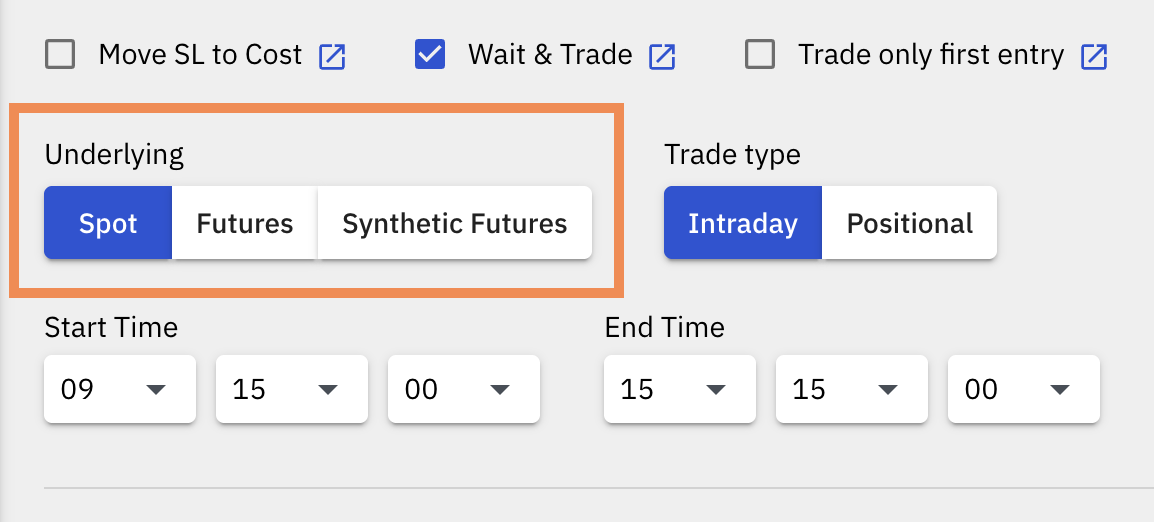

Trades can be initiated based on the following prices of the underlying Indexes:

1. Spot:

Strike selection or trade initiation would be done based on the current Spot price of the selected Index.

2. Futures:

Strike selection or trade initiation would be done based on the current price of the Futures contract of the selected Index.

3. Synthetic Futures:

Strike selection or trade initiation would be done based on the Synthetic Futures price of the selected Index. The Synthetic Futures price is a derivative of the Spot price and can be used to select a different 'At The Money' strikes with more balanced premiums which are closer to each other on the Call side and Put side.

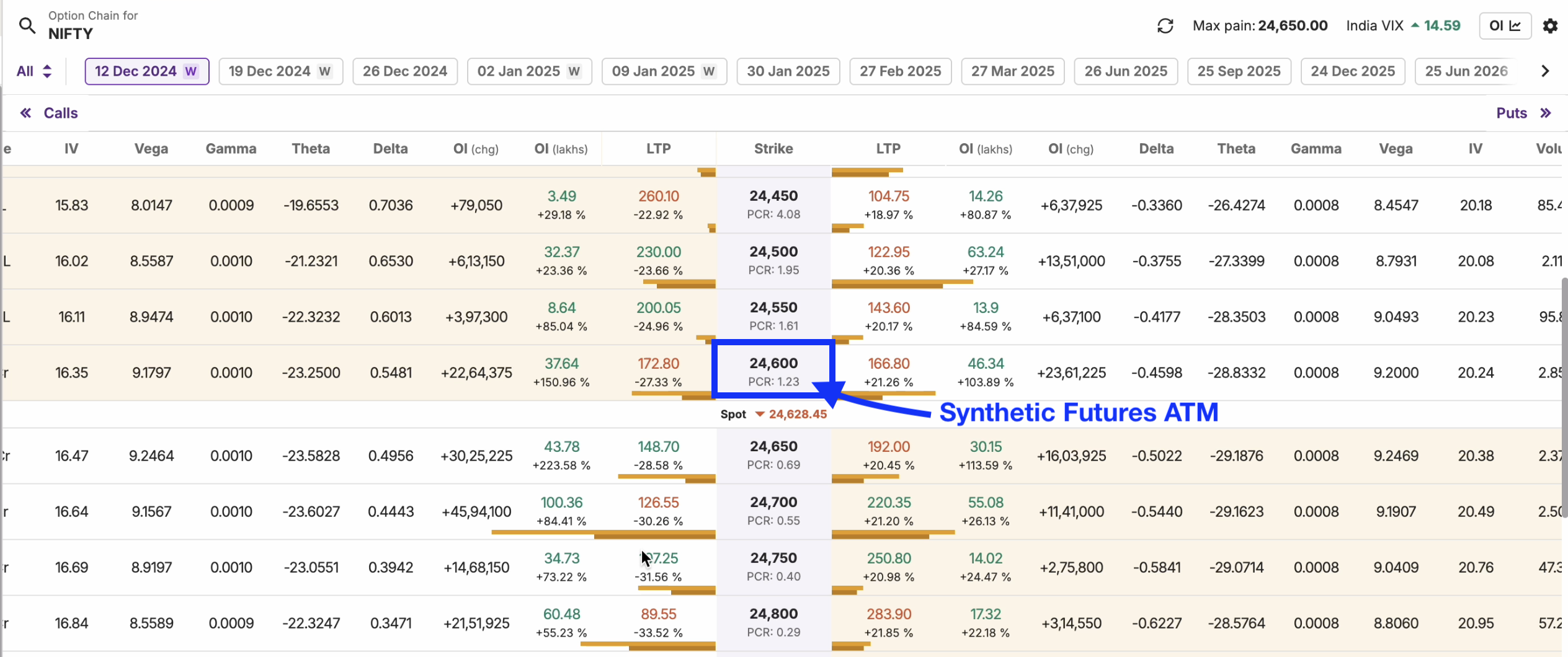

Synthetic Futures price based on which the 'At The Money' strikes are selected is calculated as per the following formula:

