Clientwise Stoploss & Target (aka. Portfolio level Stoploss & Target)

This functionality allows a trader to set a portfolio level Stoploss or Target for a particular client id. If this overall Stoploss or Target is hit, all algos running on that particular client id will immediately exit. This functionality also allows Trailing of the stoploss, locking of profit, trailing of profit, and locking & trailing of profit at the client id (portfolio level).

I. Settings:

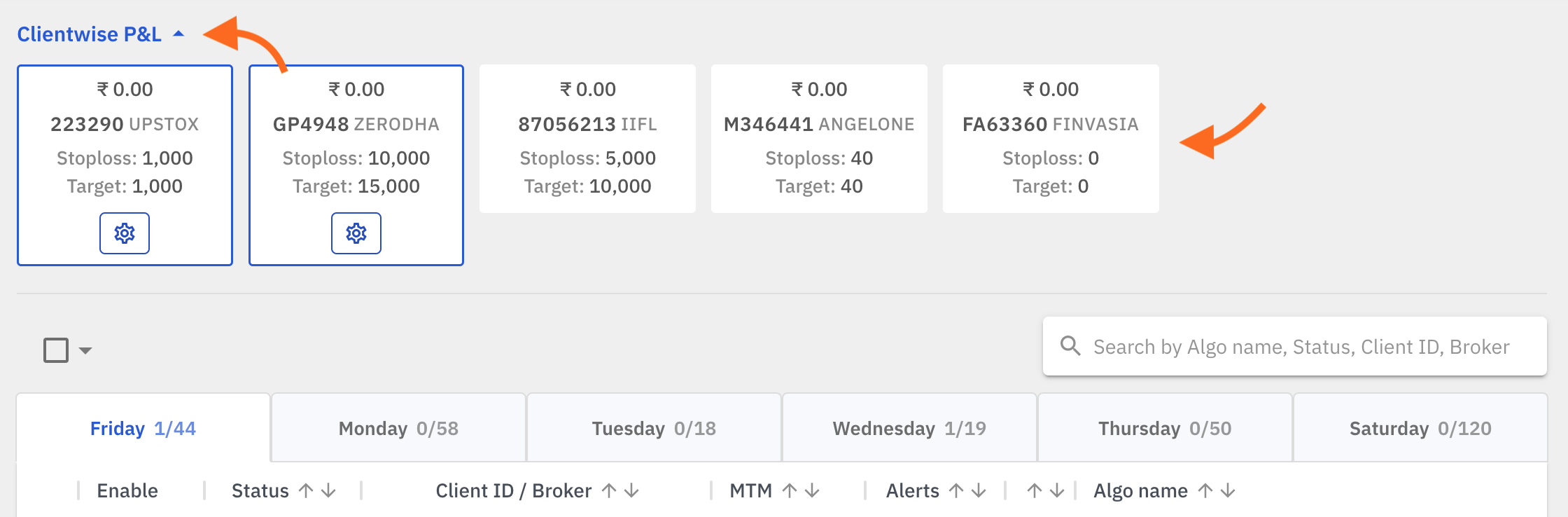

Click on Clientwise P&L seen on the top of the main page to view P&L of all client IDs configured on your Quantiply account.

