--3DH0Vs2boFwjMOlA3_vqfMVhb23FfkkzAMS.png)

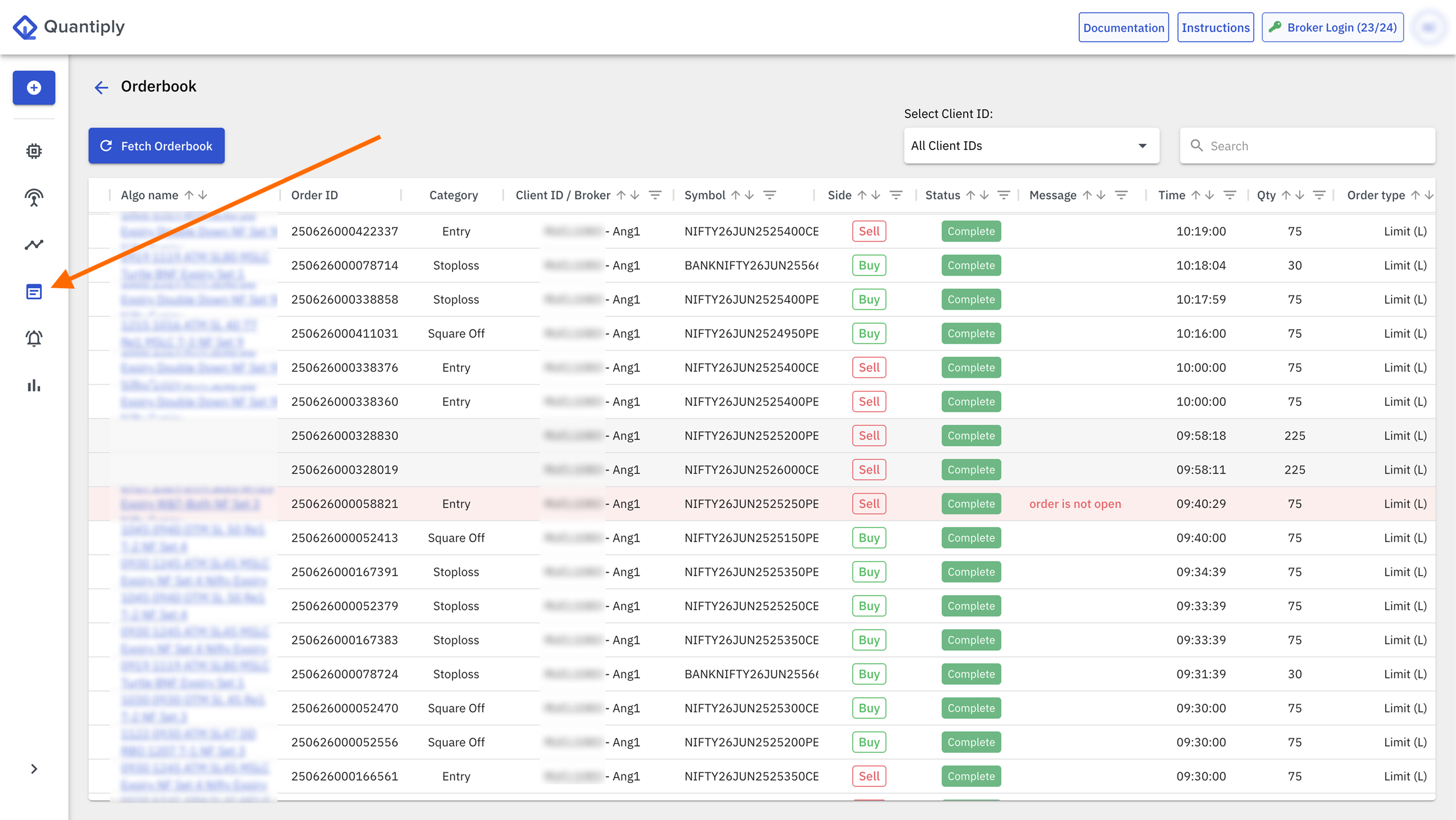

The Orderbook functionality allows you to fetch the latest/updated list of all orders of the current day and it's latest status from your trading account.

The functionality allows fetching of the entire orderbook of all active Client IDs of all brokers present in your Quantiply account at the same time. In the Orderbook section, you will only see the Client IDs for which you have done the broker login (generated access token).

Note: This functionality only fetches the individual Order data and NOT the Position book which includes the Net positions of each traded instrument.

I. How to use the Orderbook:

-wEPh6T4TAisOn6pjPqjHrTaPPA5f_5oBB3L4.png)

1. Each relevant column has a FILTER that can be used to filter out orders with specific data.

For example: You can filter out orders with a specific Error or all orders with Errors. You can then click on the respective algo name from the Algo name column and directly go to the Algo page to Retry order placement or manage the error.

2. You can SEARCH functionality to search for any data, relevant to individual orders. For example: you can search for orders specific to a Symbol by typing out the entire Symbol into the search bar like NIFTY26JUN2525400CE.

3. If any leg is showing Waiting status on the algo page, you can always come to the Orderbook page and check the latest order status of the order related to that algo, and check if the order is placed with the broker or not, and, if the order is placed then what is the status of that order ie. whether it is Open or Trigger Pending or Rejected or Completed.

