-O_PzYSKqM8P_tGiKf3TeRy13nirXriEPFsgu.png)

The SIGNALS feature of Quantiply allows you to pass ENTRY and EXIT signals from external sources like TradingView or any other Custom signal source like a third-party software or personally coded strategies. These Signals can trigger entries and exits in multiple algos at the same time.

I. There are 2 types of SIGNALS that can be configured on Quantiply:

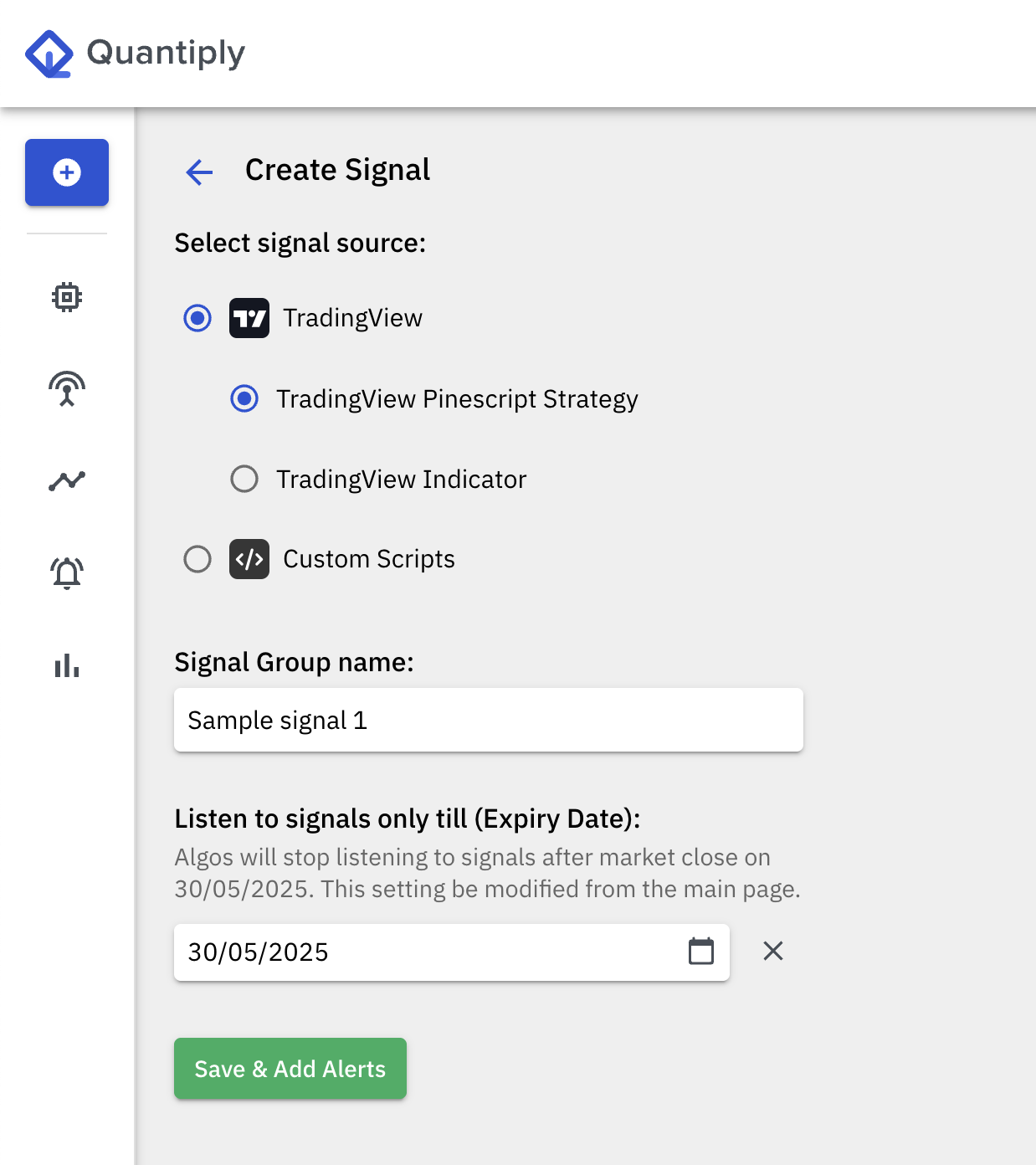

1. TradingView:

A. TradingView Pinescript Strategy:

A Pinescript Strategy, coded inside TradingView can allow multiple sets of Entry and Exit signals to be generated and sent to Quantiply, depending on how you code it.

For example: Both, a long entry and long exit signal, and a short entry signal and short exit signal can be generated as separate signals within a Strategy coded inside TradingView using TradingView's Pinescript coding language.

