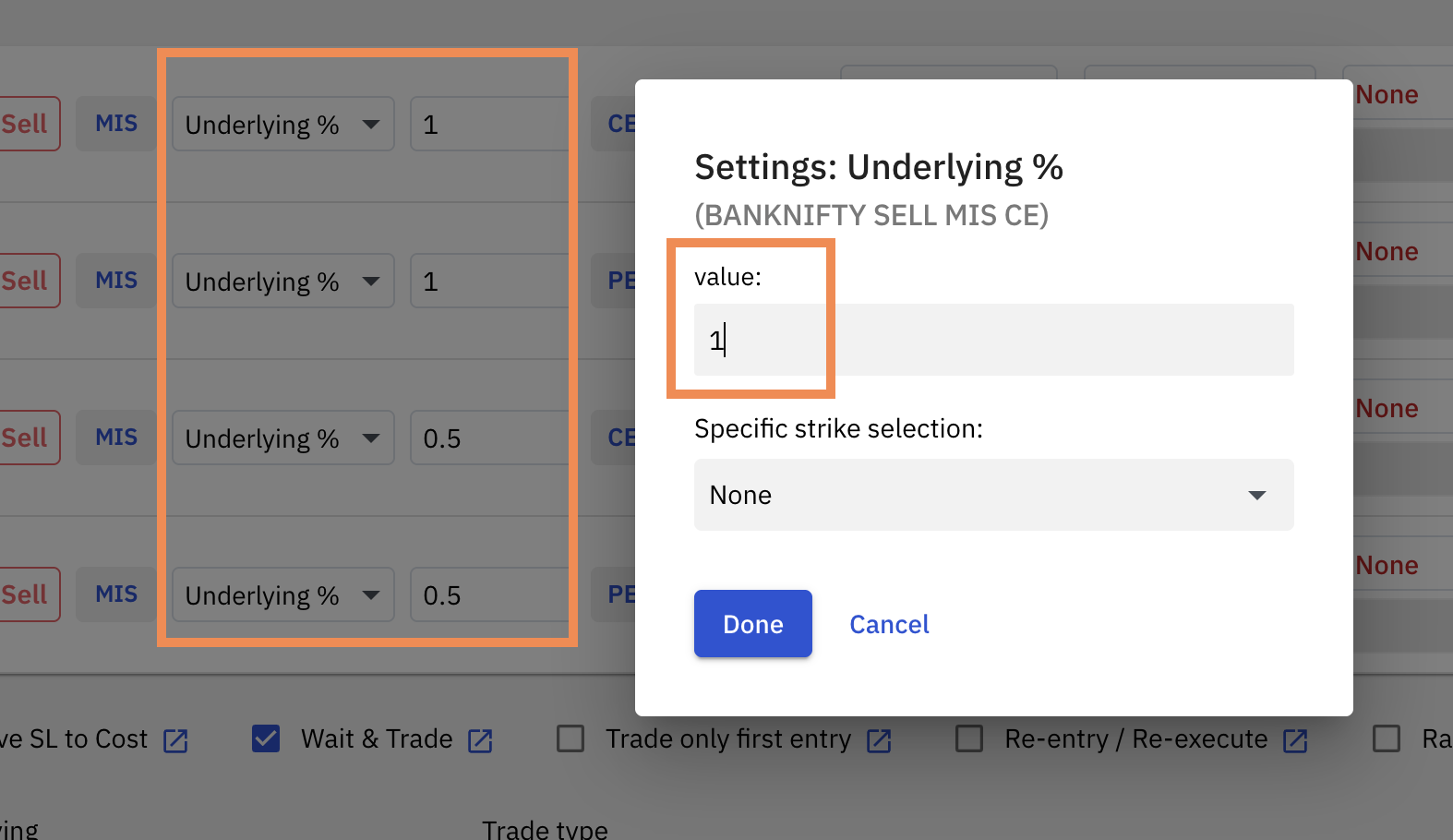

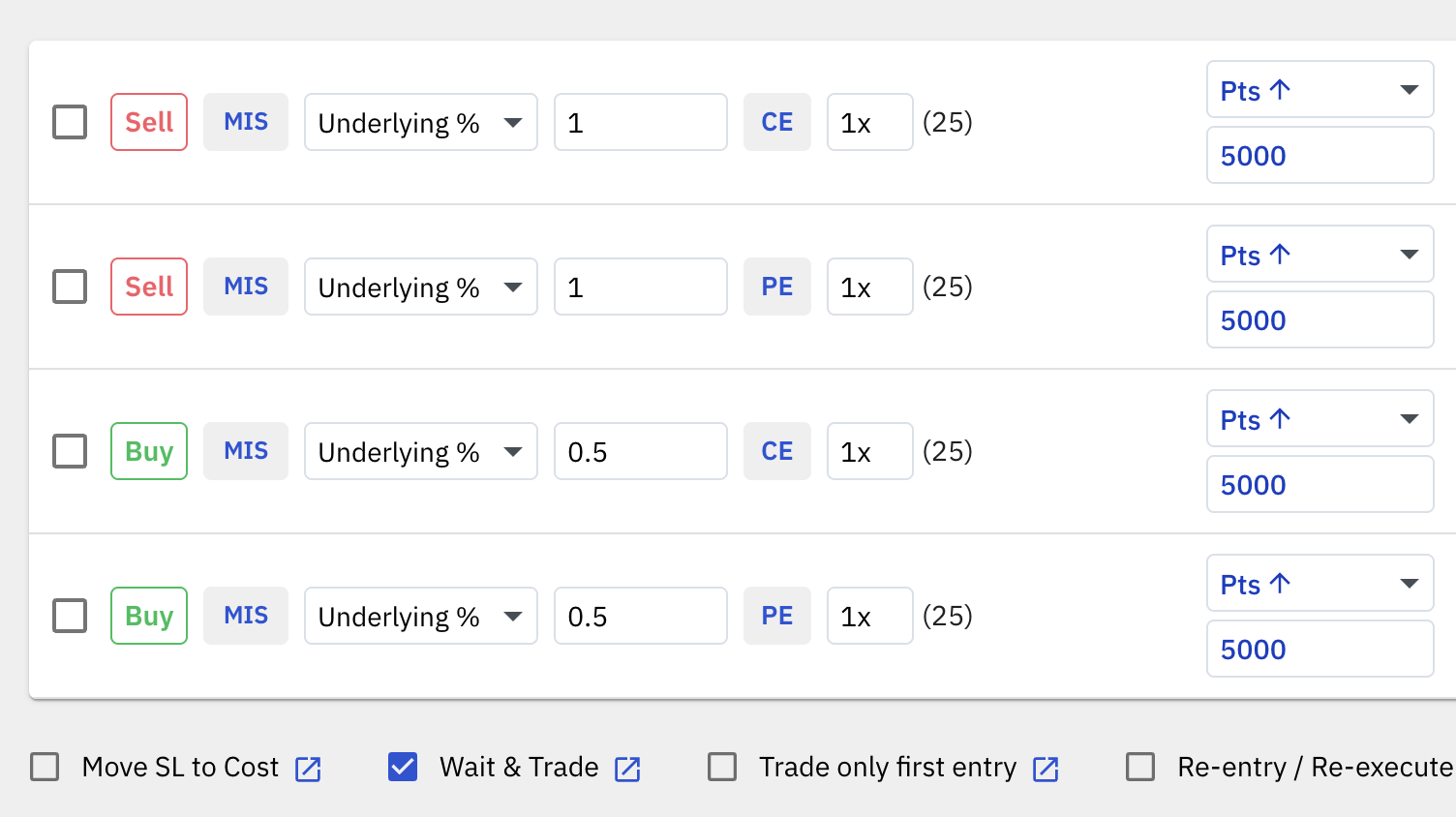

4 legs are configured in the strategy settings, as follows:

Sell - % of Underlying - 1% - CE

Sell - % of Underlying - 1% - PE

Buy - % of Underlying - 0.5% CE

Buy - % of Underlying - 0.5% PE

The spot price at the Start Time is 24622.15

Strike selection as follows:

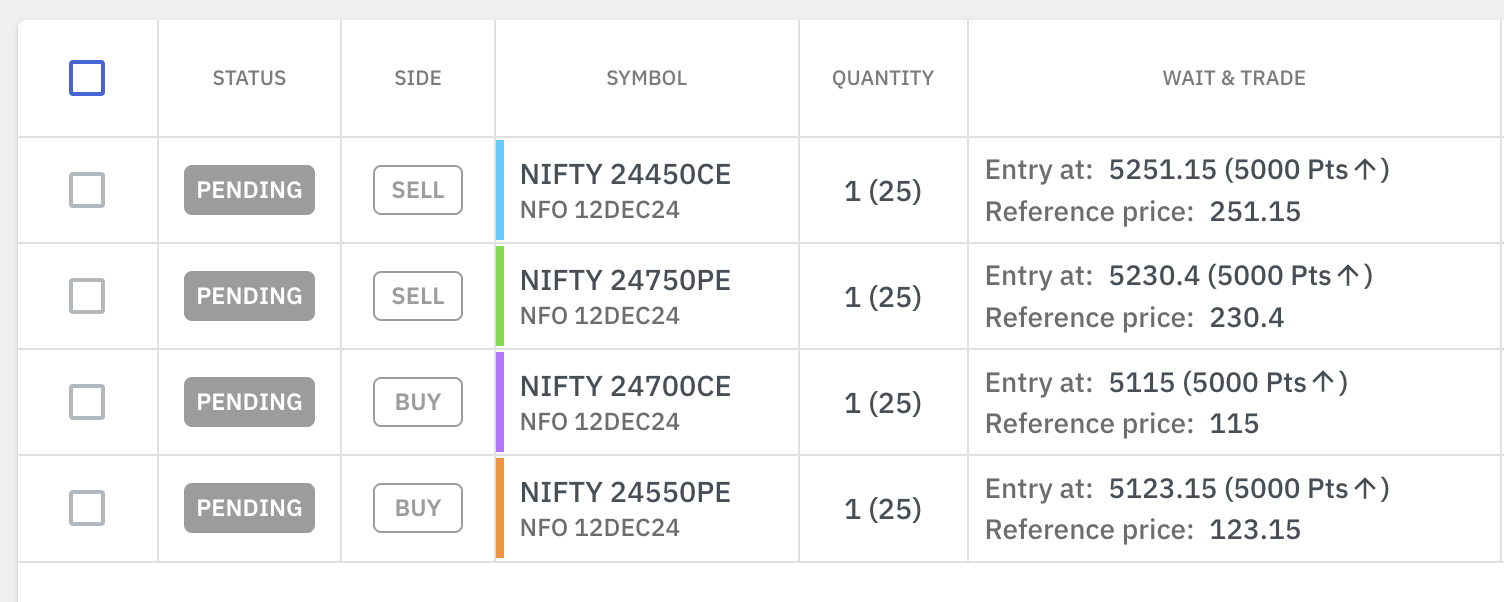

Leg 1

Sell - % of Underlying - 1% - CE

= 1% of 24622.15 = 246.22

= Strike selected with premium closest to 246.22

= Strike selected - 24450 CE which has a premium of 251.15 at algo Start time.

Leg 2

Sell - % of Underlying - 1% - PE

= 1% of 24622.15 = 246.22

= Strike selected with premium closest to 246.22

= Strike selected - 24750 PE which has a premium of 230.4 at algo Start time.

Leg 3

Buy - % of Underlying - 0.5% CE

= 0.5% of 24622.15 = 123.11

= Strike selected with premium closest to 123.11

= Strike selected - 24700 CE which has a premium of 115 at algo Start time.

Leg 4

Buy - % of Underlying - 0.5% PE

= 0.5% of 24622.15 = 123.11

= Strike selected with premium closest to 123.11

= Strike selected - 24550 PE which has a premium of 123.15 at algo Start time.