What is the Premium Matching functionality?

This functionality allows the entries to be executed only when the specified entry conditions provided under this functionality, match for configured legs.

So, in an algo if a Straddle (sell ATM CE & sell ATM PE) is configured to be Sold, and one or more of Premium Matching conditions is applied, then the algo will enter only when those Premium Matching entry conditions are met for the ATM CE and ATM PE only, and no other strikes other that the above 2 configured strikes.

To enter with with specific premiums that scan the entire option chain, refer to the functionality Entry by Premium

II. How to enable the Premium Matching functionality:

The Premium Matching option can be found on the algo under the MTM Target and MTM Stoploss section on the algo configuration page.

1. Select the desired premium matching setting and insert the desired value.

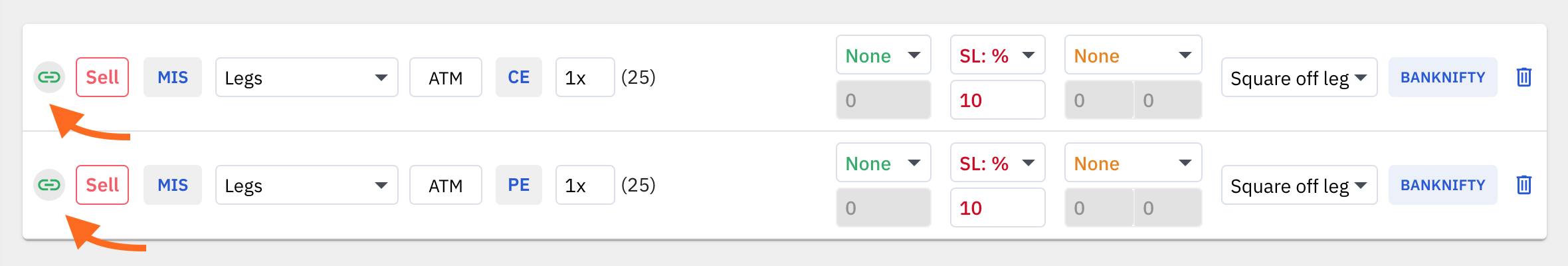

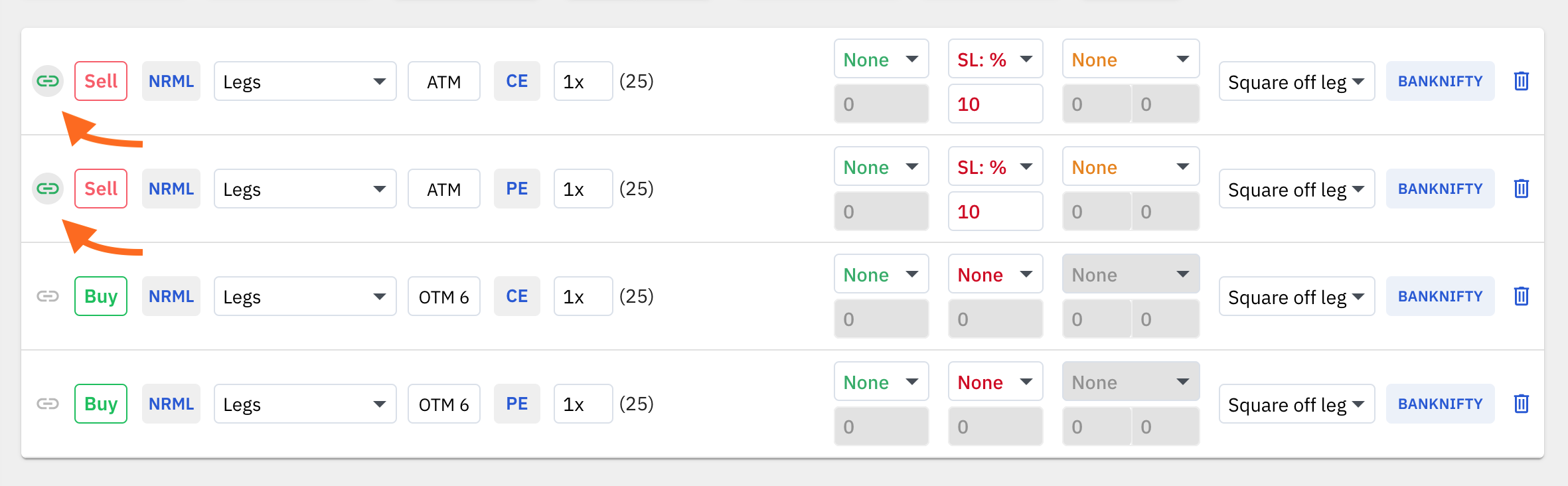

2. Mark minimum 2 legs (or any 2 legs in the case where there are more than 2 legs configured in a the same algo) whose premiums need to be matched.

