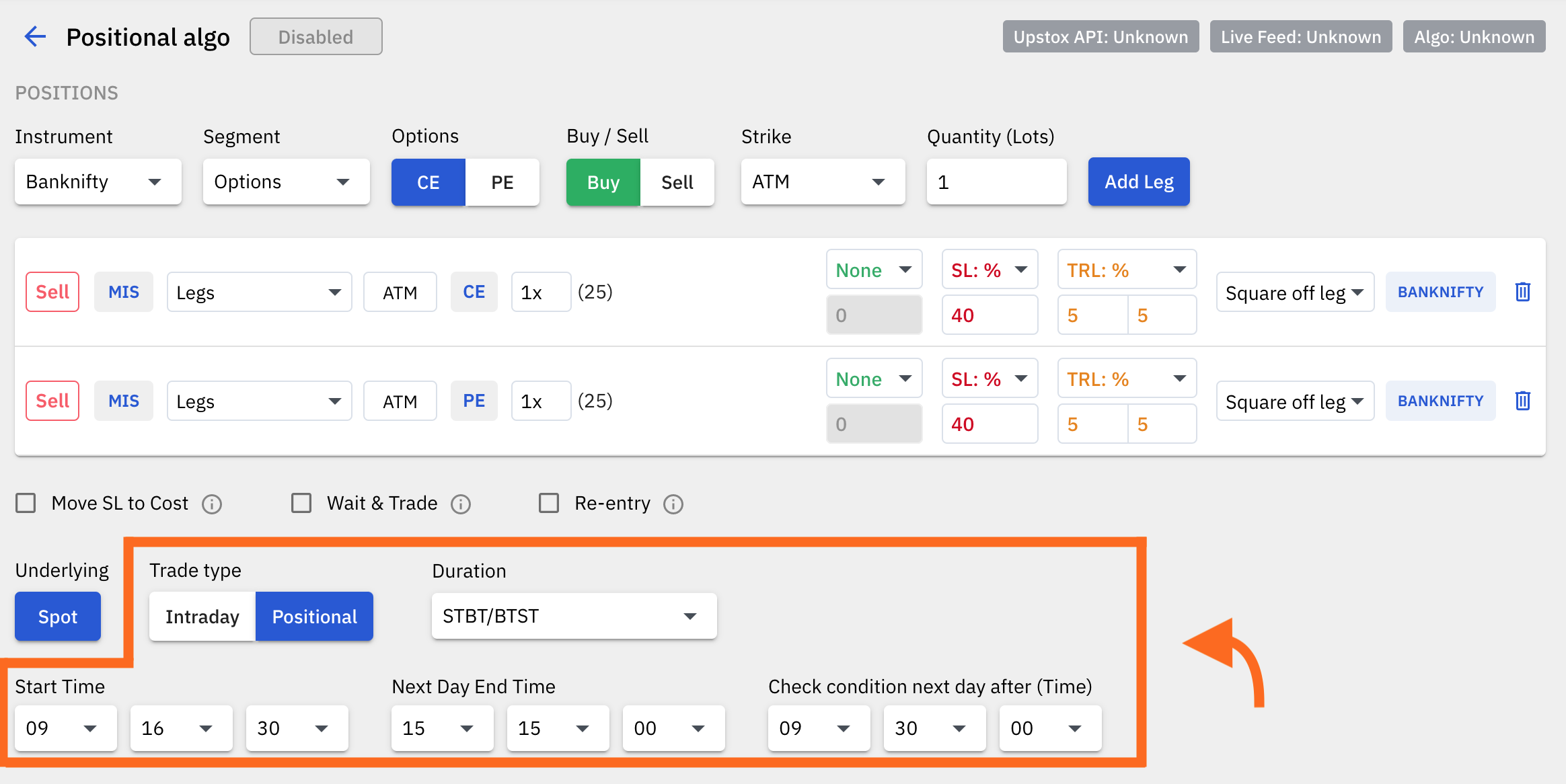

How to take Positional / Carry forward trades on Quantiply?

With Quantiply, you can carry forward positions to:

(1) The next day

(2) Till expiry

(3) Specific number of days before expiry

How to enable Positional trades:

- Select Trade type > Positional to configure a positional or carry forward trade.