B. TradingView Indicator:

A TradingView Indicator type Signal allows you to send a single Entry signal followed by a single exit signal from the indicator or set of indicators configured on a chart inside TradingView.

2. Custom Scripts:

Custom Scripts Signal functionality allows you to send Entry and Exit signals from any external source. This external source can be any other third-party software or even your own separate algo. Within a Custom Script Signal, you can create multiple signals (alerts) as per your requirement'

II. Important Terminology

Signal:

A Signal is an entity or a group of entities that listens to external entry and exit commands and triggers entries and exits of algos.

Alerts:

Alerts is a sub category of a Signal. Each Signal can have multiple Alerts, where each Alert can listen to a separate type of signals like a Long Entry signal or a Short Entry signal.

III. Important Pointers:

1. Exit logic:

For algos that are triggered by an Entry signal, the Exits can be done in either of the two following ways:

1. Exit signal received from an external source like TradingView or a custom source

2. Individual leg or MTM Target or Stoploss ie. exit rules configured inside the algo settings itself.

In the case, where both of the above are configured, the exit in position will be triggered by whichever one comes first, meaning if the Exit signal comes before configured targets or stoplosses hit, then that Exit will be triggered by the Exit signal as it has occurred first.

2. Entry and Exit Sequencing:

For a specific Signal only one Entry signal will be considered at a time until the first trade has fully exited. After the first Entry signal, till the time an Exit signal doesn't come OR all legs of an algo have not exited or been squared off, the second Entry signal if received while, even one position is open, that second Entry signal will be ignored and will not execute another entry in the same algo. This means that for a specific signal and the algo(s) that are linked to it, unless a complete exit doesn't happen, the next Entry signal will not trigger a new entry.

-jYx_ZNV_Mmsrg3oHVvJwyRY293UpdAGwGpTf.png)

3. Multiple trades in a single algo:

Multiple trades (multiple entries and exits) can be done in a single algo till the algo End Time is reached or the 'Max no. of entry signal per day' count is reached, as per the sequencing explained in the previous point. In between such a timeframe, the algo will not get Terminated.

4. Start time configuration:

Upon receiving Entry signals, an algo will only execute entries if the start time is crossed. Hence, it would be advisable to keep the start time 9:15 AM for Signal based algos.

5. Setting 'Max no. of entry Signals per day':

This setting allows you to limit the number of entries that can be done per signal. For example, if you set the max no. of entry signals per day to 3, then only 3 entries will be triggered, the 4th entry signal if any, will be ignored. This means, for each day the maximum number of entries that can be done will be defined by the number configured under the 'max no. of entry signals per day' setting.

This setting is applied at the Signal level, and can be modified anytime, even during market hours and even when the Signal or algo is active or enabled. If the max count is reached, and an entry signal is received, thereafter if the max count is increased, only the new signal which is received after the increasing of the max count, will trigger a new entry. The entry signal that was received before the max count was modified, will not trigger an entry after the max count is increased.

Algo Reset Scenario: The entry which was done before the algo was reset, this entry will be counted under the max. no of entry signals per day limit.

Positional algos: For positional algos, the 'max no. of entry signals per day' counter is reset on the next day, as this setting is applicable only for a single day. The same positional algo can take the same maximum number of entries as confgured, on the next day as well.

6. Multiple algos can be linked to a single Signal:

Multiple algos can be linked to a single Signal or Alerts within a single Signal group. This means that one single Entry signal can trigger entries and exits in multiple algos at the same time. This functionality is especially useful if the same Signal needs to be used to trigger entries and exits in multiple Client IDs at the same time.

7. Specifying algo type: 'Signal' while creation or duplication of algos:

Algos need to be set to 'Signal' type for it to be triggered using the Signals feature. Existing algos cannot be changed to Signal type. If you want to use any existing algo with Signals, you can simply Duplicate the algo and set algo type 'Signal' at the time of duplication. If you plan to create a new algo with new configurations, then you will need to specify the algo type setting as 'Signal' at the time of creating a new algo.

Note: Only the algos that are configured as 'Signal' type, will be shown in the algo linking section at the time of the creation of a new Signal.