2 legs in a single algo: In the above example, the ATM CE and ATM PE legs are marked. The premium matching conditions will be run on the premiums of these 2 marked legs. Once fulfilled, the algo will take entries in these 2 legs.

2 legs in a single algo: In the above example, the ATM CE and ATM PE legs are marked. The premium matching conditions will be run on the premiums of these 2 marked legs. Once fulfilled, the algo will take entries in these 2 legs. 4 legs in a single algo: In the above example, the ATM CE and ATM PE legs are marked. Hence, the matching conditions will be run on the premiums of these 2 legs only. Once the conditions are fulfilled, only then will the algo take entries in all the 4 legs

4 legs in a single algo: In the above example, the ATM CE and ATM PE legs are marked. Hence, the matching conditions will be run on the premiums of these 2 legs only. Once the conditions are fulfilled, only then will the algo take entries in all the 4 legs III. Types of Premium Matching settings:

There are 4 types of Premium Matching conditions:

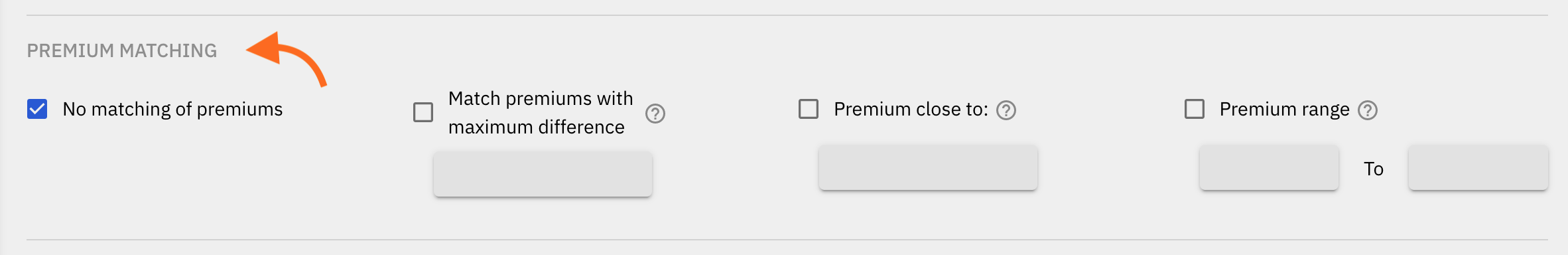

1. No Matching of Premiums: (default setting)

This is the default option that doesn't apply any matching condition between the configured legs. If this option is selected, the configured legs will immediately enter at the start time.

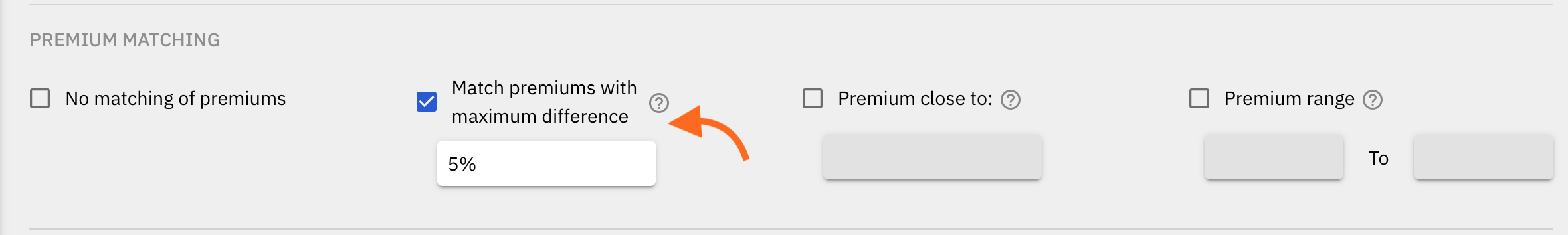

2. Match premiums with maximum difference:

If this option is selected, the positions will be taken in the configured legs when the difference between the premiums of the strikes are equal to or less than the percentage value specified by the user.

Example:

If the specified maximum matching difference (%) value is set to 5%,

- And if the current CE and PE premiums are 200 and 210 respectively, the current difference between the two premiums is 10 points which is less than 5%. Hence, the positions will be taken immediately.

- If the current CE and PE premiums were 200 and 250 respectively, the difference between the two premiums is 50 points, which is more than 5%. Hence, the positions will not be taken till the difference between the two premiums is less than 5%. In this case, the algo will keep waiting for the premium difference to be equal to or less than 5% till the End Time.