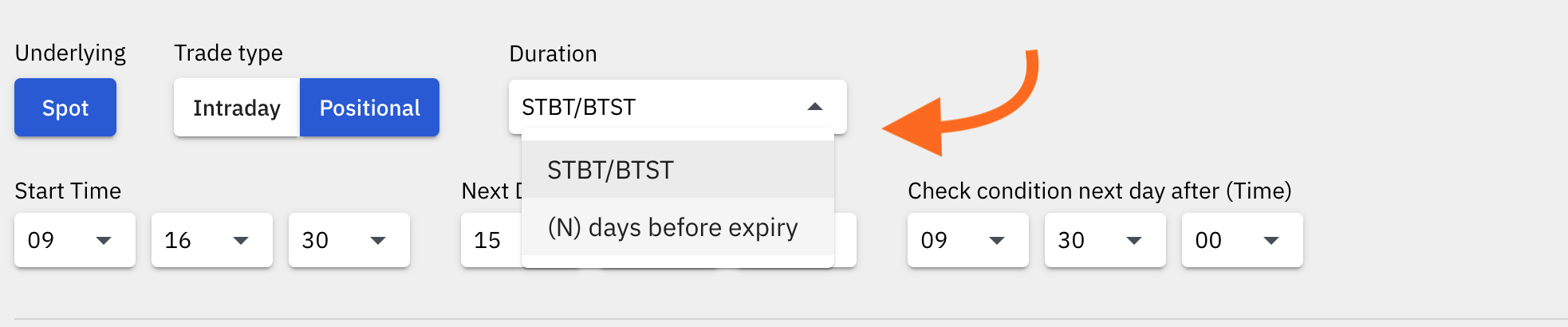

- There are 2 options to select the Duration of the trade:

- STBT/BTST (Sell today buy tomorrow/Buy today sell tomorrow): This option will square off positions the very next day. ie. the positions taken today will be squared off the next day.

- (N) days before expiry: This option will allow trades to be carry forwarded all the way till the expiry day or a specific number of days before the expiry day.

- Example: with setting N = 0 days before expiry, the algo will square off the positions on the day of the expiry. With setting N = 1, the algo will square off the positions 1 day before the expiry day, and so on. Setting Check condition next day after (time): The algo will check all entry, exit, stoploss or target conditions and place orders only after the time given as per this setting the next morning, for all days, for the entire duration of the trade.

- Check condition next day after (time) Setting: The algo will check all entry, exit, stoploss or target conditions and place orders only after the time given as per this setting the next morning, for all days, for the entire duration of the trade.

- Example: If the time is set to 09:30:00 then the algo will check if any or all SL or Target conditions or other entry or exit conditions are met and square off orders only after 09:30:00 on the next trading day. This setting can be modified even when trade is active during market hours and off market hours.

- It is advisable to set Check condition next day after (time) to a time later than 09:16:00 to avoid early morning erratic price fills, execution delays or API errors from the broker.

Important pointers:

- While the trade is active, if you modify the Duration setting from (N) days before expiry to STBT/BTST, and if the trade has already been active for more than 2 days and crossed the day 2, the algo will immediately square off positions ie. upon changing from (N) days before expiry to STBT/BTST.

- Example: If a trade is taken on a friday with (N) days before expiry setting 0, and on Tuesday or Wednesday, one were to change the Duration setting from (N) days before expiry to STBT/BTST, the algo will immediately exit all positions as Monday which would be the STBT/BTST exit day, has already passed.

- On the last day of the configured duration of a particular trade, between Next Day End Time and Check condition next day after (time), whichever time is earlier, will be treated as the check condition next day after (time) and end time both.

- This means, on the last day of the Positional trade, if the end time were 09:20 AM, and the check condition time were 09:30 AM, 09:20 will be treated as Check condition next day after (time) and the End time as well. And in this case, the algo would immediately exit any open positions and terminate the algo.

- Broker login has to be done on time, on all days, especially if you're running Positional algos. If you fail to broker login on a day when a positional algo is supposed to exit, then the positional algo will again run on the same day next week.

- Algo cancels the limit orders of target/sls before market closes and places them again in the morning after the check condition next day start time.

- Quantiply doesn't place any AMO orders during off market hours for any positional trades.

- Do not remove your client id from your Quantiply account if a positional trade is active. Even if you re-add the same client id again after removing the account, the positional trade will not continue to run. So avoid removing the client id (trading account) when a positional trade is active.