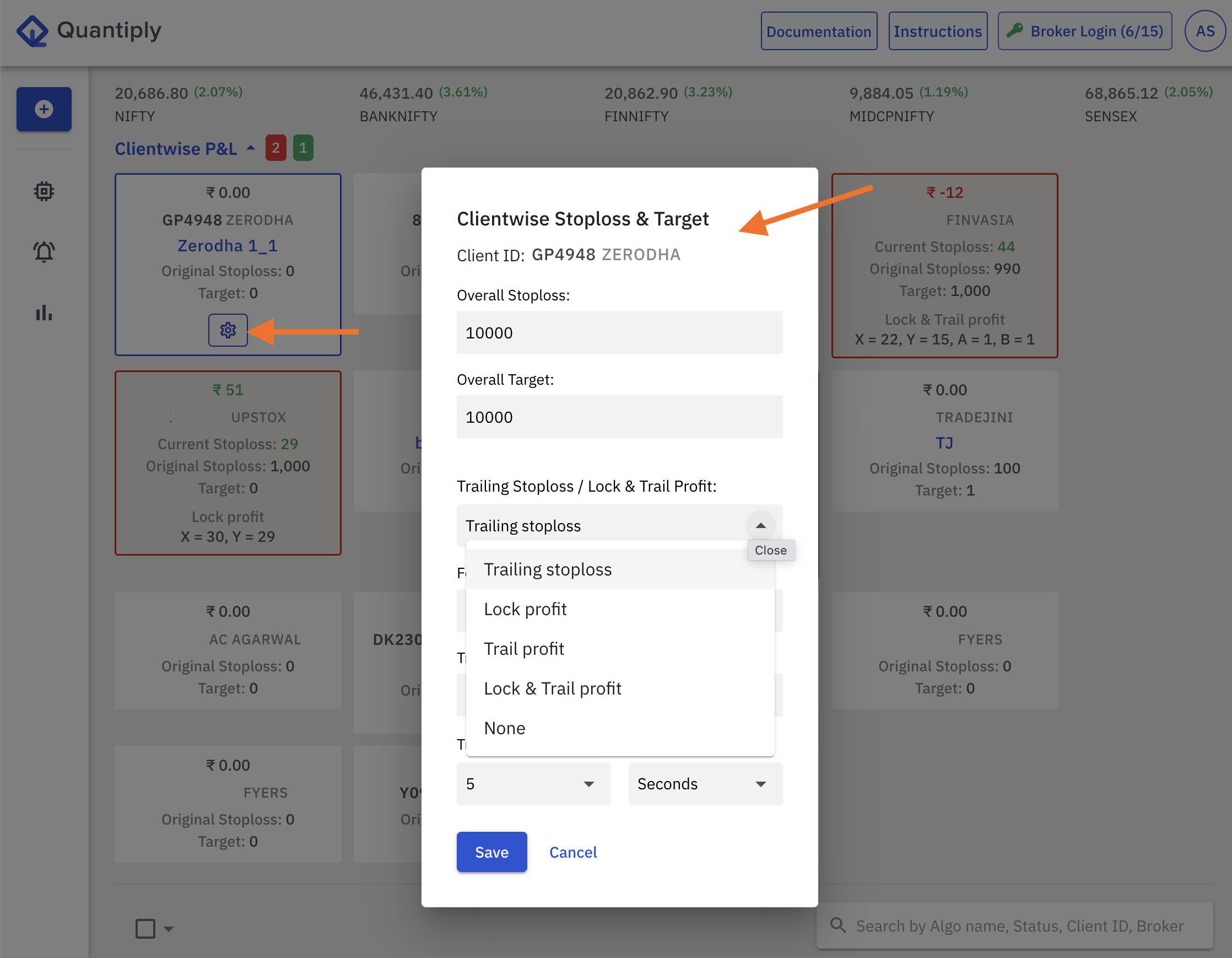

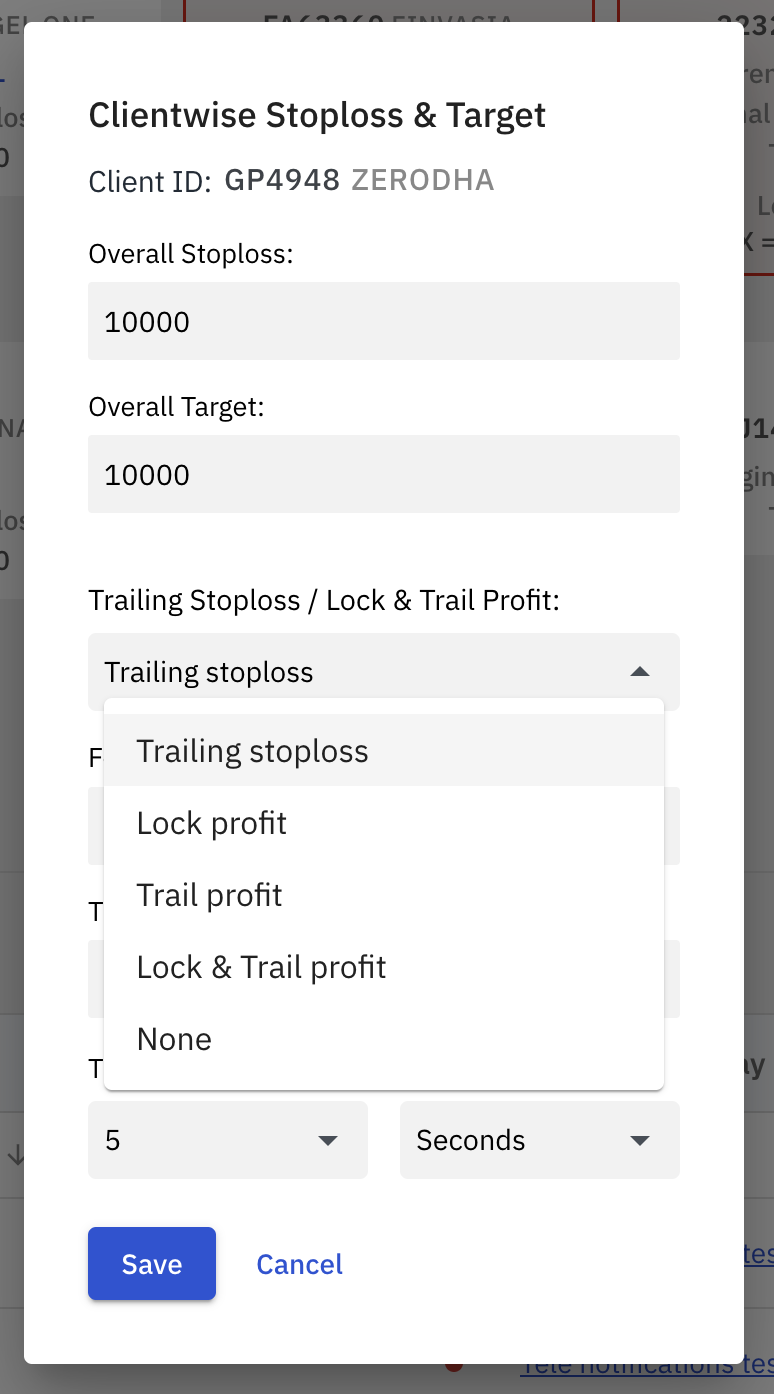

Click on the Settings button ‘⚙️ ‘ under the individual Client ID container. It will open a pop up where the Target setting, the Stoploss, Trailed stoploss can be defined, for a particular Client ID.

There are 4 settings:

- Overall Target

- Overall Stoploss

- Trailing Stoploss, Lock profit , Trail Profit, Lock & Trail Profit

- Trailing Stoploss

- Lock Profit

- Trail Profit

- Lock & Trail Profit

- Trailing Frequency Interval (in secs & minutes)

All the values specified for target, stoploss, traling stoploss, lock profit, trail profit, lock & trail profit are given in amount (in rupees).

II. Stoploss or Target hit indication:

Upon hitting the ClientIDwise Target, the individual client id card turns green, and, upon hitting ClientIDwise Stoploss, the individual client id card turns red, to indicate Target or Stoploss type of exit.

This functionality also helps view client id wise live Total MTM.

III. Trailing frequency interval setting:

The Trailing frequency interval setting can be specified in seconds or in minutes. The default minimum setting is 5 seconds, which means that the system will check the running PNL's high every 5 seconds to check of the trailing stoploss or lock, trail or lock & trail profit conditions are met or not. If conditions are met, the stoploss or profit is trailed/locked based on your setting type.

The trailing frequency interval setting can be set to one of the following values: 5 secs (default lowest setting), 10 secs, 15 secs, 30 secs, 45 secs and 1 minute.

IV. How to RESET the Client wise Target or Stoploss after it is hit:

Say you have a total of 5 algos enabled for a particular client id, 3 of them are currently active, and the other 2 a configured to run at a later time in the day. If, the clientID wise SL or target is hit while the 3 algos are running, the 3 algos will immediately exit, and the other 2 algos which were configured to run later in the day, will NOT fire ie. those other 2 algos will not run as client ID wise SL or Target is already hit.

In the above scenario, if you want the other 2 algos to run, then the client id wise Target or Stoploss counter has to be reset.

The following are the steps to reset the Client wise Target and SL:

