What is Move Stoploss to Cost ?

When any individual leg or individual open position hits a stoploss, the original stoplosses of all other open legs of the opposite side strikes get revised to cost ie. the stoploss is revised to the average entry price of those opposite side legs.

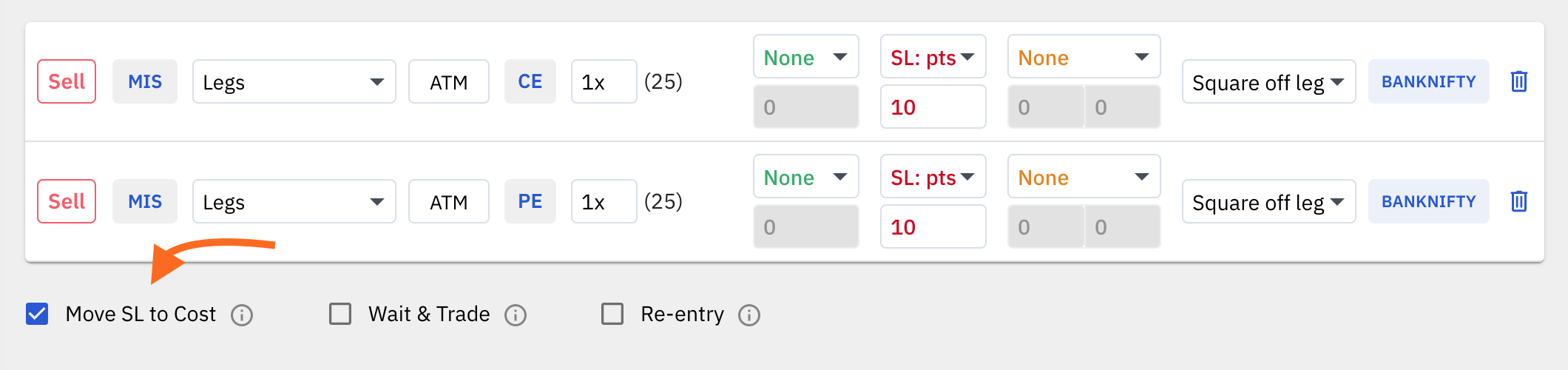

Move SL to Cost setting

Move SL to Cost settingExample 1:

In a strategy with 2 legs - Sell CE & Sell PE. If Sell CE hits stoploss, Sell PE's stoploss will be revised to cost (ie. entry price).

Example 2:

In a strategy with 4 legs - Sell CE, Sell PE, Buy CE and Buy PE. If Sell CE hits stoploss, Sell PE's stoploss and Buy PE's stoploss will be revised to cost (ie. entry price). Buy CE's stoploss will NOT get revised to cost (ie. entry price).

This stoploss revision works only on individual legs and not on the combined premium stoploss.

Other scenarios where Move Stoploss to Cost is used with other features:

- Move Stoploss to Cost + Wait & Trade:

- Move SL to Cost works only when 2 opposite side legs (ie. CE & PE) are open simultaneously. When 1 side SL hits, the leg(s) of the other side will have their stoplosses moved to cost.

- In the case of Wait & Trade, if only one leg is open, and it’s stoploss hits, and later if the other side leg also enters, the stoploss that gets applied to the leg that entered later will be as per the original stoploss setting. In short, stoplosses can be moved to cost only when 2 opposite side legs (ie. CE & PE) are open simultaneously and one side hits the stoploss.

- Move Stoploss to Cost + Re-entry

- In the case where where multiple re-entries in multiple legs have already happened, the side which moved to cost upon hitting the stoploss the very first time, will be the side that will have it's stoploss moved to cost every time throughout the time the algo is active while multiple re-entries are being taken. So, upon re-entry for all successive trades where both side (CE & PE) legs are open together, and this time if the side whose stoploss had moved to cost the very first time were to hit the stoploss while the other side leg is still open, the other side leg will NOT have it's stoploss moved to cost.

- Only in the case of MTM Re-entry, ie. where upon hitting MTM stoploss, all open legs are squared off and all legs re-enter again simultaneously. This creates a new 'group' of trades where Move Stoploss to Cost is reset and the logic is run again freshly from the start, where any side can have it's stoploss moved to cost.