This functionality allows you to configure the exact strike that you want to take entry in.

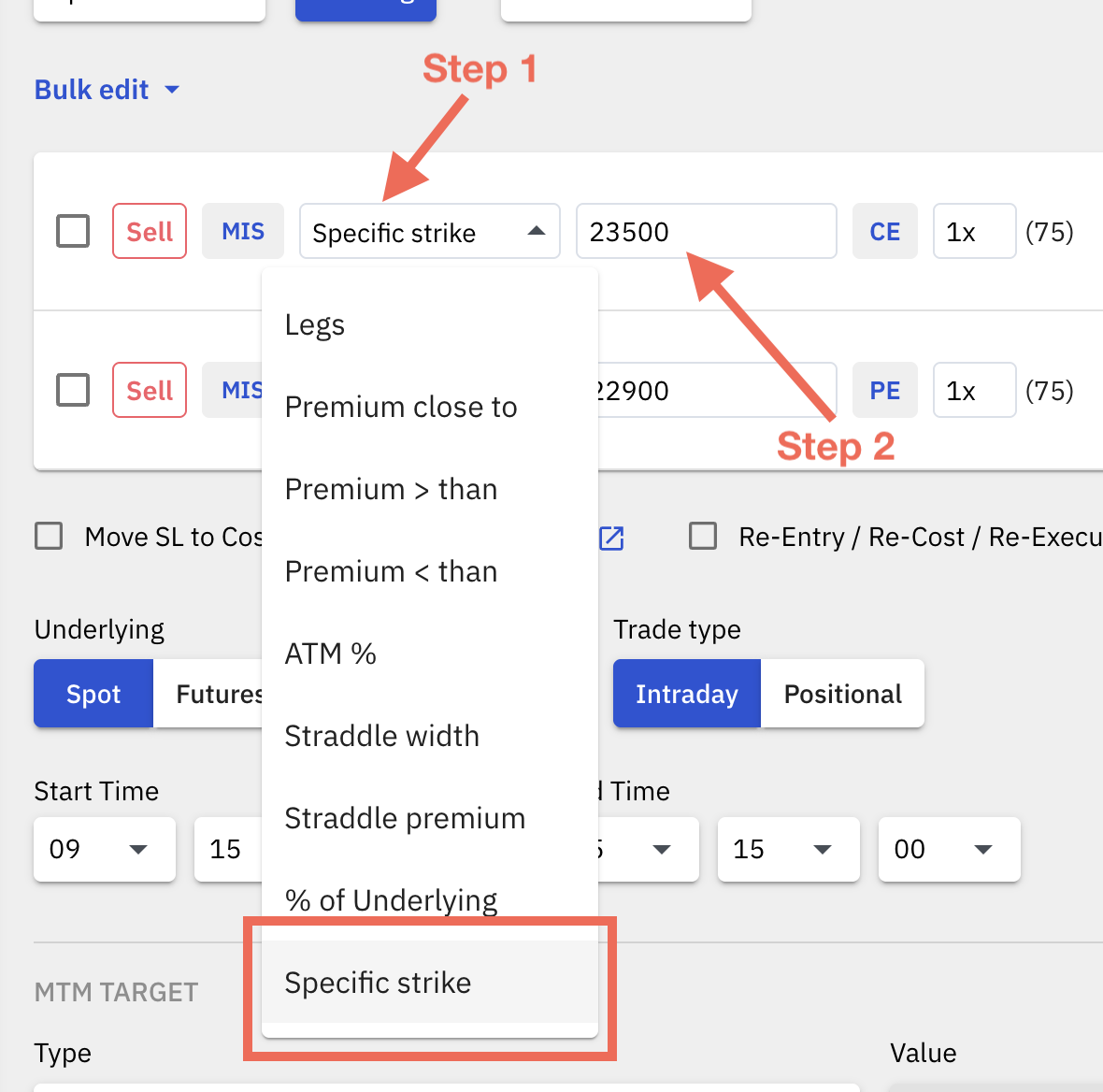

Steps to configure specific strikes:

Step 1: From the entry type drop down box select the option "Specific Strike" for a particular leg.

Step 2: Once Specific Strike option is selected, you will see a text box next to the entry type box, in the text box type in the exact strike level that you want to enter. You only need to type in the strike level which will be in numeric values only.

For example: You want to enter NIFTY 23500 CE, you will enter only 23500 in the text box, as seen in the above screenshot.

Step 3: Select leg type using the PE/CE toggle button.

Step 4: Select the Underlying ie. Nifty/Banknifty etc, and select the Expiry ie. Weekly, Next Weekly, Monthly.

Note:

1. The strike values that you feed into the text box have to be the exact strike values which are in intervals of 50 in Nifty and Finnifty, 100 in Banknifty, Sensex and Bankex, and 25 in Midcpnifty. So if you enter a value like 23510, instead of 23500 for Nifty, the setting will not get saved.

2. In the case of RE EXECUTE type of re-entry, the same strike will re-enter always, the strike price will not change.

3. If the algo is in Trade Active status already, the strike price cannot be changed. But if the algo is in Ready status, you can change the strike price. Do not forget to click the Save button after changing the strike price when the algo is in Ready status.