1. Change all setting values to a higher number, higher than the current setting

2. Change all settings values to 0 which means there is no setting and the counter is reset.

3. If you want you can again set a higher number, higher than the older setting.

IV. Other important points:

- Upon click on the individual client id card, the algo table will filter out and show only those algos that are configured for the selected client id. So, click on any single client id or multiple client ids will act like a filter. The filter can be deactivated by deselecting the client id again, which will in turn show all the algos in the algos table.

- Say you have a total of 5 algos enabled for a particular client id, 3 of them are currently active, and the other 2 a configured to run at a later time in the day. If, the clientID wise SL or target is hit while the 3 algos are running, the 3 algos will immediately exit, and the other 2 algos which were configured to run later in the day, will NOT fire ie. those other 2 algos will not run as client ID wise SL or Target is already hit.

- ClientID wise Stoploss and Target can be modified while algos are active and trades are open.

- This functionality considers all active algos running on a particular client id, in calculating the total current MTM, whether its a Positional algo running from previous days or current day Intraday algos. It will consider the MTM of all currently active individual algos. For example, if your client id wise Stoploss is set to Rs. -10,000, and you have 2 algos running - 1 positional algo from yesterday and 1 intraday algo which entered trades today. If the combined MTM of both these algos becomes Rs. -10,000, then both these algos will exit immediately.

- Once all algos exit upon hitting the Target or Stoploss for the current day, the Client ID wise Target or Stoploss counter will get reset by midnight on the same day, and fresh PNL calculations will start the next day morning as per the Target or SL settings given by the user.

- If you do not wish to have the same target or stoploss the next day for the client id, then it is important to reset or remove the Target or Stoploss setting for the next day. If the setting is not removed, it will apply for the next day as well.