What is NSE's Limit Price Protection (LPP) mechanism?

NSE has set a price range within which Limit or SL Limit orders can be placed above and below the Reference Price (RP).

If orders are placed at prices that are beyond the specified range from the RP, then orders will get rejected by the exchange resulting into the error - "17070: The price is out of the LPP range."

How is the Reference Price (RP) calculated:

The reference price is the simple average of trade prices of the contract in the last 30 seconds. This reference price shall be revised throughout the day at 30 seconds interval

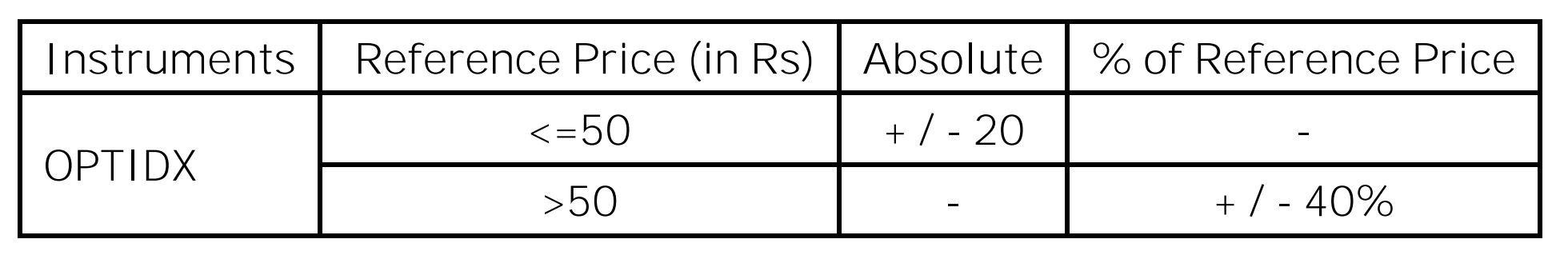

The range:

1. If RP is equal to or below a premium of 50, then the range within which the orders can be placed is +/- 20 points (absolute value) from the RP.

Example: If the RP is 50, a stoploss limit order cannot be placed with a price 30 points or below and at any price above 70 points. Orders can be placed with a limit price that is between 30 and 70 points.

2. If the RP is above 50, then the range within which the orders can be placed is +/- 40% of the RP.

Example: If the RP is 60, the range would be 40% of 60 = 24 points higher or lower, than 60. That is a Limit/SL Limit order cannot be placed with a limit price or trigger price below 36 points or 84 points.

What does it mean for Traders trading in Options on Quantiply?

Stoploss orders can be placed in advance even if they’re beyond +/- 40% or +/- 20 points from the Reference Price (RP). Limit or SL-Limit orders will not get rejected when you place them in advance or at the time of SL hit even if it is outside the LPP range.

The rejection comes only when the order is shot into the order book by the exchange. Meaning, only when the price crosses the Trigger Price, the order is shot into the order book ie. the order goes from ‘Pending’ state to ‘Open’ state. If at this point if the Limit price of your order is outside the LPP range, the order will get rejected.

We can see 2 scenarios playing out:

1. No rejection:

Price moves towards the stoploss slowly extending the LPP range along with it sufficiently to keep limit price of the exit order within the range and avoiding giving a rejection.

2. Order rejected:

Price spikes up or down, more than +/-40% or +/- 20 points in a few seconds and hitting stoploss, wherein the RP which is the average traded price of the last 30 seconds hasn’t changed in coherence with the price and the LPP range hasn’t extended yet. In the case of the rejection, the order can be squared off at the starting of the next 30 secs onwards, as by then the limit price may fall in the LPP range.

If there is an order rejection with a subsequent rejection message from the broker, the algo will exit or enter the position with a MARKET order.

Resources:

1. LPP circular: https://archives.nseindia.com/content/circulars/FAOP54242.pdf