3. Premium close to:

If premiums of the legs configured in the algo have premiums close to the specified value for all legs at the same time, then the algo will enter the positions in those legs.

If the premiums are close to the specified value of any other strikes levels above or below the configured legs/strikes, then the position will not be taken.

Both the legs that are marked for matching should have premium close to the specified value for the positions to be taken. If only 1 leg's premium is close to the premium specified and the other leg's premium is not close to the specified value, then the entry will not be taken in both the legs.

Example:

ATM CE and ATM PE are marked for premium matching with a condition premium close to with a value 200, which means that the positions in ATM CE and ATM PE will be opened only when the premiums of both these legs are close to 200.

ATM CE has a premium of 220 and ATM PE has a premium of 180, in this case the premium close to 200 condition is fulfilled and entries will be taken in both these legs.

If, for example, the premium of ATM CE is 260 and the premium of OTM1 CE (ie. ATM+100 CE) is 160, then the matching condition for ATM CE is not fufilled, as 160 is closer to 200, than 260. At the same time, on the PE side, the premium for ATM PE may be closer to 200, than ITM1 PE or OTM1 PE, but since ATM CE and ATM PE both do no have the premiums close to 200 at the same time, the positions will not be taken, till the time the condition is fulfilled for both legs.

4. Premium range:

An upper and lower limit values are specified when using this premium matching option. At any given time after the start time, when the premiums of all the marked legs fall within the specified premium range, the algo takes the positions.

Example:

Settings:

Premium range setting: 100 to 150

Legs marked for matching: ATM CE & ATM PE

Start time: 9:30 AM

Scenarios:

At 9:30 AM, ATM CE premium is 120 and ATM PE premium is 160. Since one of the legs premium's falls outside the specified range, the entries will not be taken by the algo.

At 9:45 AM, ATM CE premium is 118 and ATM PE premium is 149. Since both legs have premiums that fall within the specified range, the entries will be taken in all configured legs by the algo.

5. Combined Premium:

This functionality allows you to enter positions when the combined premium (ie. the sum of the premium prices) of two symbols/legs is higher than or lower than or in-between a specified level or range.

Example:

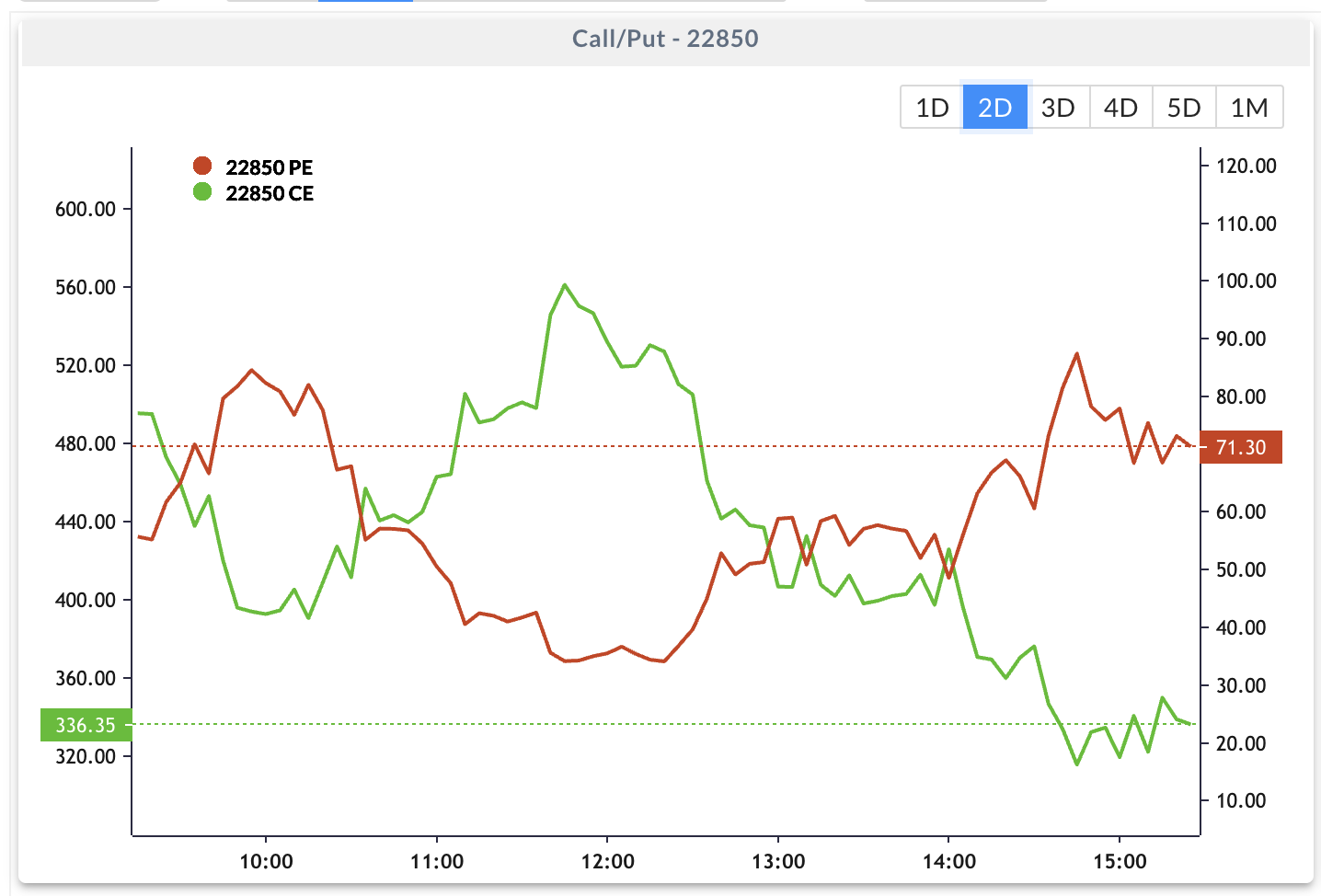

INDIVIDUAL PREMIUMS of 22850 CE - 336.35 and 22850 PE - 71.30

INDIVIDUAL PREMIUMS of 22850 CE - 336.35 and 22850 PE - 71.30 COMBINED PREMIUM (SUM OF PREMIUMS) of 22850 CE - 336.35 and 22850 PE - 71.30 = 407.65