Synthetic Futures = Spot ATM Strike + Spot ATM Call premium - Spot ATM Put Premium

Here the The 'Spot ATM Strike' refers to the 'At The Money' strike closest to the current spot price.

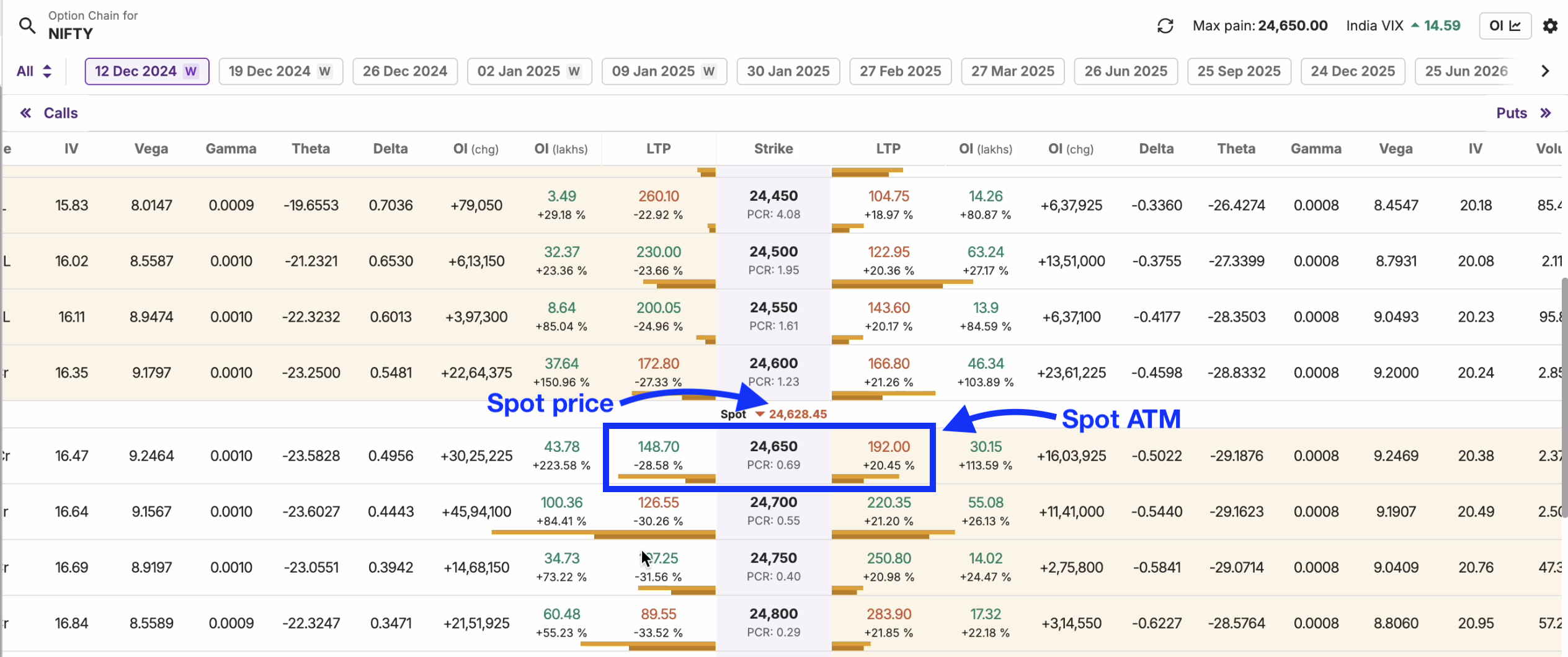

Example:

Nifty Spot Price: 24628.45

Spot ATM Strike: 24650

Spot ATM Call (CE) premium: 148.70

Spot ATM Put (PE) premium: 192

Synthetic Futures = 24650 + 148.70 - 192 = 24606.7

Once the Synthetic Futures price is derived, the strike closest to this price is considered as the new 'At The Money' strike. Hence the new ATM strike based on the Synthetic Futures price would be 24600.

From the above example you can see that the Synthetic Futures ATM CE and ATM PE premiums are closer to each other compared to the Spot ATM CE and ATM PE premiums.

Synthetic Futures ATM CE premium = 172.80

Synthetic Futures ATM PE premium = 166.80

Percentage difference between premiums: 3.53% (Synthetic Futures based selection).

Spot ATM CE premium = 148.70

Spot ATM PE premium = 192

Percentage difference between premiums: 25.41% (Spot based selection).