This functionality allows you to place the re-entry orders in advance, allowing reduction in slippages while re-entering positions when Re-Entry and Re-execute features are enabled.

Orders are placed in advance for the following re-entry/re-execute configured methods:

- Re-Cost.

- Wait & trade Re-Cost.

- Wait & trade Re-Execute.

- Re-Cost Reverse.

- Wait & trade Re-Cost Reverse.

- Wait & trade Re-Execute Reverse.

Settings:

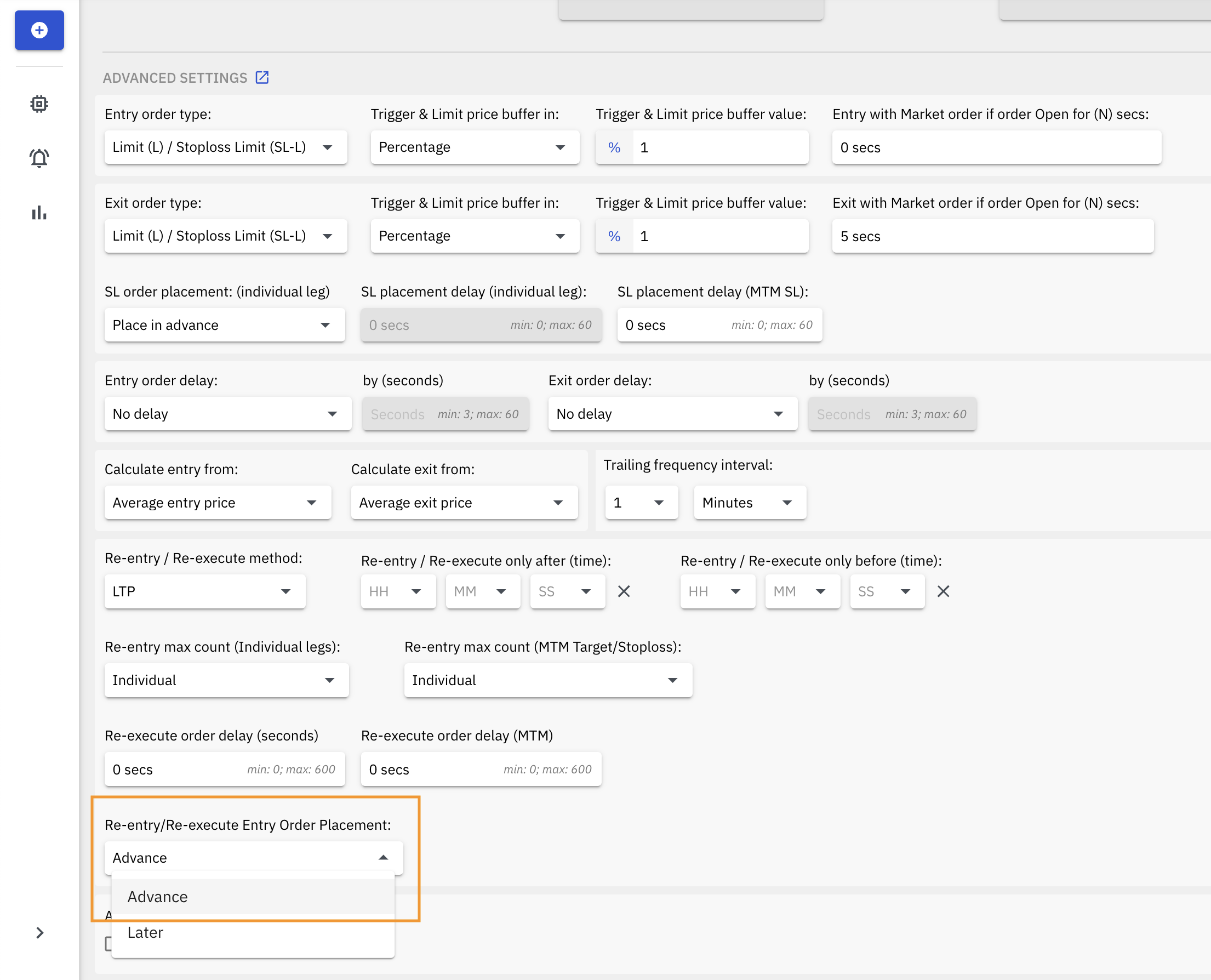

To enable advance placement of re-entry/re-execute orders, you need to first select Entry order type: Limit/Stoploss Limit under the Advanced Settings section.

Once that is selected, you need to select the Advance option under the setting Re-entry/Re-execute Entry Order Placement drop down menu.

Important points:

- The default setting under the Re-entry/Re-execute Entry Order Placement is Later, which means the orders will be placed only when the re-entry/re-execute condition is met.

- The Re-entry/Re-execute Entry Order Placement setting is not configurable when Entry Order Type setting is set to Market orders or when re-entry / re-execute method is set to Candle Close.