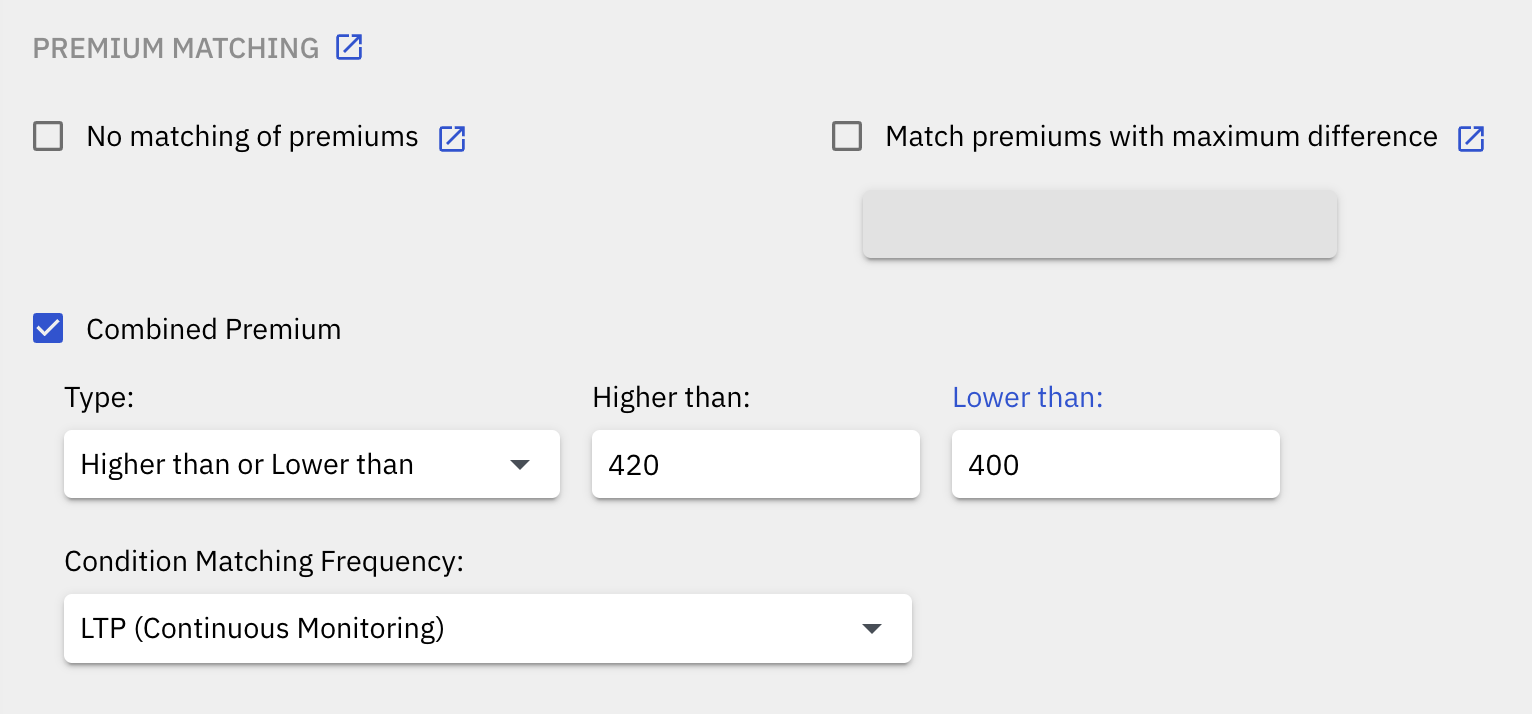

COMBINED PREMIUM (SUM OF PREMIUMS) of 22850 CE - 336.35 and 22850 PE - 71.30 = 407.65In the above example shared in the screenshots, say the current price of an ATM Call (22850 CE) is 336.35 and ATM Put (22850 PE) is 71.30, the sum of the two premiums is 407.65. Say you give an entry condition to enter trades when the Combined Premium or the sum of two premiums is higher than 420 or lower than 400. In this case if the sum of the premiums of the Call and Put goes above 420, then the algo will immediately enter your trades, or if the sum of the premiums of the Call and Put goes below 400, then the algo will immediately enter your trades.

Quantiply Combined Premium Settings

Quantiply Combined Premium SettingsThere are 4 different types of Combined Premium entry conditions or settings that can be configured:

- Lower than

- Higher than

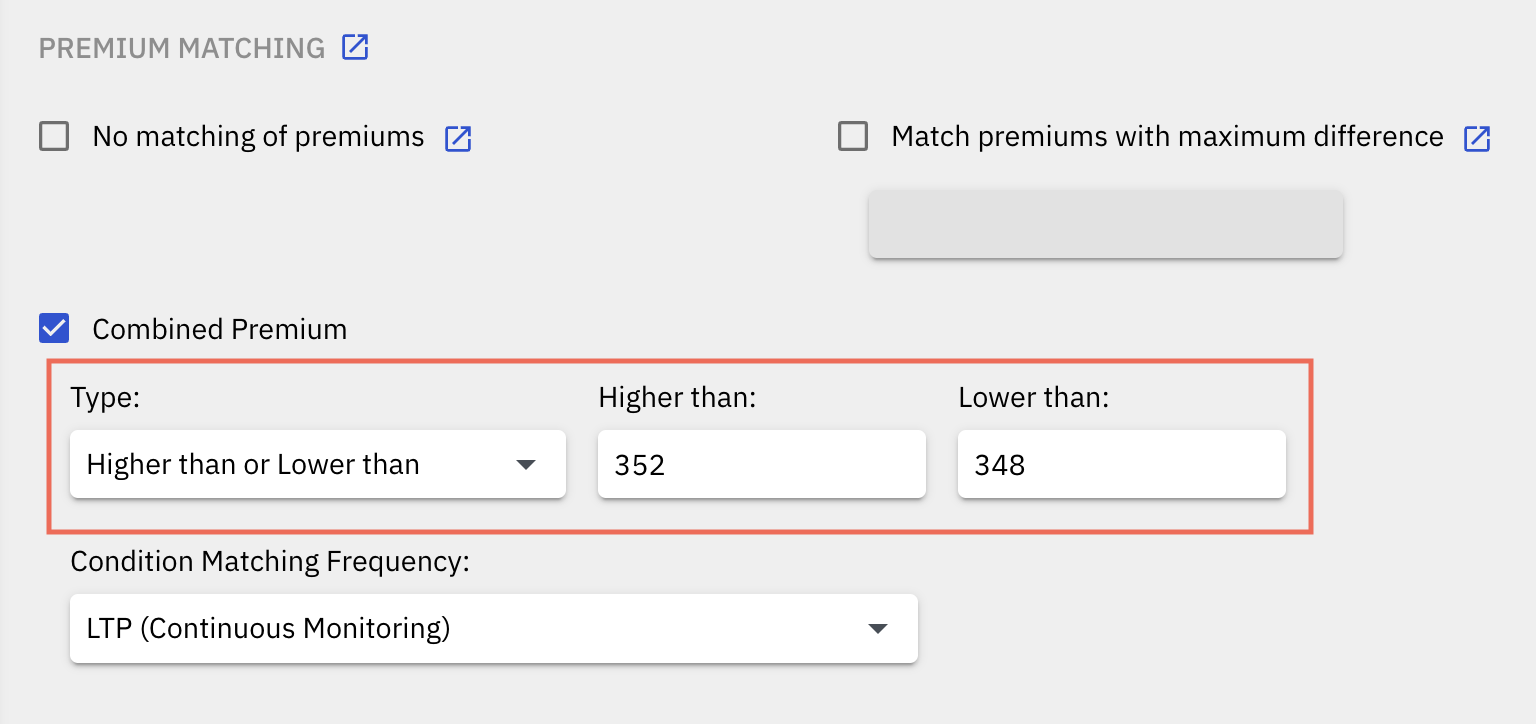

- Higher than or Lower than

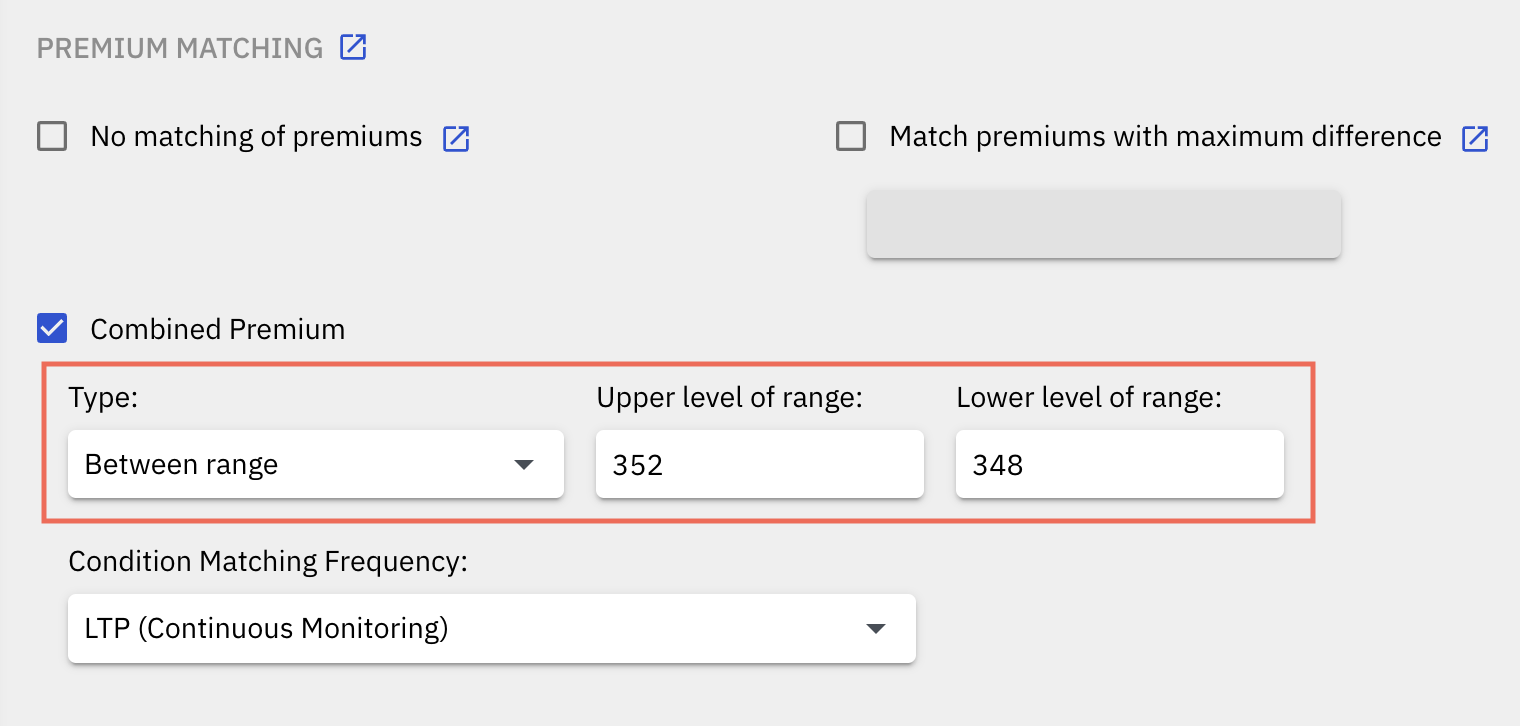

- Between range

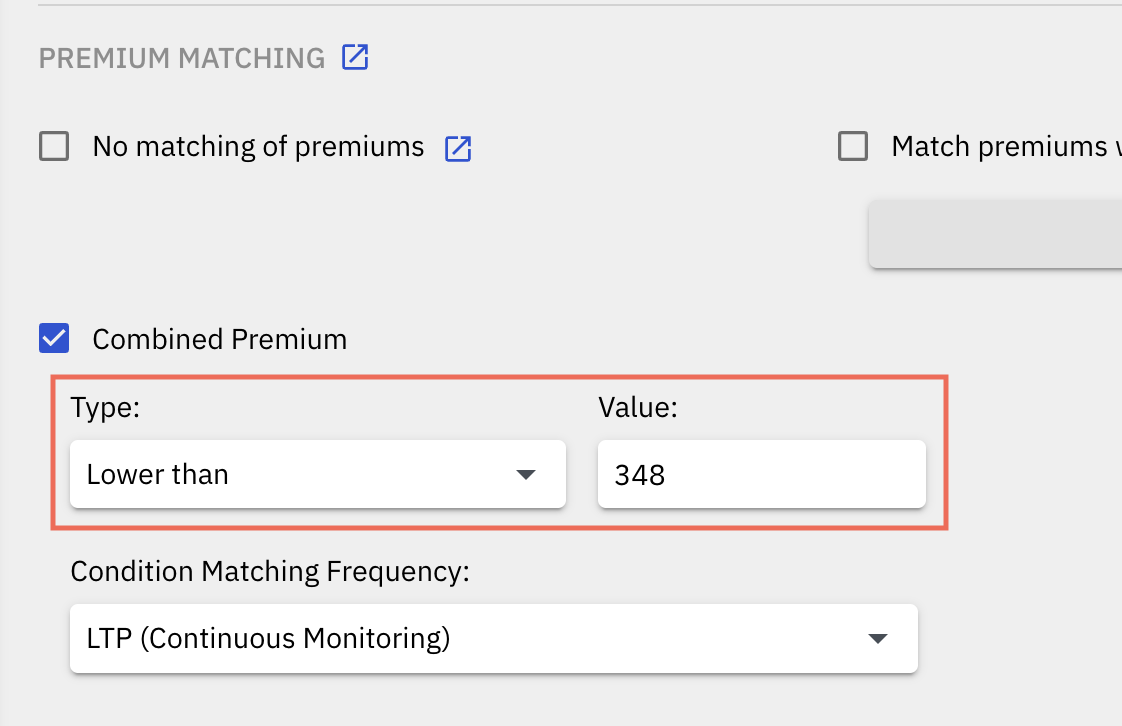

Type 1 - Lower than:

This setting will trigger the entry when the sum of the premiums of the selected leg goes below the configured ‘Lower than’ value/setting. So if the configured Lower than value/setting is 348, if the combined premium (the sum of premiums) goes below 348 ie. 347.99 from a higher value then the entry will happen.

