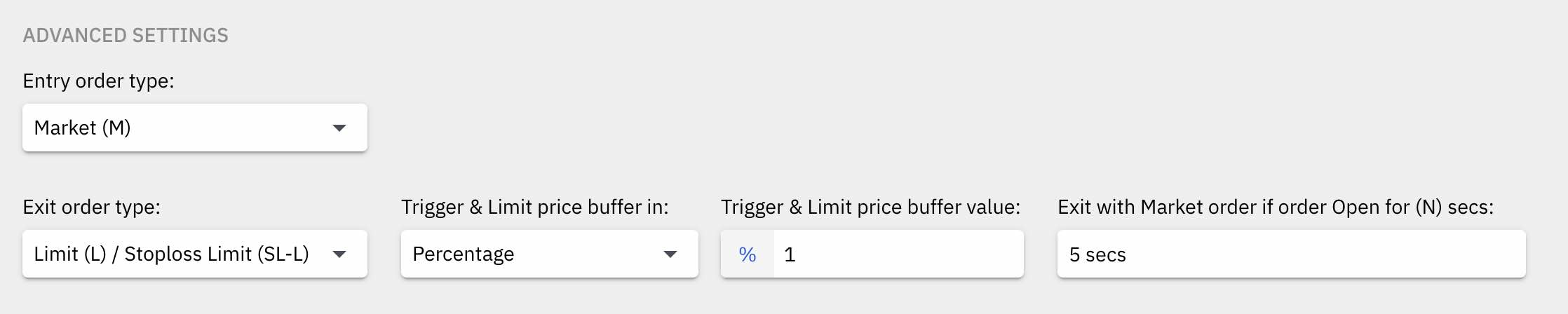

Order Type: SL-LIMIT

Once selected, a user can define the buffer between trigger and limit price in points from the trigger price or percentage of the trigger price. Once points or percentage setting is selected, specify the value of the buffer. A user can also specifiy after how many seconds of the SL-Limit order going into Open status should the algo fire a Market order to execute the trade. A trade goes into ‘Open’ status as soon as the trigger price is crossed

The Market order that may be fired after the specified number of seconds, will execute only the pending quantity that did not get filled by the Limit order.

Minimum value for the buffer value and Exit with Market order in (N) secs value is 0. There is no maximum value limitation for both.

SL-Limit settings can be configured for each algo individually.

Settings:

Setting 1. Trigger & Limit price buffer in:

The trigger & limit price buffer can be calculated in either Points or Percentage.

Based on this setting, the Limit price will be calculated in points from the Trigger price or as a percentage of the Trigger price.

Setting 2. Trigger & Limit price buffer value:

This the value given in points or percentage used to calculate the Limit price from the Trigger price.

Based on the value specified, the value is added to or subtracted from the trigger price to derive the limit price.

Example:

Trigger price is 100

Case 1:

Buffer in: points, Value: 5

In this case, for BUY orders the Limit price will be trigger price + buffer,

So, Limit price will be 100 + 5 points = 105.

For SELL orders the Limit rice will be trigger price - buffer,

So, the Limit price will be 100 - 5 points = 95.

Case 2:

Buffer in: percentage, Value: 3

In this case, for BUY orders the Limit price will be trigger price + buffer,

So, Limit price will be 100 + (3 % of 100) = 103.

For SELL orders the Limit rice will be trigger price - buffer,

So, the Limit price will be 100 - (3 % of 100) = 97.

Setting 3. Entry with Market order if order Open for (N) secs:

Once the current price (LTP) crosses the trigger price, the order goes into an OPEN status till the order gets filled at a price between the trigger price and limit price. If the order doesn’t get filed within N seconds of going into OPEN status, the limit order is converted to a Market order.

In the case the order is partially filled between the trigger and limit price, only the partial pending quantity will get executed at MARKET after N seconds.

In the case of some underlyings, Market orders are not allowed for some brokers, in such cases, the Limit order is modified again to a Limit order with a new Limit price based on the current LTP and the buffer. You can check in the order type broker wise compatibility chart on which broker doesn't allow Market orders.

Compatibility chart: https://quantiply.tech/documentation/important-topics/bse-sensex-and-nse-midcpnifty/