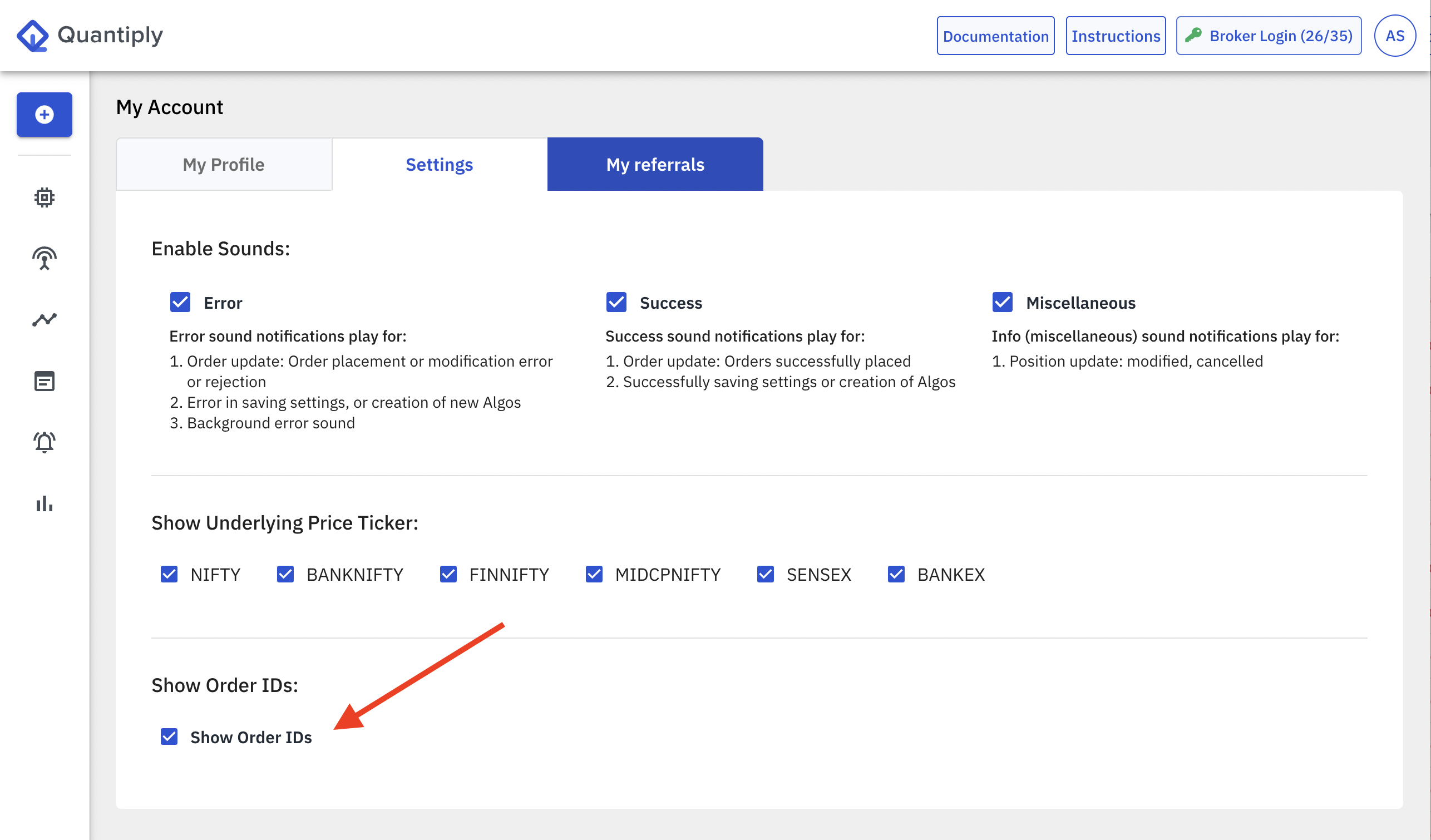

Useful Tip: You can make the Order IDs of orders visible on the algo page by going to the Settings page under your My Account section on Quantiply - (https://app.quantiply.tech/account-settings#tab=settings)

II. The following data points are available for each order:

1. Algo name and a link to the algo running on Quantiply to which the order is linked to.

2. Order ID.

3. Category - Type of order from the algo's point of view ie. Entry, Square Off or a Stoploss order. Note: Target exit orders are a part of the Stoploss category only, as Stoploss orders are modified to exit when Target is hit.

4. Client ID / Broker.

5. Symbol the order is placed in.

6. Side - Specifies whether the order is a Buy order or a Sell order.

7. Status: Contains the status of the order ie. Complete, Rejected, Cancelled, Trigger Pending or Open.

8. Message: Contains the Error message or API message coming from the exchange or the broker for a particular order.

9. Time: Specifies the time at which the order status changed to it's specified status.

10. Quantity.

11. Order Type: Specifies whether the order type is Market, Limit or SL-Limit.

12. Source: Specifies the source of the origination of the order which includes 2 types - Quantiply and Other.

13. Product type: MIS or NRML.

14. Average Price: This is the price at which an order is executed. Only orders with Completed status will have an average price.

15. Trigger Price.

16. Limit Price.

17. Algo ID.