Combined premium chart or Straddle Chart of Nifty

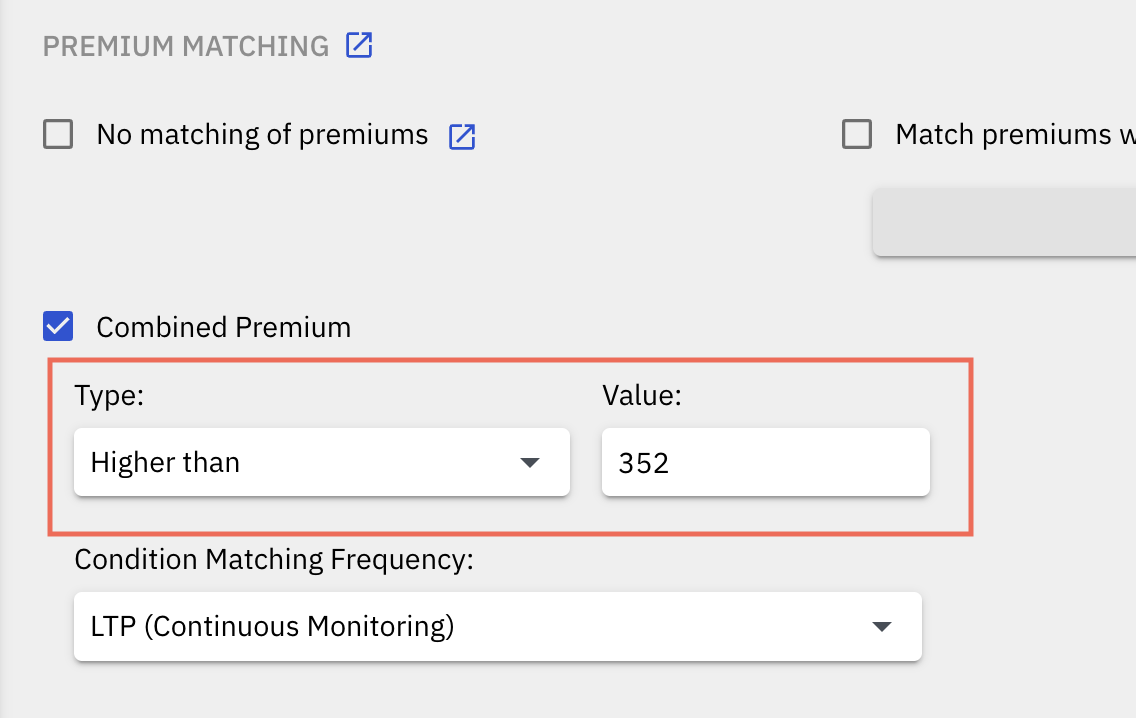

Combined premium chart or Straddle Chart of NiftyType 2 - Higher than:

This setting will trigger the entry when the sum of the premiums of the selected leg goes above the configured ‘Higher than’ value/setting. So if the configured Higher than value/setting is 352, if the combined premium (the sum of premiums) goes above 352 ie. 352.01 from a lower value then the entry will happen.