-20OolT6FEbX42n_VYuY89xgNf-hOZY6S_W1Z.png)

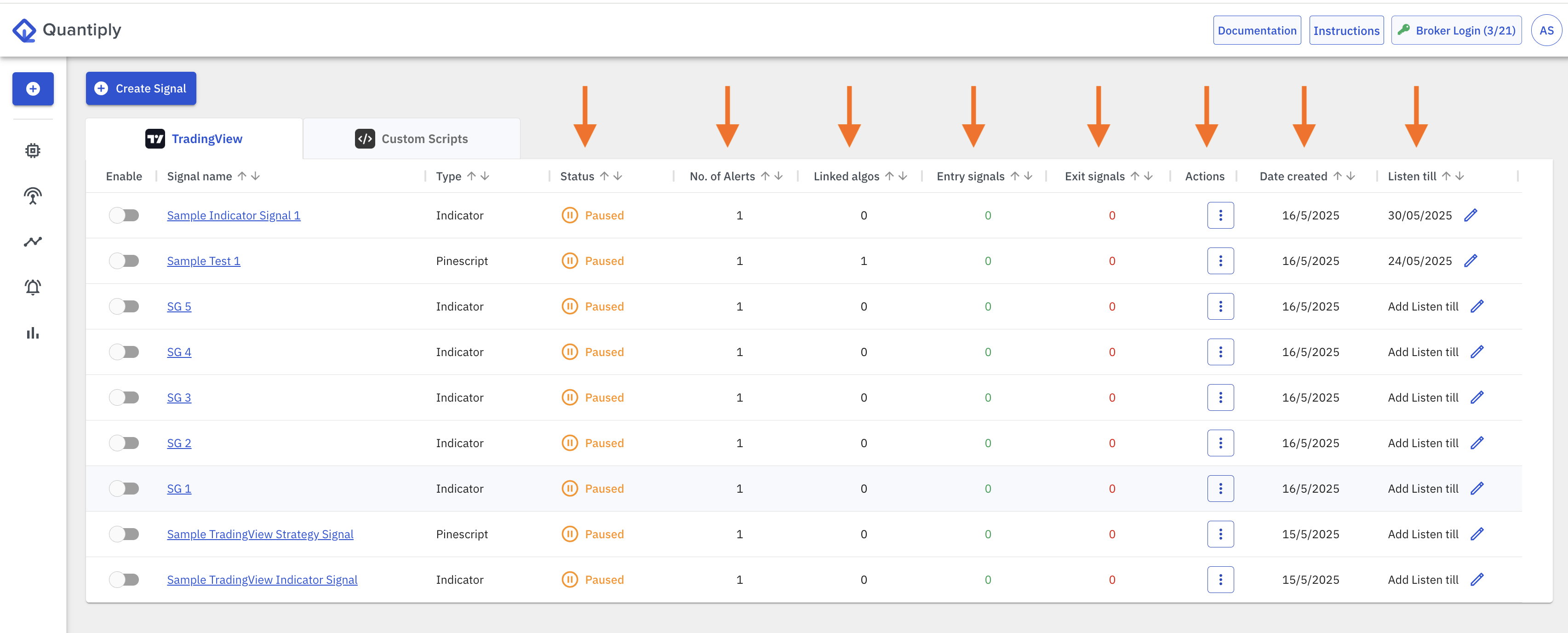

8. Signal related data:

1. Status:

Two type of statuses are applicable for a Signal:

- Listening: This status means that the Signal is actively listening for entry and exit signals. You can disable an active signal to avoid any signals from triggering entries or exits in algos that are linked to that particular signal.

- Paused: This status means that the Signal is paused, and any entry or exit signal received from external sources will be ignored. Any newly created Signal will be in Paused status until it is enabled.

2. No. of alerts: This is the number of Alerts that have been created within a single Signal group. Only TradingView Pinescript Strategy type Signal and Custom Scripts type Signals can have multiple Alerts configured inside a Signal.

3. Linked algos: This coulmn shows the number of algos that are linked to a single Signal.

4. Entry Signals: This column shows the number of Entry signals received from the external source. This count also includes an Entry signals that are ignored by the algos in the case where they're out of sequence as per the above mentioned Entry and Exit Sequencing of Signals.

5. Exit Signals: This column shows the number of Exit signals received from the external source. This count also includes an Exit signals that are ignored by the algos in the case where they're out of sequence as per the above mentioned Entry and Exit Sequencing of Signals.

6. Actions: The action button allows you to Rename a Signal or Delete a Signal

7. Date created: This specifies the date the Signal was created on.

8. Listen till: This column specifies the Expiry date set for the Signal. This date is modifiable.

9. TradingView paid Subscription requirement:

You will need to subscribe to the TradingView Essential Plan to use the Signals feature.

10. Simulate SIGNAL based trades before going Live using the FORWARD TESTING functionality:

Configure Signals and simulate the trades using Quantiply's Forward Testing functionality. The Forward Testing functionality allows you to determine if the generated Signals are correctly triggering the linked algos on Quantiply or not, without having to take actual trades in the Trading Account.