BSE SENSEX, BANKEX & NSE MIDCPNIFTY F&O now available on Quantiply.

MIS/NRML order & Order type compatibility

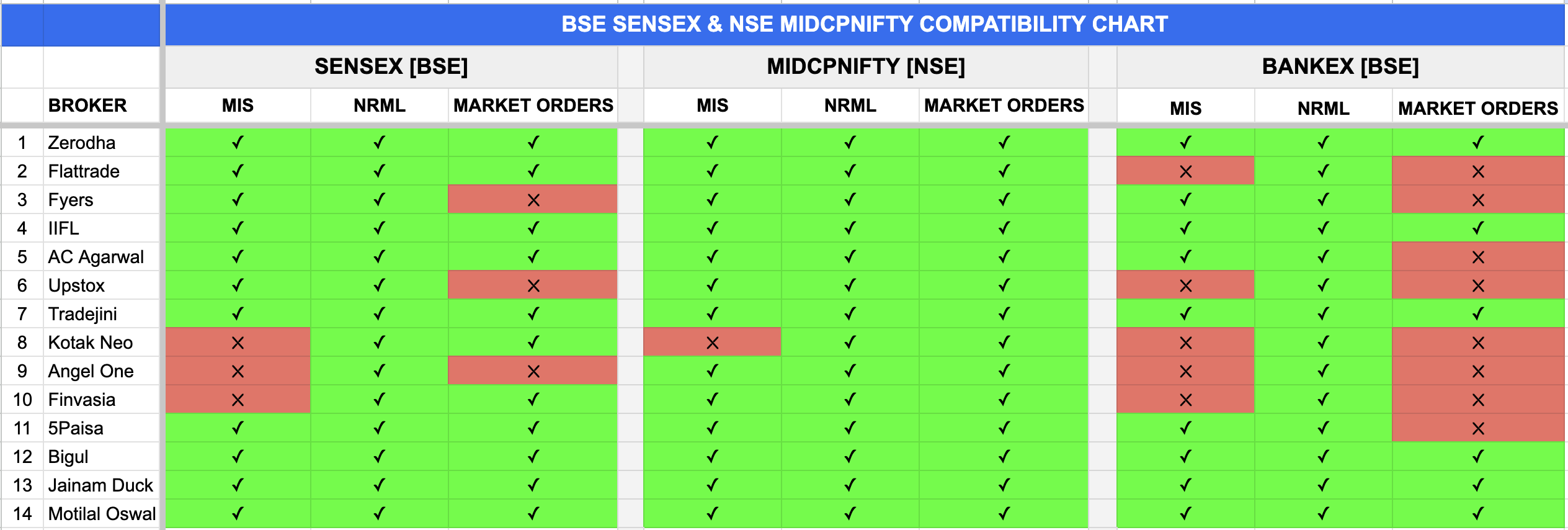

1. Check the MIS/NRML compatibility and Order Type compatibility of brokers in the above chart.

2. Configure MIS/NRML in your algos accordingly.

3. Configure Entry and Exit order type settings in your algos accordingly.

That is, for BSE Sensex Fyers & Upstox users will have to configure Entry and Exit order type under Advanced Settings as Limit/SL Limit.

For NSE Midcpnifty, Finvasia users users will have to configure Entry and Exit order type under Advanced Settings as Limit/SL Limit.

III. BSE SENSEX & BANKEX 'FREAK TRADE' WARNING:

Freak trade protection:

There is no such thing as Freak trade protection as advertised by other algo platforms. Only the exchange can provide a mechanism to avoid orders from matching and trades from executing at prices far away from the current LTP.

To reduce the chances of 'freak trades' from occurring, you can use the SL order placement delay functionality that can be configured from under the Advanced Settings on your algo configuration page.

Read more about this functionality here: https://quantiply.tech/documentation/advanced-settings/sl-order-placement-delay

Note: This is the same functionality that is termed as 'Freak trade protection' on some other algo platforms.

SL ORDER PLACEMENT DELAY functionality in a snapshot:

When this functionality is used, the algo doesn't place your stoploss order when your stoploss is hit initially, and also doesn't place the stoploss exit order in advance. Instead, after the stoploss hit condition is fulfilled the first time, the algo waits for N seconds (as configured by the user), and re-checks if the stoploss hit condition still holds true after those N number of seconds. If the condition holds true after those N seconds, then the stoploss exit order is fired or an exit of the open position is carried out by the algo.

Here, the assumption is that many a times the price spikes abnormally and crosses the stoploss trigger price and the stoploss gets executed with a high slippage, and then in a few seconds the LTP comes back to the normal mean price. Since the abnormal spike in price is observed only for a few seconds (in most cases), the SL order placement delay functionality can thus delay the exit of the position in an event the spike occurs for a few seconds.

The N seconds setting is configurable and can be set as per your own understanding of how much time (in seconds) can a price spike last and how much time it can take for the price to normalise.

Please note, there is no research or study on how long a spike can last or how much time it takes for the price to normalise back to a short term mean. As loosely observed it may take up to 6-7 seconds for a spike to subside and normalise.