This functionality allows entries and exits to be taken based on the movement of the underlying. Currently, this feature will work only with Nifty and Banknifty spot price as underlying.

There are 3 parts to this functionality:

- Wait & Trade entries based on Underlying.

- Underlying based SL.

- Underlying based Target.

I. Wait & Trade entries based on Underlying:

The algo captures the spot price at the start time. This captured spot price at the start time is the reference price.

Based on the Wait & Trade settings, the algo calculates the spot entry price from the reference price based on the values specified in the Wait & Trade settings and waits for the spot price to go up or down to the entry price.

Once the spot entry price is reached, the algo takes entries in the configured legs.

Settings:

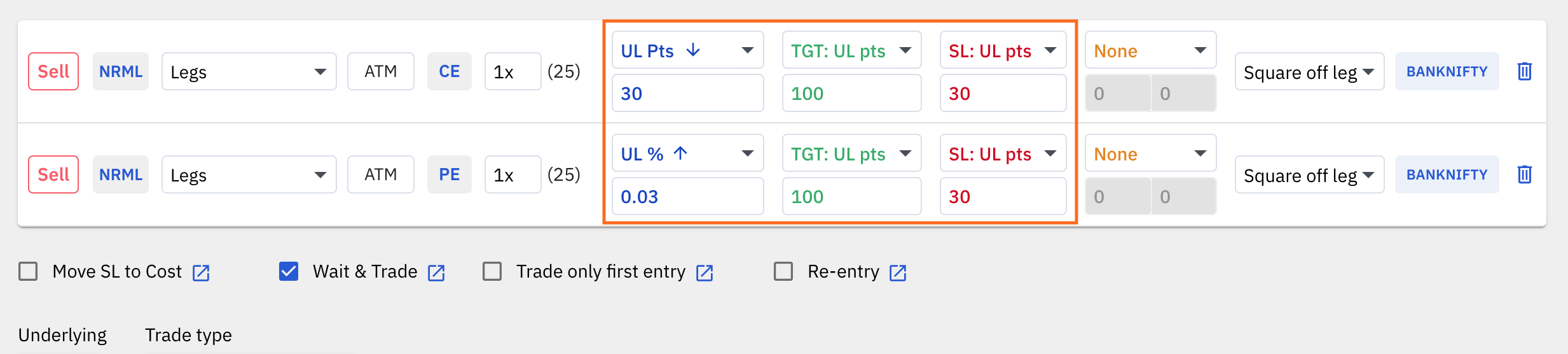

1. Wait & Trade checkbox:This is a checkbox under the legs configuration table that allows you to activate or deactivate the Wait & Trade feature for a particular algo.

2. Trade only first entry checkbox: This is a checkbox under the legs configuration table that allows you to activate or deactivate a functionality which allows the algo to take only the first entry that fulfils the Wait & Trade condition. This setting is selected only when Wait & Trade is activated.

3. Wait & Trade setting drop down:

- UL Points ⬆️: Using this selection, a trader can allow the algo to take positions in the configured leg only when the spot price goes up by 'X' points. 'X' here is the value specified by the trader.

- UL Points ⬇️: Using this selection, a trader can allow the algo to take positions in the configured leg only when the spot price ogoes down by 'X' points. 'X' here is the value specified by the trader.

- UL Percentage ⬆️: Using this selection, a trader can allow the algo to take positions in the configured leg only when the spot price goes up by 'X' percent. 'X' here is the value specified by the trader.

- UL Percentage ⬇️: Using this selection, a trader can allow the algo to take positions in the configured leg only when the spot price goes down by 'X' percent. 'X' here is the value specified by the trader.

- Value: This value is added or subtracted from the reference price to calculate the entry price.

II. Underlying based Stoploss

The algo captures the the price of the underlying when the configured legs enter. Based on the Stoploss setting given by the trader, the stoploss is calculated from the underlying price captured at the time of entry. ie. the entry price.

The calculated stoploss price ie. the price at which the open leg would exit would also be calculated in terms of the underlying.

Stoploss Trailing:

When Underlying based SL is configured, the stoploss or the stoploss price (which is in underlying value) is also trailed in terms of underlying price, and NOT the underlying traded symbol.

Settings:

1. Stoploss type dropdown:

- SL: UL %

- SL: UL Pts

2. Value

III. Underlying based Target

The algo captures the the price of the underlying when the configured legs enter. Based on the Target setting given by the trader, the target is calculated from the underlying price captured at the time of entry. ie. the entry price.

The calculated price price ie. the price at which the open leg would exit would also be calculated in terms of the underlying.

Settings:

1. Target type dropdown:

- TGT: UL %

- TGT: UL Pts

2. Value

Important Pointers:

1. Underlying based W&T entry (I), Underlying based SL (II), Underlying based Target (III) can work with the Re-Entry feature (works with all re-entry types).

2. Where Underlying based Entry, Target & Stoploss is configured, there are 3 underlying prices to understand and make note of:

- Reference price: The price captured at the start time, from which entry price is derived based on W&T settings

- Entry at: This is the entry price at which entry orders are fired. This price is calculated using the reference price and the W&T setting values.

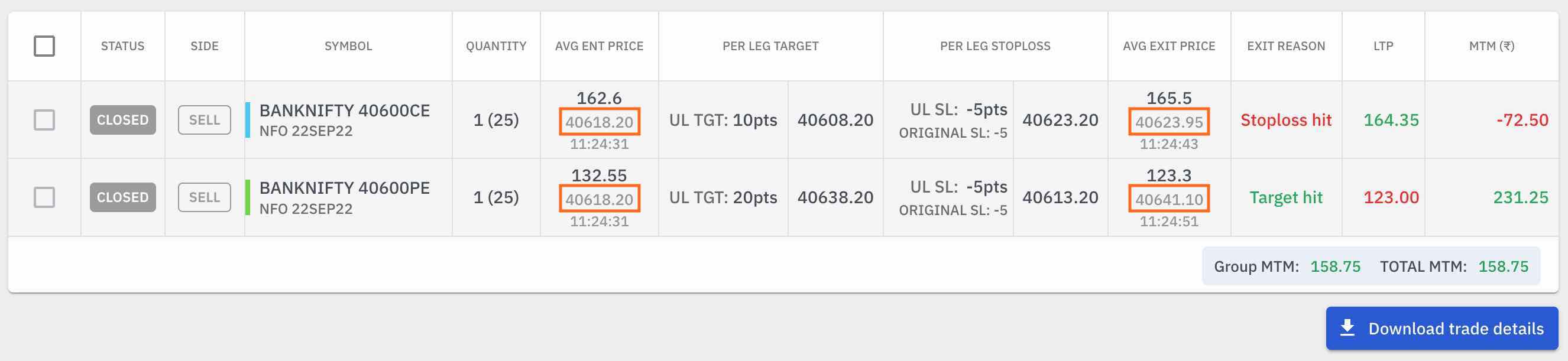

- Underlying price captured when entry order is filled: This is the underlying price that is captured at the time the entry order was successfully filled. All targets, stoplosses, re-entry conditions are calculated using this price only. This price will show under the Average Entry Price and Average Exit Price columns on the Quantiply terminal, as shown in the image below.