Combined premium chart or Straddle Chart of Nifty

Combined premium chart or Straddle Chart of NiftyType 3 - Higher than or Lower than:

This setting will trigger the entry when the sum of the premiums of the selected leg goes above the configured ‘Higher than’ value/setting OR goes below the configured ‘Lower than’ value/setting, whichever comes first. In the case where the configured Lower than value/setting is 348, and if Higher than value/setting is 352, if the combined premium (the sum of premiums) goes above 352 ie. 352.01 from a lower value OR if the combined premium (the sum of premiums) goes below 348 ie. 347.99 then from a higher value, the entry will happen. So, if any one of these conditions ie. higher than or lower than holds true, then the entry will get triggered.

Combined premium chart or Straddle Chart of Nifty

Combined premium chart or Straddle Chart of NiftyType 4 - Between range:

This setting will trigger the entry when the sum of the premiums of the selected legs comes between a particular range specified. In the case where the configured Upper level of range value/setting is 352, and if Lower level of range value/setting is 348, then if the combined premium (the sum of premiums) comes between 348 and 352 from a lower or higher value then the entry will be triggered.

Combined premium chart or Straddle Chart of Nifty

Combined premium chart or Straddle Chart of NiftyImportant Pointers:

1. If you configure MTM Re-entry for MTM SL or MTM Target hit, then the Premium Matching condition will be checked again before the Re-Entry can be done. So, only if the Premium Matching condition matches will the re-entry be done.

2. The 'Combined Premium' functionality works with only 2 legs at a time. Which means you can mark any two legs where you want the combined premium condition to run. If you want to run this functionality on more than 2 legs, then you can raise a request with Quantiply Support.

3. Premium Matching functionality will not work if Wait & Trade is selected.

IV. Additional setting: "Condition Matching Frequency"

This setting allows you to select between two options that define when the Premium Matching condition should be checked or at what time intervals the Premium Matching condition should be checked.

Note: This setting is applicable to all 4 types of Premium Matching functionalities ie. it is a global setting for all 4 types of Premium Matching functionalities.

There are 2 types of settings under 'Condition Matching Frequency' setting:

1. LTP (Continuous Monitoring):

If this setting is selected, the Premium Matching conditions are checked continuously every second. As soon as the premium matching condition is fulfilled the entries will be triggered, even if it is in the middle of the minute.

2. Candle Close (Check once at the end of the minute):

If this setting is selected, the Premium Matching conditions are checked once only at the end of every minute. If the premium matching condition holds true at the end of the minute the entries will be triggered.

Important point to note if you are using the Candle Close option:

1. The closing price showing on a chart and the last price received by the algo in the live price feed which is considered at the closing price may not always match with each other. This is because the chart or any chart provider uses a different price feed source and the algo uses a different price feed source. Any price feed source be it charts of 2 different brokers or price data provider will always have differences at any given point in time. So it is possible that the condition may have matched if seen in the chart but the entry condition may not have met and entry is not triggered in the algo OR the entry condition is fulfilled and the entry has triggered in the algo but as per the price in the chart the entry condition is not fulfilled the. This happens as the price feed source is different and slight differences in live price will always be there.

2. Charts get repainted/corrected after a few minutes or at the end of the day. So a 1 minute candle chart will show a different closing price at the end of the minute compared to the same chart of the same minute showing a different closing price at the end of the day. Here's an example of the same:

The following is the Rolling Straddle Chart of NIFTY. In the chart below, the closing price of straddle at 14:53 as seen in the chart was 348.10 while the market was Open.

The same chart as seen below, shows a closing price of 347.75, after market close on the same day. In this case, the charts have been repainted with other data sources by the chart provider later in the day.

So, bottom line is that you may observe such differences and scenarios from time to time while observing charts. You may think that the entry is triggered wrongly or entry has not triggered, as per the price seen in the charts, but that is not the case, entries can be and will be triggered only if the condition is matched and the condition is matched only if the price received in the feed triggers the condition. If the entry is triggered means the price condition is triggered.